- 8 Marks

Question

Fridays Ltd is a resident company. It provides cleaning services across the country. The following is available from its tax returns for the 2020 year of assessment.

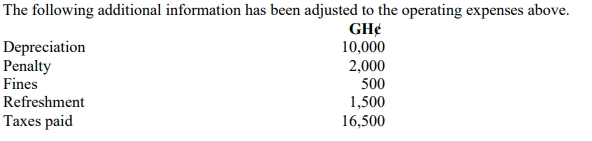

Other relevant information:

- The dividend was received from Z Ltd, a resident company where Fridays Ltd has 27% shares.

Required:

i) Compute the tax payable assuming its tax rate is 25%. (6 marks)

ii) Explain the treatment of the following:

- Rental income (1 mark)

- Dividend (1 mark)

Answer

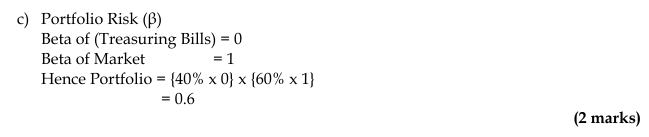

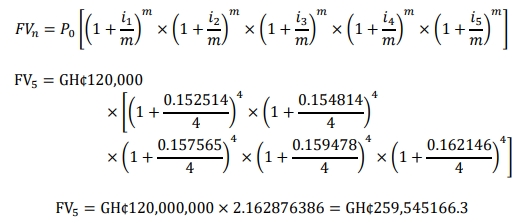

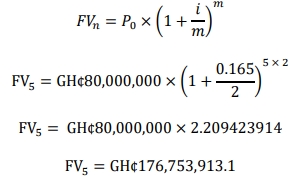

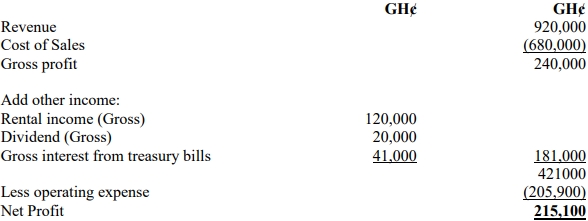

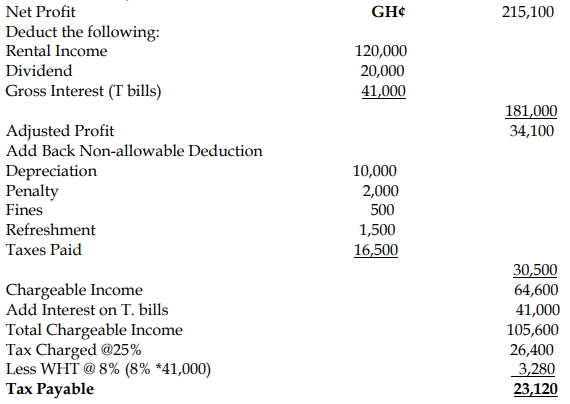

i) Computation of Tax Payable for Fridays Ltd

BASIS PERIOD JANUARY 1-DECEMBER 31, 2020

ii) Treatment of Rental Income

Rental income is taxed as investment income, and withholding tax applies. For residential premises, the rate is 8%, and for commercial premises, the rate is 15%. This withholding tax is treated as final.

(1 mark)

Treatment of Dividend

Dividends paid by a resident entity to another resident entity are exempt from tax if the recipient holds at least 25% voting rights in the paying entity. In this case, since Fridays Ltd holds 27% of Z Ltd’s shares, the dividend is exempt from tax.

(1 mark)

- Tags: Corporate Tax, Dividend, Rental Income, Treasury bills

- Level: Level 2

- Topic: Corporate Tax Liabilities

- Series: MAY 2021

- Uploader: Theophilus