- 9 Marks

Question

Question:

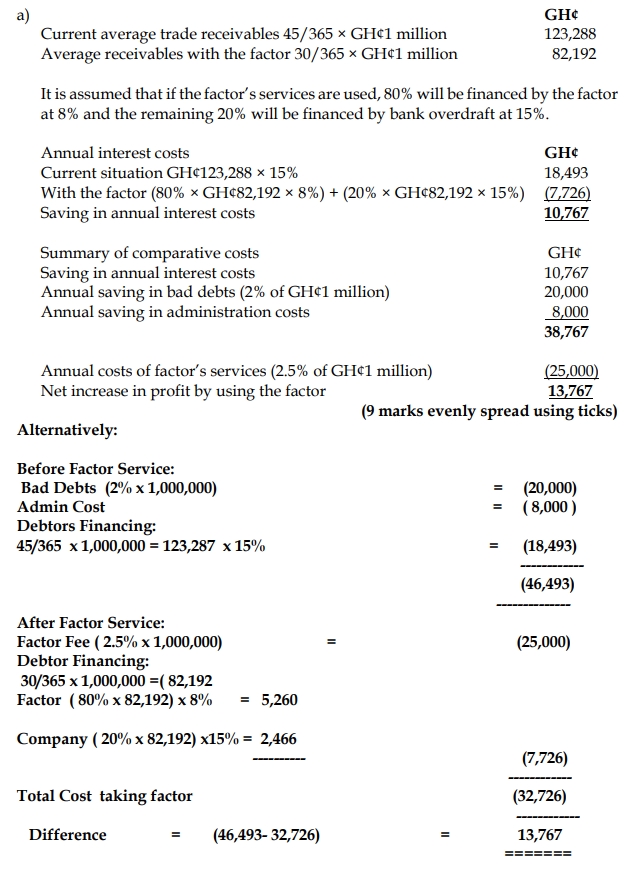

Lisa-Joys Company has annual credit sales of GH¢1,000,000. Credit customers take 45 days to pay. Bad debts are 2% of sales. The company finances its trade receivables with a bank overdraft, on which interest is payable at an annual rate of 15%.

A factor has offered to take over administration of the receivables ledger and collections for a fee of 2.5% of the credit sales. This will be a non-recourse factoring service. It has also guaranteed to reduce the payment period to 30 days. It will provide finance for 80% of the trade receivables, at an interest cost of 8% per year.

Lisa-Joys Company estimates that by using the factor, it will save administration costs of GH¢8,000 per year.

Required:

What would be the effect on annual profits if Lisa-Joys Company decides to use the factor’s services? (Assume a 365-day year). (9 marks)

Answer

- Tags: Cost-benefit analysis, Factoring, Trade receivables, Working Capital

- Level: Level 2

- Topic: Management of receivables and payables

- Series: MAY 2019

- Uploader: Joseph