- 8 Marks

Question

Kaeka Ltd is a resident company providing cleaning services in Ghana. For the first time in the history of the entity, it launched operations as an external company in January 2020 in Lusaka, Zambia. It came to light that the entity earned the equivalent of GH¢2,500,000, which was evenly made for the 2020 year of assessment. On the home front, it earned GH¢16,000,000 in the 2020 year of assessment as income in Ghana. Assume that allowable costs of GH¢12,000,000 were incurred. It received a dividend net of tax from a company in Israel it acquired shares from, amounting to GH¢20,000 in December 2020. Tax of GH¢5,000 was paid on the dividend received.

Required:

i) Compute the tax payable by Kaeka Ltd.

ii) Explain the tax implication if the company made the income from Zambia in the last quarter of 2020.

Answer

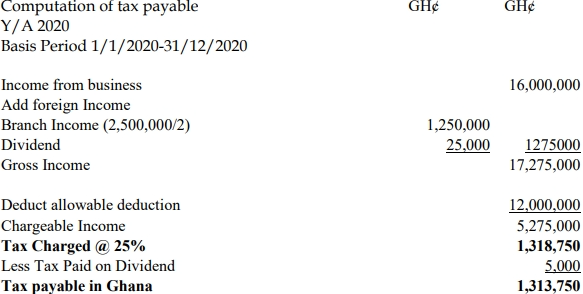

i) Computation of tax payable

Explanation:

Income received from a foreign country loses its character; hence, the dividend is added to the income, and the tax paid in the foreign country is given as credit. Additionally, the branch of the entity in Ghana has become a foreign PE, and therefore, its income for the first 183 days is taxable in Ghana. After that, it is exempt from tax.

ii) Computation of tax payable if the income from Zambia was earned in the last quarter of 2020

| Description | GH¢ | GH¢ |

|---|---|---|

| Income from business (Ghana) | 16,000,000 | |

| Add foreign income: | ||

| Dividend | 25,000 | |

| Gross Income | 16,025,000 | |

| Deduct allowable deduction | (12,000,000) | |

| Chargeable Income | 4,025,000 | |

| Tax Charged @ 25% | 1,006,250 | |

| Less tax paid on dividend | (5,000) | |

| Tax payable in Ghana | 1,001,250 |

Explanation:

Since the foreign Permanent Establishment did not earn the income in the first 183 days or first 6 months, the income shall be exempt from tax in Ghana in line with section 111 of Act 896 (Act 2015).

- Tags: Corporate Tax, Domestic Income, Foreign income, Tax computation

- Level: Level 3

- Topic: Business income - Corporate income tax, International taxation

- Series: MAY 2021

- Uploader: Joseph