- 15 Marks

Question

Below are the recently issued financial statements of Madina Ltd, a listed company, for the year ended 30 September 2018, together with comparatives for 2017.

Statement of Profit or Loss for the year ended 30 September:

| Details | 2018 (GH¢’000) | 2017 (GH¢’000) |

|---|---|---|

| Revenue | 125,000 | 90,000 |

| Cost of Sales | (100,000) | (75,000) |

| Gross Profit | 25,000 | 15,000 |

| Operating Expenses | (13,000) | (11,000) |

| Finance Costs | (4,000) | – |

| Profit before Tax | 8,000 | 4,000 |

| Tax (at 25%) | (2,000) | (1,000) |

| Profit for the year | 6,000 | 3,000 |

Statement of Financial Position as at 30 September:

| Details | 2018 (GH¢’000) | 2017 (GH¢’000) |

|---|---|---|

| Non-Current Assets | ||

| Property, Plant, and Equipment | 105,000 | 45,000 |

| Goodwill | 5,000 | – |

| Total Non-Current Assets | 110,000 | 45,000 |

| Current Assets | ||

| Inventory | 12,500 | 7,500 |

| Receivables | 6,500 | 4,000 |

| Bank | – | 7,000 |

| Total Current Assets | 19,000 | 18,500 |

| Total Assets | 129,000 | 63,500 |

| Equity and Liabilities | ||

| Equity | ||

| Share Capital | 50,000 | 50,000 |

| Retained Earnings | 7,000 | 6,000 |

| Total Equity | 57,000 | 56,000 |

| Non-Current Liabilities | ||

| 8% Loan Notes | 50,000 | – |

| Current Liabilities | ||

| Bank Overdraft | 8,500 | – |

| Trade Payables | 11,500 | 6,500 |

| Current Tax Payable | 2,000 | 1,000 |

| Total Current Liabilities | 22,000 | 7,500 |

| Total Equity and Liabilities | 129,000 | 63,500 |

Additional Information:

- On 1 October 2017, Madina Ltd acquired 100% of the net assets of Aboabu Ltd for GH¢50 million. In order to finance this transaction, Madina Ltd issued GH¢50 million 8% loan notes on the acquisition date.

Aboabu Ltd’s results for the year ended 30 September 2018 are shown below:

Aboabu Ltd’s Statement of Profit or Loss for the year ended 30 September:

| Details | GH¢’000 |

|---|---|

| Revenue | 35,000 |

| Cost of Sales | (20,000) |

| Gross Profit | 15,000 |

| Operating Expenses | (4,000) |

| Profit before Tax | 11,000 |

| Tax (at 25%) | (2,750) |

| Profit for the year | 8,250 |

- Aboabu Ltd has not paid any dividend during the year, but Madina Ltd paid a dividend of GH¢0.05 per share.

- The following ratios have been calculated for Madina Ltd for the year ended 30 September 2017:

- Return on capital employed: 7.1%

- Gross profit margin: 16.7%

- Net profit (before tax) margin: 4.4%

Required:

a) Calculate the equivalent ratios for Madina Ltd for 2018:

i) Including the results of Aboabu Ltd acquired during the year. (3 marks)

ii) Excluding all effects of the purchase of Aboabu Ltd. (3 marks)

b) Analyse the performance of Madina Ltd for the year ended 30 September 2018. (5 marks)

c) Analyse the cash position of Madina Ltd as at 30 September 2018. (4 marks)

Answer

a)

Madina Ltd

Equivalent ratios

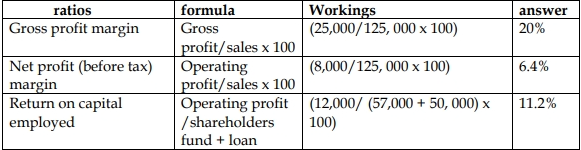

i) Including Aboabu Ltd:

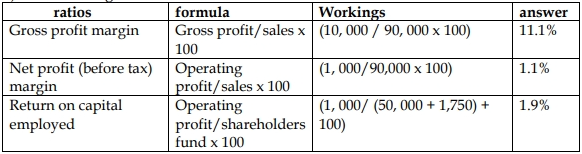

ii) Excluding the effects of Aboabu Ltd:

Candidates are to be mindful that the financial statements of Madina Ltd for the year

ended 30 September 2018 includes the results of Aboabu Ltd acquired during the year.

