- 12 Marks

Question

b) Akorfa Vinyo, an equipment hiring company, raises an invoice in the sum of GH¢500,000.00 in respect of hiring of equipment services to a withholding VAT agent (Sir James Enterprise). This supply excludes Value Added Tax (VAT of 12.5%), National Health Insurance Levy (NHIL of 2.5%), and Ghana Education Trust Fund Levy (GETFL of 2.5%).

Assume that this is the only supply of value-added activity done by Akorfa Vinyo in the period and payments are made in the same period.

Required:

i) Calculate the proportion of VAT that should be withheld by the agent in respect of payment of the invoice (the withholding VAT rate is 7%). (3 marks)

ii) Calculate the output VAT to be shown on the face of Akorfa’s monthly VAT Return. (3 marks)

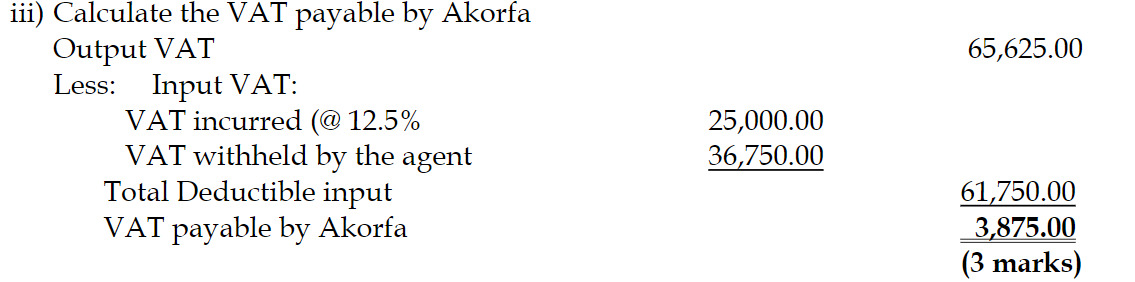

iii) Calculate the VAT payable by Akorfa, if the total input VAT incurred for the period is GH¢25,000. (3 marks)

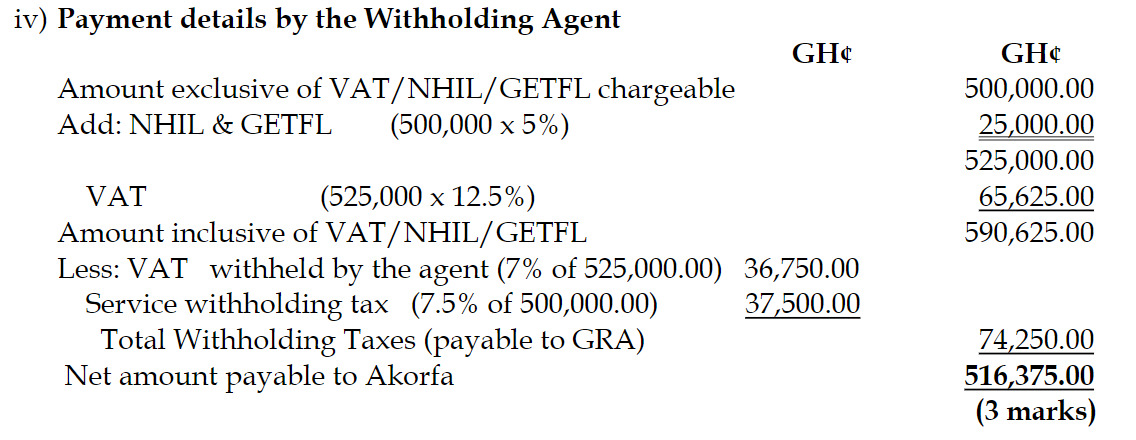

iv) Show the payment details by the Withholding Agent for the supply. (3 marks)

Answer

i) Proportion of VAT that should be withheld by the agent:

Proportion of VAT to be withheld (7% x 525,000) GH¢36,750

(3 marks)

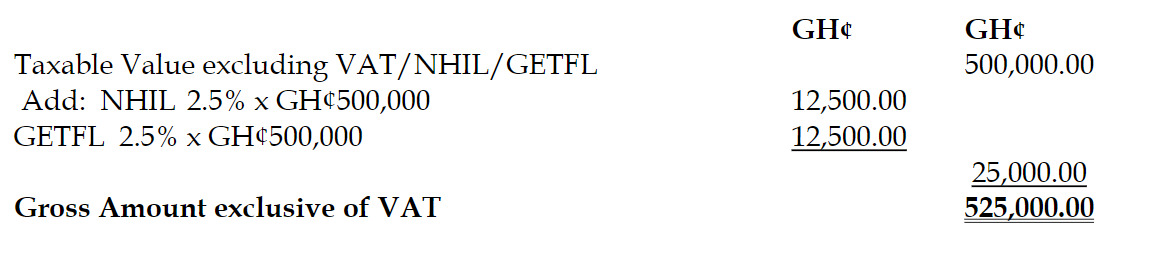

ii) Calculation of output VAT:

Description Amount (GH¢)

12.5% x 525,000 65,625.00

Output VAT GH¢65,625

(3 marks)

- Tags: Input VAT, Output VAT, Tax deduction, VAT, Withholding VAT

- Level: Level 2

- Topic: Value-Added Tax (VAT)

- Series: NOV 2019

- Uploader: Cheoli