- 3 Marks

Question

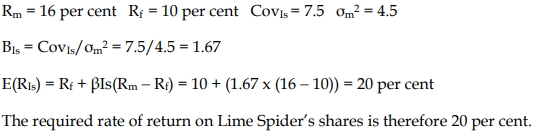

The market is currently yielding a return of 16% while Treasury bills are yielding 10%. Shares of Lime Spider Ltd have a covariance of 7.5 with the market, while the market has a variance of 4.5.

Required:

Determine the required rate of return for Lime Spider Ltd’s shares

Answer

Using the Capital Asset Pricing Model (CAPM):

- Market return (Rm) = 16%

- Risk-free rate (Rf) = 10%

- Covariance of Lime Spider shares with the market (CovLs) = 7.5

- Market variance (σ²m) = 4.5

Step 1: Calculate Beta (β):

β = CovLs / σ²m

= 7.5 / 4.5

= 1.67

Step 2: Apply CAPM formula:

E(RLs)=Rf+β(Rm−Rf)E(R_{Ls}) = Rf + β (Rm – Rf)E(RLs)=Rf+β(Rm−Rf)

= 10% + 1.67 × (16% – 10%)

= 10% + 1.67 × 6%

= 10% + 10.02%

= 20.02%

Conclusion:

The required rate of return for Lime Spider Ltd’s shares is 20%.

OR

- Tags: CAPM, Financial management, Required Rate of Return, Share Price

- Level: Level 3

- Topic: Theories of capital structure

- Series: MAY 2018

- Uploader: Theophilus