- 20 Marks

Question

You are a manager in Amable & Co, a firm of Chartered Accountants, responsible for the audit of Kpandu Sika Limited for the year ended 31 December 2015. Kpandu Sika Limited is a company listed on the Ghana Stock Exchange (GSE) which has been a client of your firm in the past three years. The company manufactures consumer electronic appliances which are then sold to major retail organizations. You are aware that during the last year, Kpandu Sika Limited lost several customer contracts due to cheap imports. However, a new division has been created to sell its products directly to individual customers in Ghana and worldwide via a new website, which was launched on 1 December 2015.

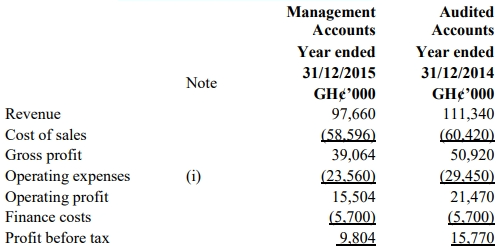

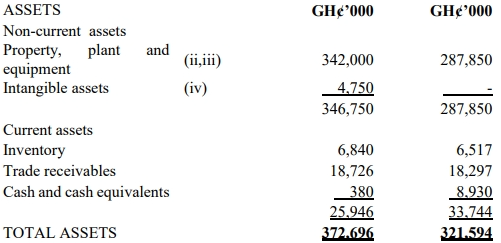

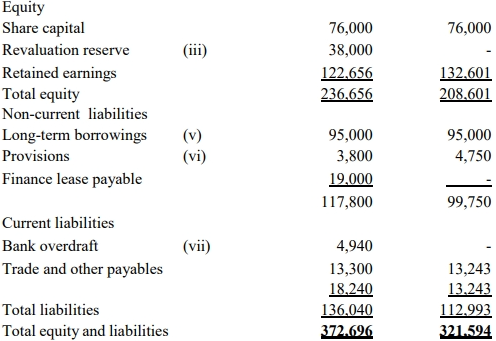

Financial information provided by the Finance Manager is shown below:

STATEMENT OF PROFIT OR LOSS

STATEMENT OF FINANCIAL POSITION AS AT

EQUITY AND LIABILITIES

NOTES:

i) Kpandu Sika Limited established an equity-settled share-based payment plan for its executives on 1 January 2015. 250 executives and senior managers have received 100 share options each, which vest on 31 December 2015 if the executive remains in employment at that date and if Kpandu Sika Limited’s share price increases by 10% per annum. No expense has been recognized this year as Kpandu Sika Limited’s share price has fallen by 5% in the last six months, and so it is felt that the condition relating to the share price will not be met this year-end.

ii) On 1 July 2015, Kpandu Sika Limited entered into a lease which has been accounted for as a finance lease and capitalized at GH¢19 million. The leased property is used as the head office for Kpandu Sika Limited’s new website development and sales division. The lease term is for five years and the fair value of the property at the inception of the lease was GH¢76 million.

iii) On 30 June 2015 Kpandu Sika Limited’s properties were revalued by an independent expert.

iv) A significant amount has been invested in the new website, which is seen as a major strategic development for the company. The website has generated minimal sales since its launch last month, and advertising campaigns are currently being conducted to promote the site.

v) The long-term borrowings are due to be repaid in two equal installments on 30 September 2016 and 2017. Kpandu Sika Limited is in the process of renegotiating the loan, to extend the repayment dates, and to increase the amount of the loan.

vi) The provision relates to product warranties offered by the company.

vii) The overdraft limit agreed with Kpandu Sika Limited’s bank is GH¢5.7 million.

Required:

a) Using the information provided by the Finance Manager, identify and explain the principal audit risks to be considered in planning the final audit.

(10 marks)

b) State the principal audit procedures which should be performed in respect of the provision for the product warranties offered by the company.

(6 marks)

c) State the principal audit evidence which you would expect to find in respect of the classification of the new lease in terms of IAS 17 Leases (Do not consider the application of the new leasing standard IFRS 16 Leases).

(4 marks)

Answer

a)

Principal Audit Risks:

- Profitability: Declining profitability with revenue falling by 12.3% and operating profit falling by 27.8% increases going concern risk.

- Management Bias: Risks of management overstating assets or understating liabilities due to renegotiating long-term finance.

- Operating Expenses: Possible understatement of expenses, especially due to new business division setup costs.

- Share-Based Payment Plan: Misstatement risk as no expense was recognized despite IFRS 2 requirements.

- Finance Costs: Static finance costs despite increased overdraft suggests possible understatement.

- Liquidity: Deteriorating liquidity position with increased reliance on overdraft indicates a going concern risk.

- Revaluation: Risk of overstatement due to material revaluation, potential depreciation issues, and deferred tax liability.

- Current Assets: Potential overstatement of inventory and receivables, increased holding, and collection periods.

- Long-Term Borrowings: Incorrect classification could lead to material misstatement; possible liquidity and going concern risk if loans are not renegotiated.

- Intangible Assets: Capitalization of website development costs may not meet IAS 38 criteria, leading to possible overstatement.

b)

Principal Audit Procedures:

- Review and test management’s process in developing the provision for warranties.

- Obtain independent estimates and compare them with management’s provision.

- Review subsequent events that may affect the provision.

c)

Principal Audit Evidence for Lease Classification:

- Verify the lease agreement terms, especially the lease term and payments.

- Compare capitalized amount with the fair value of the asset.

- Ensure correct classification as finance or operating lease per IAS 17 criteria.

- Tags: Audit risks, Financial Statements, IAS 17, IAS 37, Leases, Provisions

- Level: Level 3

- Topic: Audit evidence, Planning

- Series: NOV 2016

- Uploader: Joseph