- 20 Marks

Question

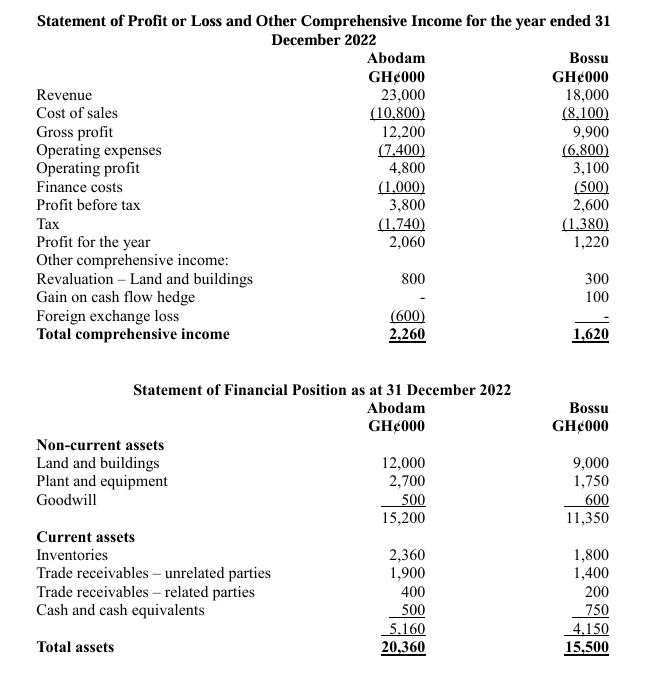

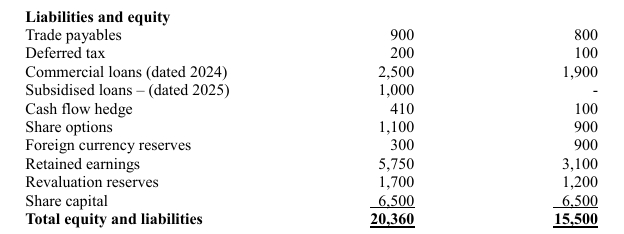

You are a financial consultant of Synel Investments (SI). The Directors of SI have tasked you to evaluate the financial health of two wholesaling companies – Abodam Plc (Abodam) and Bossu Plc (Bossu) – to help them decide which entity to invest in. Assume that all other factors of the two companies have been considered except their current period’s relative financial performance and position. The financial statements of Abodam and Bossu for the year ended 31 December 2022 are provided below:

Additional information:

- The Directors of Bossu announced at the beginning of the current period to repurchase 20% of the company’s issued shares in equal proportion over a three-year period. The purchase of the first tranche is expected to occur around February 2023. At the start of second quarter this year, the major commercial lender of Abodam triggered its covenant modification right to include stricter profit-based clauses in the loan agreement.

- During the year, Abodam and Bossu paid ordinary dividends of GH¢450,000 and GH¢315,000 respectively.

- Average borrowing rate for the two companies has remained 11% during the period.

Required:

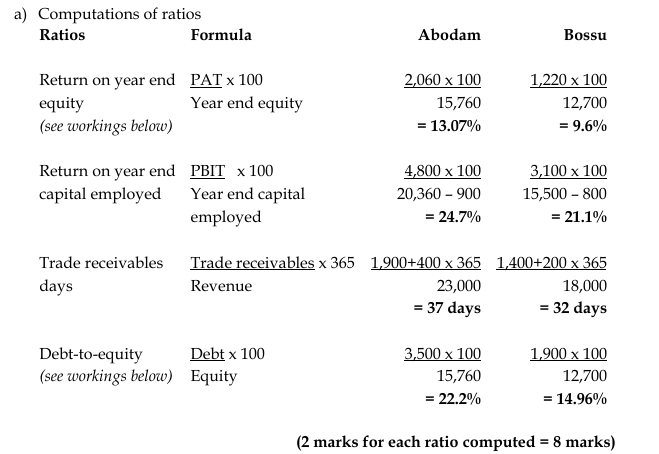

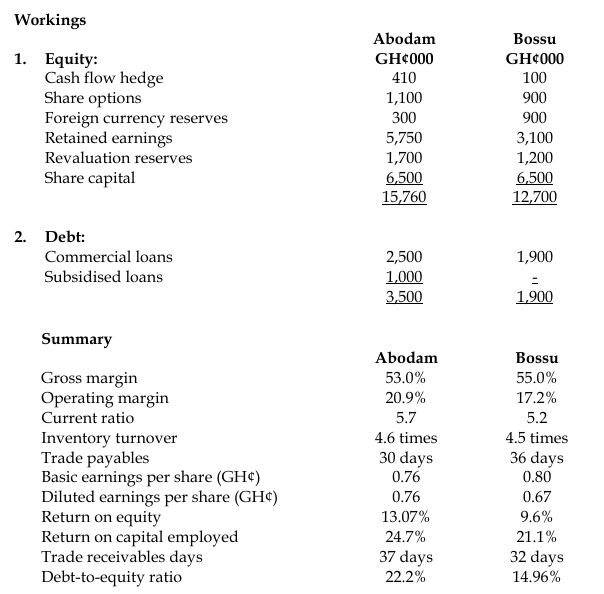

a) Compute the following additional ratios for the two companies:

