- 10 Marks

Question

Your audit and assurance firm has just accepted a financial statement audit engagement from Lunch Special Ltd., a restaurant that prepares lunch for the general public and on special orders. The company operates at a number of sales points in the city.

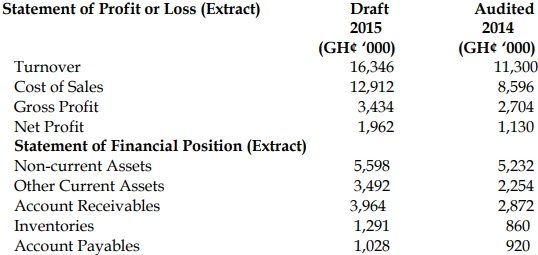

The company uses a computerised system that has networked all the Sales Points to its Head Office. Your firm is planning the new audit and has received the draft financial statements for the year. As the audit senior to lead the engagement team, you are examining the financial statements, an extract of which is shown below:

Required:

i) Using analytical procedures at the planning stage, state your observations drawn from the extracts from the draft financial statements and how they may impact your audit of the Accounts Receivables. (10 marks)

Answer

The following are the observations made from the draft financial statements and their impact on the audit of the Account Receivables:

- Increase in Turnover:

- Turnover has increased by 45% from the previous year, which may require verification of the sales transactions. This significant rise necessitates a closer look at the accuracy and completeness of sales records and their corresponding impact on accounts receivable.

- Increase in Accounts Receivable:

- Accounts Receivable has increased by 38%, which is slightly less than the increase in turnover. This could indicate efficient collections, but it still warrants a review of the aging of receivables and potential bad debts.

- Reduction in Receivables Collection Period:

- The payment period for receivables has reduced from 93 days to 89 days, which suggests improved collections. The audit should verify this by comparing receivables against cash receipts to ensure no unrecorded receipts and to detect any signs of teeming and lading.

- Gross Profit Margin:

- The Gross Profit Margin has decreased from 24% to 21%, which might be a result of increased cost of sales. This decline requires further investigation into whether all sales have been appropriately recorded and whether discounts offered are properly accounted for.

- Reconciliation of Receivables:

- The increase in both turnover and receivables requires confirmation of year-end balances through customer circularization and reconciliation of customer statements. Additionally, management policies on discounts and their proper recording should be verified.

- Topic: Audit evidence, Planning

- Series: MAY 2016

- Uploader: Joseph