- 15 Marks

Question

Mion Ltd is a listed company in Ghana and operates many super markets in Ghana. During the year 2014, there was speculation in the financial press that the entity was likely to be a takeover target for larger companies in Ghana. A recent newspaper publication has suggested that the directors are unlikely to resist a takeover. The seven member board are all nearing retirement and all own significant minority shareholdings in the business.

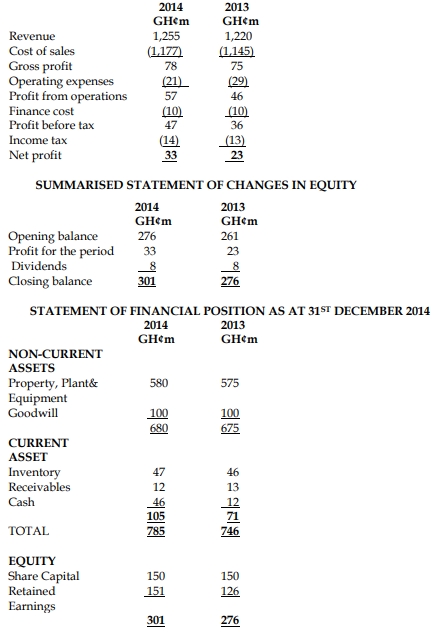

You have been approached by a private shareholder in Mion Ltd. She is concerned that the directors have conflict of interests and that financial statements for 2014 may have been manipulated. The income statement and summarized statement of changes in equity of Mion together with comparatives for the year ended 31st December 2014 and a statement of financial position as at that date are given below:

INCOME STATEMENT FOR THE YEAR ENDED 31ST DECEMBER 2014

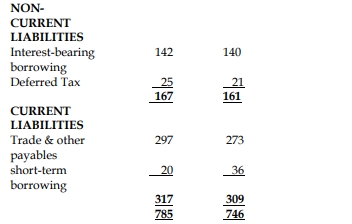

The following additional information is relevant:

i) Non-current asset turnover (including both tangible and intangible non-current asset): 1.93 ii) Mion Ltd’s directors have undertaken a reassessment of useful lives of non-current tangible assets during the year. In most cases they estimate that the useful lives have increased and the depreciation charges in 2014 have been adjusted accordingly. iii) Six new stores have been opened during 2014, bringing the total to 42. iv) Three key ratios for the supermarket sector (based on the latest available financial statement of 12 listed entities in the sector) are as follows:

- Annual sales per store: GH¢27.6m

- Gross Profit margin: 5.9%

- Net profit margin: 3.9%

Required:

Prepare a report and address to the investor, analyzing the performance and position of Mion Ltd based on the financial statements and supplementary information provided above. The report should also include comparisons with key sector ratios, and it should address the investor’s concerns about the possible manipulation of the 2014 financial statements. (15 marks)

Answer

REPORT To: A private shareholder

From: Management accountant

Date: 31/12/2014

Subject: Performance and position of Mion

As requested, I have analyzed the performance and position of Mion. My analysis is based on extracts from the financial statements for the year ended 31 December 2014 with comparative figures for the year ended 31 December 2013. A number of key measures have been calculated and these are set out in the attached Appendix.

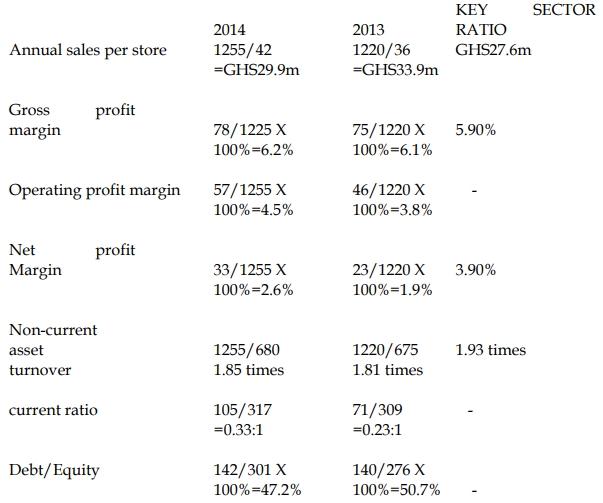

SALES The company has opened six new stores during the year. However, sales have only increased very slightly in 2014 and annual sales per store have fallen. This may be because the new stores have only opened part way through the year and have therefore not contributed a full year’s revenue. Alternatively, there may have been an increase in the level of sales tax.

Annual sales per store are still above the industry average. On the face of it, this is a good sign. However, it is possible that Mion has large stores relative to the rest of the sector.

PROFITABILITY Gross profit margin has increased very slightly during the year and this is a little above the industry average. However, although net profit margin has increased significantly during the year, this is still below the industry average. The increase in net profit margin has occurred because operating expenses have fallen by over a quarter in 2014. The operating profit margin has risen from 3.8% in 2013 to 4.5% in 2014.

Given the information available, the mostly likely cause of this fall is the increase in asset lives and the resulting reduction in the depreciation expense. As might be expected, the company has a considerable investment in property, plant & equipment and depreciation would normally be significant expense. An increase in asset is relatively unusual and it is possible the directors have used this method to deliberately improve the operating and the net profit margins. (They may have been particularly concerned that the net profit margin has obviously been well below the industry average.)

On the other hand, the directors may have carried out their review of assets lives in good faith or there could be another legitimate reason why operating expenses have fallen. For example, the 2013 figure may have been inflated by a significant “one off” expense.

It is impossible to prove that the profit figure has been manipulated on the basis of the very limited information available. Information about the reasons for the fall in operating expenses and review of asset lives and about the property, plant & equipment held by the company would be extremely useful.

OTHER MATTERS Non-current asset turnover has improved slightly, but still below the industry average. This suggests that the company uses its asset less efficiently than others in the same sector. However, increasing the asset lives will have reduced the ratio for 2014; it is possible that the company’s asset turnover would have approached the sector average had the review not been carried out. Given that six new stores have opened in 2014, it is surprising that property, plant & equipment has only increased by GHS5 million in the year. It is possible that most of the investment in new property was made during 2013.

The current ratio for both years is extremely low. Supermarkets often do have relatively low current and quick ratios, but no average figure for the industry is available, so it is difficult to tell whether this is normal for the type of operation. Short-term liquidity appears not to be a problem because the company has a positive cash balance which has increased in the year. However, the appearance of the statement of financial position suggests that this has been achieved by delaying payment to suppliers. Trade and other payables have increased by nearly 9%, while revenue and cost of sales have only increased by approximately 3%.

The debt/ equity ratio has fallen in the year and gearing does not appear to be a problem.

CONCLUSION Mion’s profit margins appear to be reasonable for a company in its industry sector. Although its net profit margin is below the industry average, this is improving. There are no apparent short-term liquidity problems.

It is possible at least some of this improvement has been achieved by deliberately reducing the operating expenses for the year. If, as seems likely, the directors wish to sell their interest in the company in the near future, improved results will help to secure a better price.

However, it is impossible to be certain that this has happened without much more detailed information about the reason for the fall in operating expenses. There may be legitimate explanation for the improvement in the company’s profit margins.

APPENDIX

- Topic: Analysis and Interpretation of Financial Statements

- Series: MAY 2016

- Uploader: Theophilus