i) Return on year-end equity

ii) Return on year-end capital employed (where capital employed equals total assets less current liabilities)

iii) Trade receivables days

iv) Debt-to-equity

(8 marks)

b) Write a report to the board of SI to evaluate the relative financial performance and position of Abodam and Bossu, based on the following headings:

i) Profitability

ii) Working capital management

iii) Gearing

iv) Earnings per share

v) Bossu’s repurchase plan vi) Abodam’s loan covenant

(12 marks)

(Total: 20 marks)

Answer

b) Report

To: Board of Directors, Synel Investments From: Financial Consultant Date: 01/11/2023 Subject: Analysis of the relative financial performance and position of Abodam and Bossu

This report provides a detailed evaluation of the financial performance and position of two “investment target” entities – Abodam and Bossu for the year ended 31 December 2022. The analysis seeks to provide insight into the financial health of the two shortlisted entities to help your company decide which of them to invest in. The evaluation covers relative profitability, working capital, gearing, and earnings per share of the two entities. This report, which also reserves a space for discussing the effects of the announced repurchase plan and the modified covenants, should be read along with the attached appendix.

Profitability Profitability has to do with how well an entity deploys its resources to generate and maximize revenues in an efficient and cost-effective manner. If done well, the entity is expected to earn positive returns. In this section, I would use four metrics to gauge which of the two have been more profitable and how. The measures include gross margin, operating margin, return on capital employed, and return on equity.

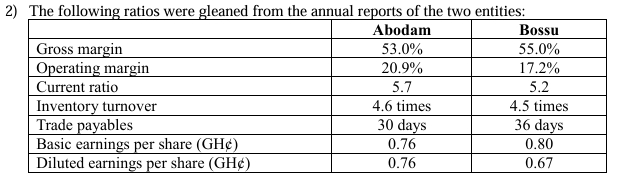

Abodam’s reported gross margin of 53% sits two percentage points below that of Bossu. This seems to suggest that Bossu has better control over cost of sales. Nothing however stops any supposition from being stretched as far as to suggest that this could as well result from different pricing strategies or different classification of expenses between cost of sales and other operational expenses. This last reasoning could so soon have sufficed by the fact the operating margin takes an opposite turn; Abodam’s operating margin is noticeably higher than Bossu’s margin. Could it be that Abodam keeps more within cost of sales than within the other lines of operational costs? Whatever the answer may be, it does not prevent the fact that Abodam has better control over overall operational costs than Bossu. The former requires around 81% of revenues to attend to operational costs in entirety whereas the latter needs around 83%.

Abodam’s better margins feed seamlessly into the returns for long-term investors as well as for only equity holders. With the return on capital employed of Abodam at 24.7% against Bossu’s 21.1%, Abodam has generated more profit for providers of long-term funds, including lenders and shareholders. Equally, Abodam’s 13.07% return on equity is higher and better than Bossu’s 9.6%, and this implies that from shareholders’ perspective only, Abodam has earned more profits per every cedi of capital invested.

Working capital management Managing working capital is one activity which is very key in helping entities to not only ensure that they have appropriate level of liquidity but to also keep their operations running efficiently without sacrificing profitability. If well managed, arranging the constituents of current assets and current liabilities should lead to a good balance between liquidity and profitability. I conduct this analysis using four ratios: current ratio, inventory turnover, trade receivables days, and trade payables days.

The current ratio of Abodam compares more favourably than Bossu’s. But with both entities covering their current liabilities with current assets by more than five times, it does not make much difference that one is more liquid than the other. A look at the individual working capital items provides interesting revelations. Abodam appears to be managing inventory better but tends to be sluggish in dealing with suppliers and customers. Abodam has a slightly faster inventory turnover rate; it turns inventory over 4.6 times in a year compared to Bossu’s 4.5 times. These figures also seem to lend credence to the initial thoughts that perhaps Abodam may have employed a lower product pricing strategy to increase turnover rate. Bossu’s receivables days of 32 days against Abodam’s 37 days means that the former takes five (5) fewer calendar days to collect its debts from credit customers. In terms of managing credits received from suppliers, Bossu takes six (6) more days than Abodam before making payment to credit suppliers. These decent working capital management efforts by using fewer days to collect debts and more days to pay suppliers may be the cause of Bossu’s lower current ratio.

