- 20 Marks

Question

Wadie Ltd has been in operation for the past ten years. The company started operations in Kumasi with just three employees, but currently operates in all regions of Ghana, with over five hundred employees.

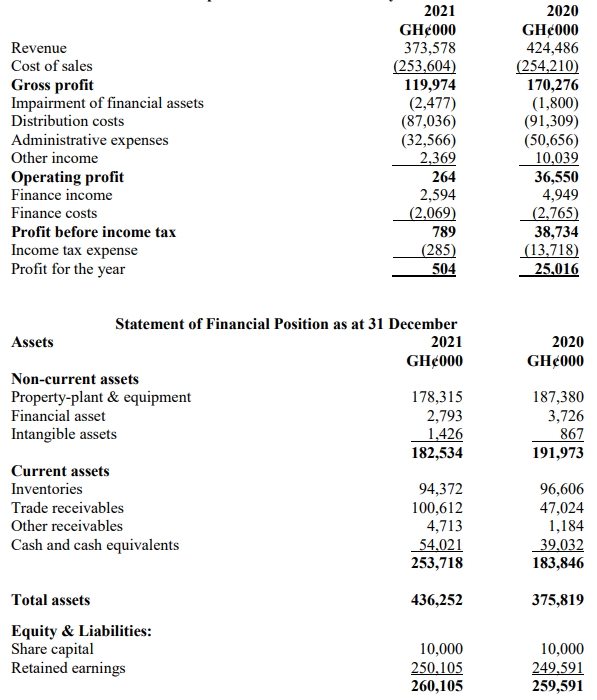

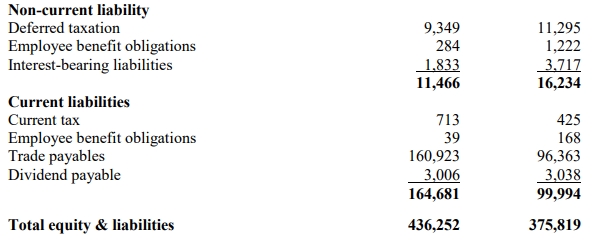

The final meeting for the year of the Board of Directors of the company is to be convened, and as a tradition, the Finance Manager presented an analysis of the financial performance of the company for the financial year ended 31 December 2021. Below are the financial statements for the year ended 31 December 2021:

Statement of Comprehensive Income for the year 31 December

Additional Information:

i) Finance income relates to interest earned on the company’s investment in Government of Ghana loan notes.

ii) Dividend payable represents the dividend declared or approved by shareholders at the last Annual General Meeting.

Required:

As the Finance Manager of the company, write a report to the Board of Directors, assessing the comparative performance of the company for the year ended 31 December 2021. Your report should use THREE (3) profitability ratios, TWO (2) liquidity ratios, THREE (3) efficiency ratios, and TWO (2) gearing ratios.

Answer

To: The Board of Directors

From: The Finance Manager

Date: 3rd April 2022

Subject: Performance Assessment of Wadie Ltd for the Year Ended 31 December 2021

This report provides an analysis of the performance of Wadie Ltd for the year ended 31 December 2021, compared with the previous year (2020). The assessment is based on profitability, liquidity, efficiency, and gearing ratios.

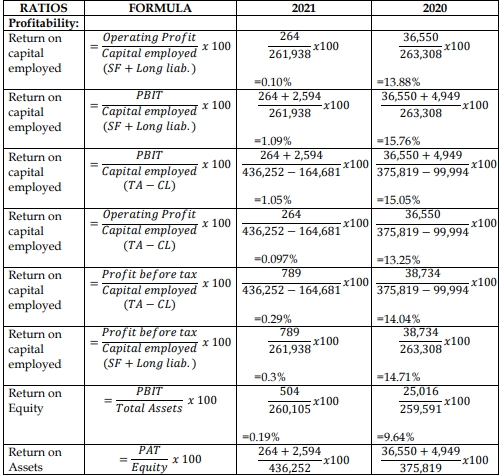

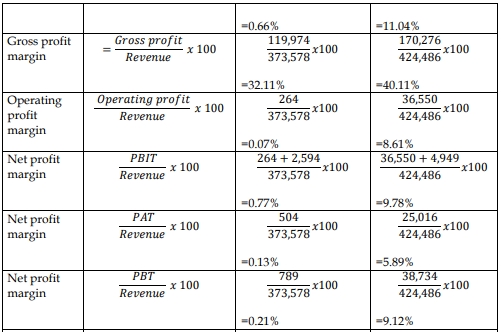

Profitability Ratios

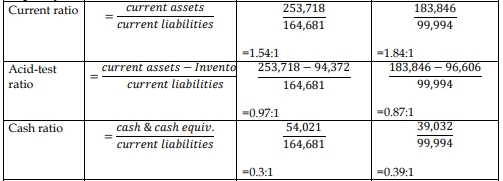

Liquidity Ratios

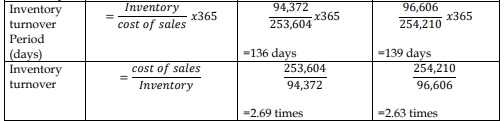

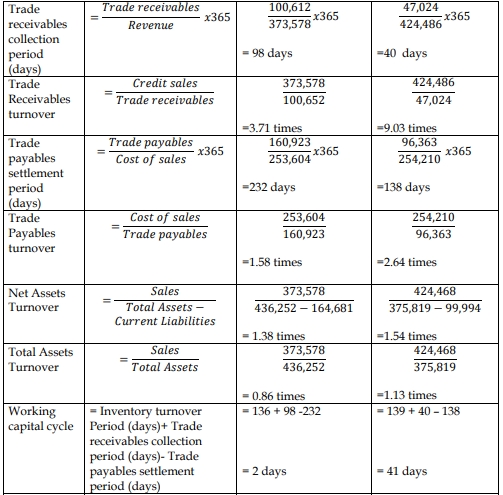

Efficiency Ratios

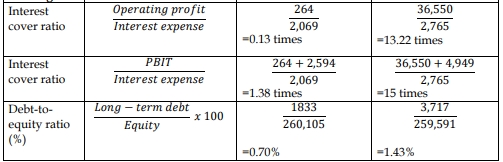

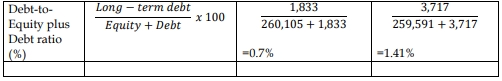

Gearing Ratios

Conclusion

Overall, Wadie Ltd’s financial performance for the year ended 31 December 2021 has deteriorated compared to 2020. The company has experienced a sharp decline in profitability, weakened liquidity, and deteriorating efficiency in managing trade receivables and payables. While the debt-to-equity ratio has decreased, indicating lower financial risk, the company’s ability to meet its interest obligations has worsened significantly. Immediate action is needed to improve cash flow management and operational efficiency.

Signed,

Finance Manager

- Tags: Efficiency, Financial Ratios, Gearing, Liquidity, Performance Analysis, Profitability

- Level: Level 3

- Topic: Analysis and Interpretation of Financial Statements

- Series: AUG 2022

- Uploader: Theophilus