- 10 Marks

Question

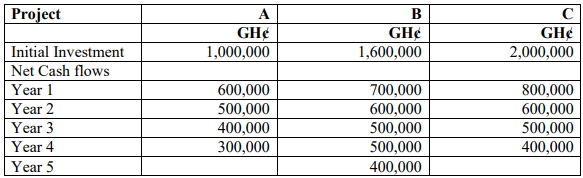

SAKAMA Ghana Ltd uses the Accounting Rate of Return (ARR) as the basis of evaluating projects for investment of its scarce financial resources. It uses its predetermined expected return on capital as the basis for the choice of investment projects. The company’s Finance team has provided the information below regarding various projects and their initial investments and net cash flows. The hurdle rate or target Accounting Rate of Return for SAKAMA Ghana Ltd is 25%.

Required:

i) Calculate the Accounting Rate of Return for each project (Average Investment basis). (7 marks)

ii) Using the target return of 25%, advise SAKAMA Ghana Ltd which projects should be undertaken. (3 marks)

Answer

i) Calculation of the Accounting Rate of Return (ARR) for each project:

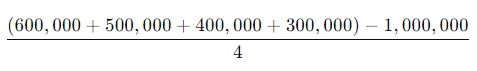

Project A:

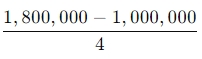

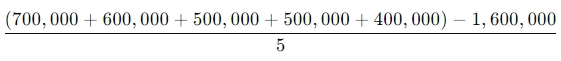

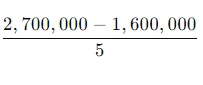

Average Annual Accounting profit =

=  =200,000

=200,000

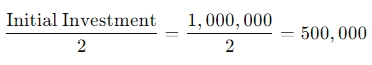

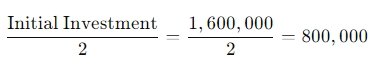

Average Annual Investment =

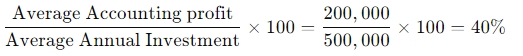

ARR =

Project B:

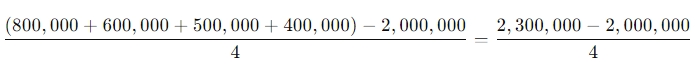

Average Annual Accounting profit =

=  =220,000

=220,000

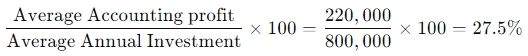

Average Annual Investment =

ARR =

Project C:

Average Annual Accounting profit =

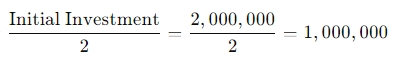

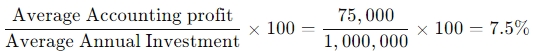

Average Annual Investment =

ARR =

ii) Advice on Projects:

Given the target ARR of 25%, the projects with ARR above this target should be accepted. Therefore, SAKAMA Ghana Ltd should undertake Projects A and B as they both have ARR above the target rate, while Project C should not be undertaken as its ARR is below the target.

- Topic: Introduction to Investment Appraisal

- Series: APR 2022

- Uploader: Theophilus