Gearing Gearing shows how an entity blends equity and debt in its capital structure. This relationship reveals the amount of financial risk investors will bear to create or keep financial contracts with the entity. Bossu maintains a debt-to-equity ratio of 14.96%, which is about seven (7) percentage points less than Abodam’s. Bossu’s lower gearing ratio makes it less financially risky and safer to keep investments with. But given that the operating margins of both entities edge above the average borrowing rate of 11%, it seems questionable for Bossu to have kept debt levels that low. Since debt tends to be cheaper than equity, it is prudent to use more of it especially if profit levels provide sufficient cushion to help service the legal interest payments.

Earnings per share This measures the cedi amount of profit earned on each number of issued ordinary share. It gauges an entity’s profitability from shareholders’ perspective based on number of shares held, rather than the monetary value of shareholders’ investments. In this analysis, I use two related measures: basic earnings per share and diluted earnings per share. Basic earnings per share denotes how much actual earnings is attributable to each one weighted ordinary share outstanding while diluted earnings per share refers to earnings (both actual and notional) attributable to each one weighted ordinary share, after considering both issued and dilutive potential shares.

With Abodam reporting same basic and diluted earnings per share, it simply suggests that Abodam does not have any dilutive potential shares even though it has issued some share options. What this means is that these outstanding options are not in the money; the fair value of shares is lower than the exercise price. Bossu however reports different figures for the two types, meaning that Bossu’s options are in the money and dilutive.

Based on the basic earnings per share, Bossu is considered to be more profitable than Abodam as it earns 4 pesewas more on each issued share. However, the more predictive and more useful diluted earnings per share figures put Abodam above Bossu. The higher diluted earnings per share indicates that if dilutive potential shares were assumed to have been issued at the beginning of the period or the date of issue, whichever comes later, Abodam would earn 9 pesewas more on each weighted ordinary share than Bossu. Considering possible dilution of the earnings per share helps investors to have a better view of the company’s future.

Bossu’s repurchase plan Share repurchase plans represent one popular way, often more tax-efficient than cash dividend alternative from shareholders’ point of view, used by corporate entities to return monies to shareholders while helping the buying entities to reduce the number of shares in circulation. From the company’s perspective, it may be preferable to buy back shares where management believes or ensures that the company’s shares trade at a price lower than their true value. Accounting gimmicks could play a role in ensuring that this is the case. For instance, motivated by the desire to cause share under-pricing, management could cause negative market reaction by choosing techniques, often sophisticated earnings management mechanisms, to paint less healthy financials by cutting incomes, overstating expenses, understating assets, and inflating liabilities. Bossu’s general poor show could therefore have been driven by this desire to keep share prices down and minimize the cost of the share repurchase.

Modification of Abodam’s loan covenant Debt covenant violations can be very costly for borrowing entities as failure to keep to the covenant requirements could trigger early repayment, unfavourable renegotiations, and lost credibility for future debt contracting. These covenants could be based on either accounting numbers or non-accounting numbers. Those which are related to accounting numbers broadly require the borrower to achieve and maintain strong financial performance and healthy financial position. Thus, entities have a large incentive to put measures in place to ensure that they meet these requirements in order not to invite the wrath of their lending counterparts. With the lender putting stricter clauses into the existing covenant, Abodam would be motivated to do all it can put up a good show of financial performance. While Abodam’s good performance which I have laid bare from the above analyses may be the outcome of prudent decisions, these urges to resort to biased reporting in order to meet the new covenants at all costs cannot be discounted.

Conclusion From the assessment above, I would like to suggest that Abodam is a better entity and target to proceed with as it has generally been more profitable, more liquid, and kept debts at sustainable and more prudent level. Its diluted earnings per share figure, which is more predictive and relevant, is better than that of Bossu. However, there are concerns that the good numbers could have been induced by motivation to meet the stricter covenants. Yet, until concrete evidence to that effect is tended it would be far too unjustifiable to be assuming any wrongdoing. In terms of short-term efficiency, Abodam seems to be lagging behind Bossu. But this deficiency with Abodam pales into insignificance when compared to its overall good showing.

(Signed) Financial Consultant

(2 marks for each explanation = 12 marks)

- Topic: Analysis and Interpretation of Financial Statements

- Series: NOV 2023

- Uploader: Dotse