- 5 Marks

Question

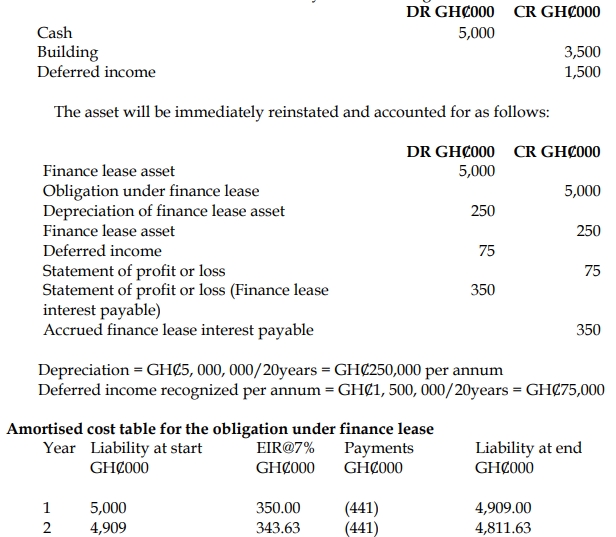

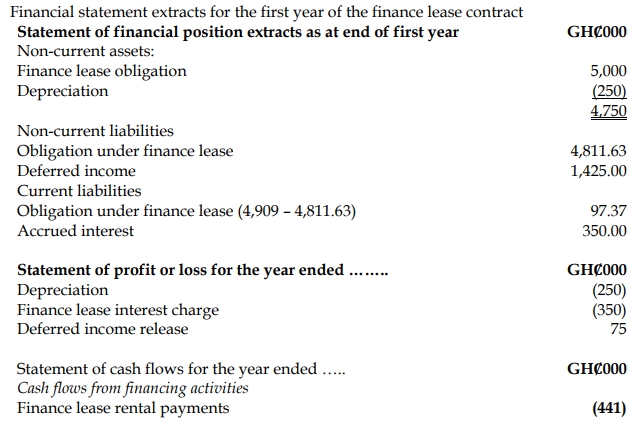

Hard-Work Ltd is a public limited company in Ghana and owned a building on which it raised finance to support its operations. On 1 June 2015, Hard-Work Ltd disposed of the building for GH¢5 million to a finance company when the carrying amount of the building was GH¢3.5 million. However, the same building was immediately leased back from the finance company for a period of 20 years, which was considered to be equivalent to the majority of the asset’s useful economic life. The lease rentals for the period amounted to GH¢441,000 payable annually in arrears. The interest rate implicit in the lease is 7%. The present value of the guaranteed minimum lease payments is the same as the sale proceeds.

Required:

Demonstrate how Hard-Work Ltd will account for the above transaction for the year ended 31 May 2016 in accordance with IAS 17 Leases. Show relevant extracts to the statement of profit or loss and the statement of financial position as at 31 May 2016.

Answer

This transaction qualifies as a sale and leaseback. Given that the lease term is for the majority of the asset’s useful life and the present value of the minimum lease payments equals the fair value, the lease should be accounted for as a finance lease under IAS 17.

- Tags: Finance lease, Leases, Sale and Leaseback

- Level: Level 3

- Topic: IFRS 16: Leases

- Series: NOV 2016

- Uploader: Theophilus