- 20 Marks

Question

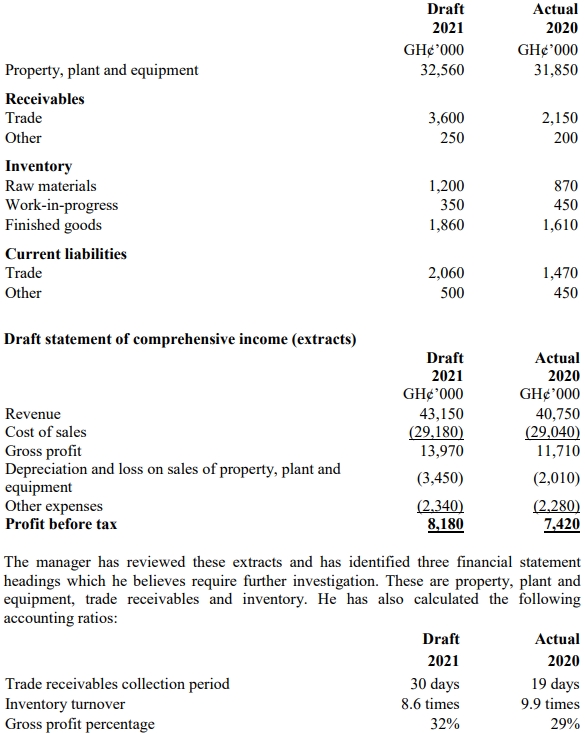

Maggie Manufacturing is a long-established manufacturing company. The audit manager has been provided with the following extracts from the draft financial statements for 2021, prior to the final audit planning meeting with the financial controller.

Draft Statement of Financial Position (Extracts):

The manager has reviewed these extracts and has identified three financial statement headings that require further investigation: property, plant, and equipment, trade receivables, and inventory. He has also calculated certain accounting ratios.

Required:

a) Explain why the manager has selected these three headings for further investigation.

b) Detail and explain the further information that the manager should request from the financial controller at the final audit planning meeting to clarify the situation with regards to the three financial statement headings.

Answer

a) The manager has selected these three headings for further investigation due to the following reasons:

- Property, Plant, and Equipment:

Property, plant, and equipment account for 87% of net assets, which is material for a manufacturing company. Although the balance has increased by 2%, depreciation and loss on sale have increased by 72%. This inconsistency suggests that there might be an issue with the recognition of depreciation or disposals, and further investigation is needed to ensure the balance is not overstated. - Trade Receivables:

Trade receivables have increased by 67%, while revenue has increased by only 6%, indicating a possible recoverability issue. This is supported by the increase in the collection period from 19 days to 30 days. There might be a need for increased allowances for receivables, and further testing is required to assess the recoverability of debts and the accuracy of the cut-off. - Inventory:

Inventory has increased by 16%, driven by significant increases in raw materials and finished goods, despite a 22% decrease in work-in-progress. The inventory turnover has decreased, suggesting possible slow-moving or obsolete inventory. The 6% increase in revenue, without a corresponding increase in cost of sales, could indicate an issue with inventory valuation or cut-off errors.

b) The audit manager should request the following information from the financial controller:

- Property, Plant, and Equipment:

- An explanation for the increase in net book value and the significant increase in depreciation/loss on disposals.

- Confirmation that the depreciation policy is consistent with the prior year.

- A detailed analysis of additions, disposals, and depreciation charges during the year.

- Information on whether any assets are carried at valuation rather than cost.

- A breakdown of the expense between depreciation and loss on sales.

- Trade Receivables:

- An explanation for the increase in the trade receivables collection period.

- Details of significant new customers and their credit ratings.

- An analysis of bad debts written off and the provision for doubtful debts.

- An aged receivables analysis.

- Details of post-year-end cash receipts to assess the collectibility of receivables.

- Inventory:

- Explanations for the movements in raw materials, work-in-progress, and finished goods, particularly the reasons for the build-up in inventory.

- Details of any adjustments required from the year-end inventory count.

- Post-year-end sales and next year’s order book to assess inventory turnover and potential obsolescence.

- An analysis of the provision for obsolete or slow-moving inventory.

- Confirmation that inventory is valued at the lower of cost and net realizable value.

- Topic: Audit and Assurance Evidence

- Series: MAR 2023

- Uploader: Theophilus