- 10 Marks

Question

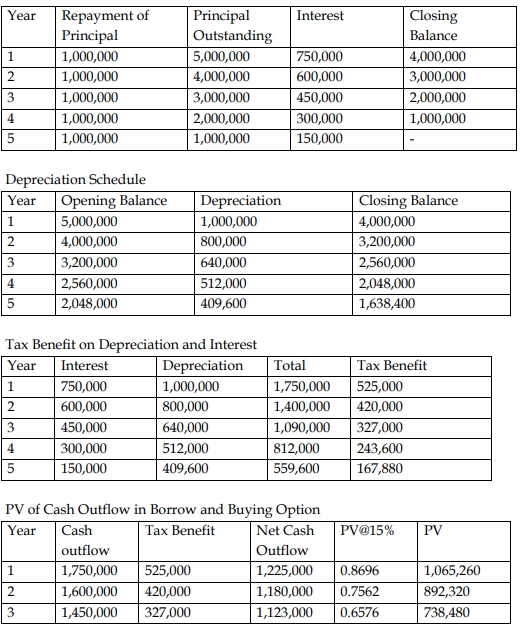

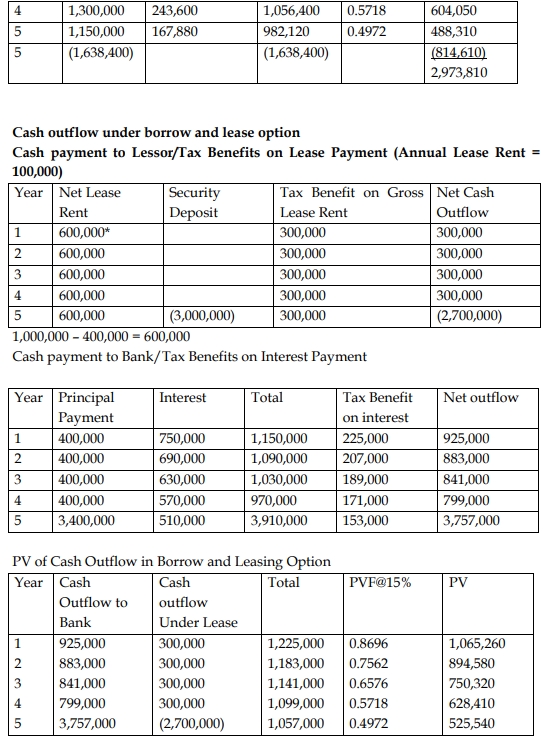

Rahim Ltd requires a machine for 5 years. There are two alternatives, either to take it on lease or buy basis. The company is reluctant to invest an initial amount for the project and approaches their bankers. The bankers are ready to finance 100% of its initial required amount at a 15% rate of interest for any of the alternatives.

Under lease option, an upfront security deposit of GH¢5,000,000 is payable to the lessor, which is equal to the cost of the machine. Out of which, 40% shall be adjusted equally against annual lease rent. At the end of life of the machine, the expected scrap value will be at book value after providing depreciation at 20% on written down value basis.

Under the buying option, loan repayment is in equal annual installments of the principal amount, which is equal to annual lease rent charges. However, in the case of bank finance for the lease option, repayment of principal amount equal to lease rent is adjusted every year, and the balance at the end of 5th year.

Assume income tax rate is 30%, interest is payable at the end of every year, and discount rate at 15% p.a. The following discounting factors are given:

| Year | Factor |

|---|---|

| 1 | 0.8696 |

| 2 | 0.7562 |

| 3 | 0.6576 |

| 4 | 0.5718 |

| 5 | 0.4972 |

Required:

Recommend the most viable option on the basis of net present values.

Answer

Total Present Value of Buy Option: 3,864,110

Recommendation

The present value of the lease option (GH¢2,011,440) is lower than the buy option (GH¢2,973,810). Therefore, the lease option is more viable for Rahim Ltd.

(10 marks evenly spread)

- Tags: Capital Investment, Depreciation, Discounting, Financing decisions, Lease vs Buy, Net Present Value

- Level: Level 3

- Topic: Discounted cash flow techniques

- Series: MAY 2019

- Uploader: Theophilus