- 20 Marks

Question

You have just been appointed the full-time Management Accountant for Genuine Jobbers Limited, a company based in the North Industrial Area in Accra that produces cartons to meet customers’ specific requirements. You have been tasked to determine the cost and invoice price per job for the forthcoming period and have been provided with the following:

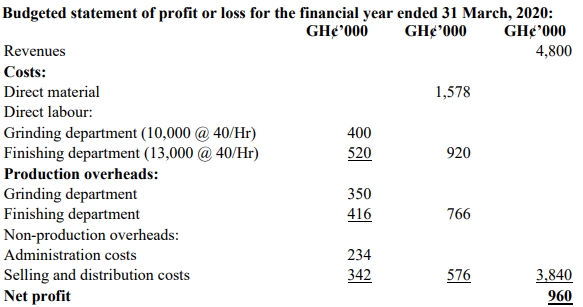

Budgeted statement of profit or loss for the financial year ended 31 March, 2020:

The sales department is currently negotiating a price for an enquiry for job number 45A/2020 and the following information has been provided for that purpose:

Direct costs estimates:

| GH¢ | |

|---|---|

| Direct material | 18,000 |

| Direct labour: Grinding department 400 hours @ GH¢10 each | 4,000 |

| Finishing department 300 hours @ GH¢12 each | 3,600 |

Note:

- It is recommended that production overheads are charged to jobs on the basis of direct labour hours worked.

- Selling and administrative expenses are charged at 10% of production cost.

- It is a policy of the company to make a profit margin as budgeted on each job.

Required:

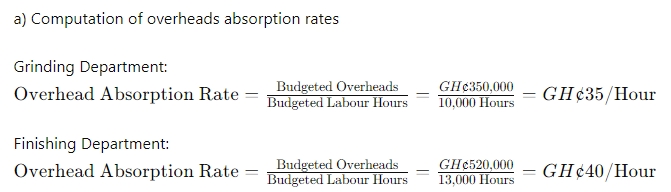

a) Compute the overheads absorption rates for each of the production departments. (4 marks)

b) As the Management Accountant, estimate the costs of Job 45A/2020 in the light of the information provided, and hence an invoice price for the Sales Manager’s use. (16 marks)

Answer

b) JOB 45A/2020

JOB COST SHEET

| GH¢ | GH¢ | |

|---|---|---|

| Direct materials | 18,000 | |

| Direct labour: | ||

| Grinding (400 x GH¢10) | 4,000 | |

| Finishing (300 x GH¢12) | 3,600 | 7,600 |

| Prime costs | ||

| Production overheads: | ||

| Grinding (400 x GH¢35) | 14,000 | |

| Finishing (300 x GH¢40) | 12,000 | 26,000 |

| Production costs | 51,600 | |

| Selling & Administration overheads (10%x GH¢51,600) | 5,160 | |

| Total costs | 56,760 | |

| Profit mark-up (20/80 x GH¢56,760) | 14,190 | |

| Selling price of Job | 70,950 |

- Tags: Invoice Price Calculation, Job Costing, Overhead Absorption

- Level: Level 1

- Topic: Job Costing

- Series: NOV 2019

- Uploader: Joseph