- 20 Marks

Question

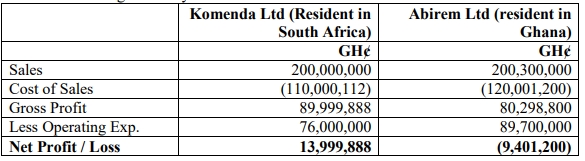

Gomoa Ltd, a resident of the United States of America, established two companies, Komenda Ltd (resident in South Africa) and Abirem Ltd (resident in Ghana). The Ghana Revenue Authority (GRA) requested information about Abirem Ltd for tax purposes.

The details for the 2021 year of assessment are as follows:

Additional information:

i) Gomoa Ltd invoiced goods to Abirem Ltd at a price of GH¢1,900,000, which is 10% higher than the market price.

ii) Dividend of GH¢700,000 paid by Abirem Ltd to Gomoa Ltd has been incorporated into Abirem Ltd’s cost.

iii) Management and technical services fee of GH¢1,290,000 paid to the group by Abirem Ltd has been added to operating expenses.

iv) Goods invoiced to Komenda Ltd by Gomoa Ltd amounted to GH¢1,000,000, priced 15% below the arm’s length price.

v) Dividend of GH¢200,000 received by Abirem Ltd from a resident company is included in its revenue. Abirem Ltd holds 25% of the resident company’s voting power.

vi) The Managing Director of Abirem Ltd took goods for personal use, valued at GH¢200,000 (cost), with a margin of 20%.

vii) The Managing Director of Abirem Ltd took additional goods worth GH¢130,000 at cost for home consumption, which was not added to the cost of goods above. The goods were sold at a 10% markup.

viii) Abirem Ltd paid GH¢20,000 in tax in South Africa at a rate of 27% on goods sold, which was included in its revenue.

ix) Abirem Ltd received a loan from Komenda Ltd for operations. Loan details are as follows:

- Loan amount: GH¢10 million

- Interest on loan payable: GH¢1,000,000

- Foreign exchange loss on the loan: GH¢200,000

x) Equity at the start of the year: GH¢2,000,000, and at the end of the year: GH¢2,800,000

xi) GH¢400,000 was transferred from retained earnings to share capital.

xii) Financial gain from derivative: GH¢2.5 million, and financial cost from derivative: GH¢6 million, included in operating expenses.

Required:

Calculate the tax payable by Abirem Ltd for the 2021 year of assessment.

Answer

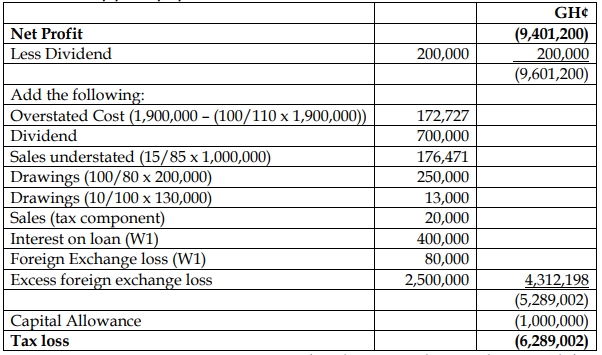

Abirem Ltd – Computation of Tax Payable for Year of Assessment 2021

Workings:

W1 – Loan Interest and Foreign Exchange Loss Adjustments:

- Loan amount: GH¢10 million

- Interest on loan: GH¢1,000,000

- Foreign exchange loss: GH¢200,000

- Equity: GH¢2,000,000

- Debt-to-equity ratio: 3:1

- Allowable debt: 3 × GH¢2,000,000 = GH¢6,000,000

- Allowable interest: (GH¢6,000,000 / GH¢10,000,000) × GH¢1,000,000 = GH¢600,000

- Disallowed interest: GH¢1,000,000 – GH¢600,000 = GH¢400,000

- Allowable foreign exchange loss: (GH¢6,000,000 / GH¢10,000,000) × GH¢200,000 = GH¢120,000

- Disallowed foreign exchange loss: GH¢200,000 – GH¢120,000 = GH¢80,000

Withholding Tax on Management and Technical Services:

20% × GH¢1,290,000 = GH¢258,000

- Topic: International taxation

- Series: DEC 2023

- Uploader: Theophilus