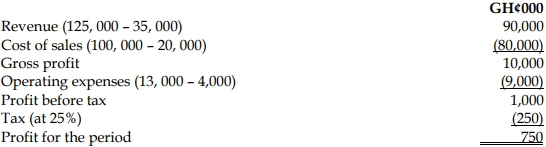

It is useful to re-draft a statement of profit or loss without the effects of Aboabu Ltd.

Statement of profit or loss

Note: Capital employed will be made up of share capital and retained earnings, as no

loan notes will exist without the purchase of Aboabu Ltd. Retained earnings without

Aboabu Ltd will actually be GH¢1.75 million. This can be calculated in two ways:

Closing retained earnings of GH¢7 million less GH¢8.25 million from Aboabu Ltd’s

profit, plus GH¢3 million increase in profit after tax relating to the interest on the loan

notes (GH¢4 million interest saved less GH¢3 million tax relief at 25%).

An alternative calculation of retained earnings would be GH¢6 million in 2017 plus

GH¢0.75 million from Madina Ltd’s profit excluding Aboabu Ltd less GH¢5 million

dividend (GH¢0.05 per share), which would also give GH¢1.75 million.

A final alternative calculation of retained earnings would be closing retained earnings

of GH¢7 million less the original profit of GH¢6 million plus the GH¢0.75 million

profit excluding Aboabu Ltd, to give GH¢1.75 million.

Part (b) Performance Analysis

The acquisition of Aboabu Ltd has significantly improved the overall financial performance of Madina Ltd. Key observations include:

- Revenue Growth: Including Aboabu Ltd, revenue increased by GH¢35 million (from GH¢90 million in 2017 to GH¢125 million in 2018, and an additional GH¢35 million from Aboabu Ltd).

- Profitability: The gross profit margin increased from 16.7% in 2017 to 25% in 2018 (including Aboabu Ltd). Without Aboabu Ltd, the gross profit margin would still have improved to 20%.

- Efficiency: The return on capital employed (ROCE) shows a substantial improvement, rising from 7.1% in 2017 to 21.5% in 2018 when including Aboabu Ltd. Without the acquisition, ROCE would still show an improvement at 11.2%.

- The acquisition positively impacted profitability and capital efficiency, contributing to the overall growth of the company.

Part (c) Cash Position Analysis

- Bank Overdraft: The company has moved from a cash surplus position in 2017 (GH¢7 million) to a significant bank overdraft of GH¢8.5 million in 2018. This indicates a potential liquidity issue.

- Current Liabilities: The increase in trade payables (from GH¢6.5 million to GH¢11.5 million) suggests the company is relying more on credit from suppliers to finance operations.

- Acquisition Financing: The acquisition of Aboabu Ltd was financed by issuing GH¢50 million 8% loan notes. This increased non-current liabilities but also resulted in higher finance costs (GH¢4 million).

- Working Capital Management: Despite the acquisition, the current ratio has deteriorated. In 2017, current assets of GH¢18.5 million exceeded current liabilities of GH¢7.5 million, whereas in 2018, current assets of GH¢19 million are lower than current liabilities of GH¢22 million. This indicates potential liquidity risks and a strain on short-term cash flow.

- Tags: Cash Flow, Financial Ratios, Profitability, Return on Capital Employed

- Level: Level 3

- Topic: Analysis and Interpretation of Financial Statements

- Series: MAY 2019

- Uploader: Joseph