- 10 Marks

Question

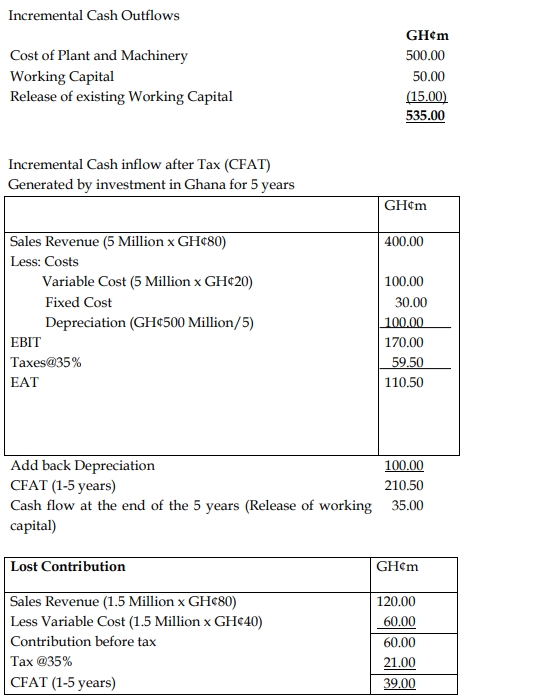

A Multinational Company (MNC) is planning to set up a subsidiary company in Ghana (where hitherto it was exporting) in view of growing demand for its product and competition from other MNCs. The initial project cost (consisting of Plant and Machinery including installation) is estimated to be GH¢500 million. The net working capital requirements are estimated at GH¢50 million. The company follows the straight-line method of depreciation. Presently, the company is exporting two million units every year at a unit price of GH¢80, with variable costs per unit being GH¢40.

The Chief Finance Officer has estimated the following operating cost and other data in respect of the proposed project:

i) Variable operating cost will be GH¢20 per unit of production.

ii) Additional cash fixed cost will be GH¢30 million p.a. and the project’s share of allocated fixed cost will be GH¢3 million p.a. based on the principle of ability to share.

iii) Production capacity of the proposed project in Ghana will be 5 million units.

iv) Expected useful life of the proposed plant is five years with no salvage value.

v) Existing working capital investment for production & sale of two million units through exports was GH¢15 million.

vi) Exports of the product in the coming year will decrease to 1.5 million units if the company does not open a subsidiary in Ghana, due to competing MNCs setting up subsidiaries in Ghana.

vii) Applicable corporate income tax rate is 35%.

viii) Required rate of return for such a project is 12%.

ix) Assume that there will be no variations in the exchange rate of the two currencies and all profits will be repatriated, as there will be no withholding tax.

Required:

Calculate the Net Present Value (NPV) of the proposed project in Ghana and advise management.

(10 marks)

Answer

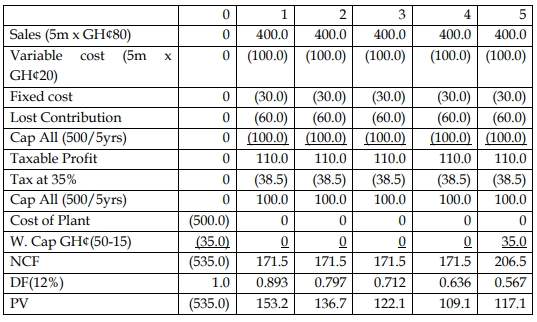

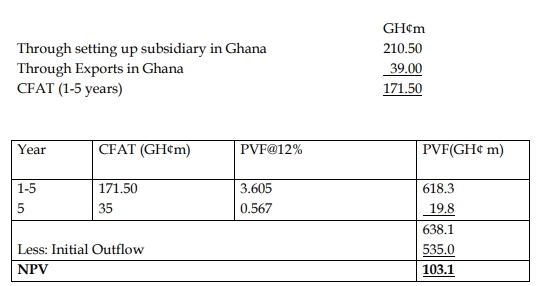

NPV = GH¢103.2m

An alternative financial Analysis whether to set up the manufacturing units in Ghana or not may be carried using NPV technique as follows:

- Tags: Fixed Costs, International Investment, Multinational, Net Present Value (NPV), Subsidiary, Taxation

- Level: Level 3

- Topic: International investment and financing decisions

- Series: MAY 2019

- Uploader: Theophilus