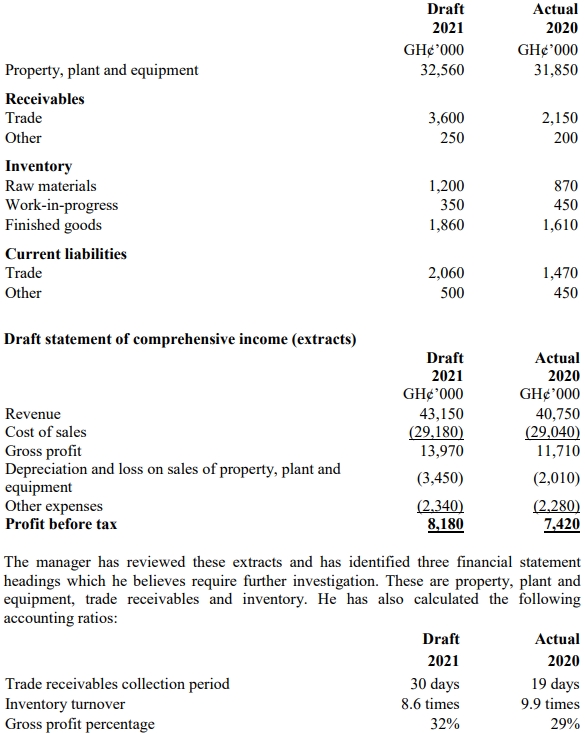

The main assertions about account balances are:

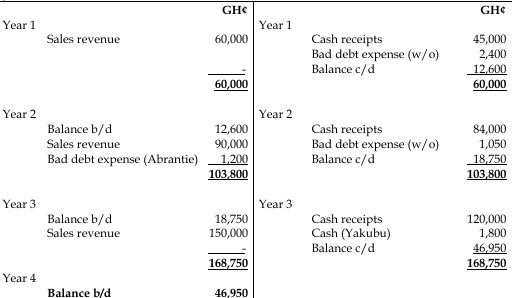

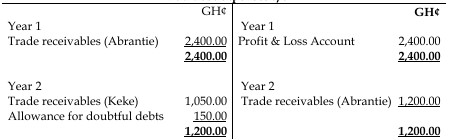

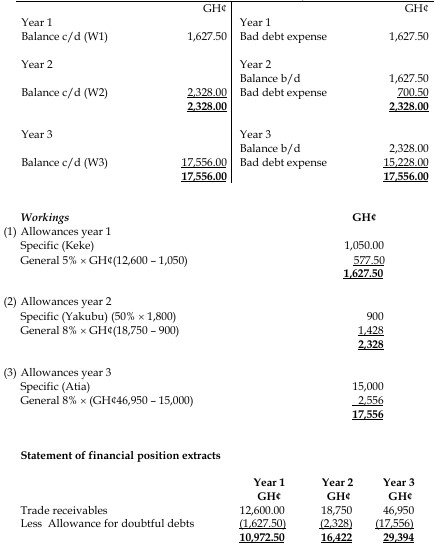

Completeness: All assets, liabilities, and equity interests that should have been recorded have been recorded. Example: Ensuring that all trade receivables are included in the financial statements by reconciling the trade receivables listing to the general ledger.

Accuracy, Valuation, and Allocation: Assets, liabilities, and equity interests are included in the financial statements at appropriate amounts. Example: Verifying that trade receivables are stated at their net realizable value by reviewing subsequent cash receipts or evaluating the adequacy of the allowance for doubtful accounts.

Rights and Obligations: The entity holds or controls the rights to assets, and liabilities are the obligations of the entity. Example: Confirming that the receivables are the entity’s legal rights by sending direct confirmations to customers.

Existence: Assets, liabilities, and equity interests exist at the reporting date. Example: Verifying the existence of trade receivables by sending confirmations to customers to confirm balances at the year-end date.

Classification: Assets, liabilities, and equity interests have been recorded in the proper accounts. Example: Ensuring that trade receivables are classified as current assets in the financial statements.

Presentation: Assets, liabilities, and equity interests are appropriately aggregated or disaggregated and clearly described in the financial statements. Example: Using a disclosure checklist to verify that trade receivables are properly disclosed in accordance with IFRS/IAS requirements.

(8 marks)

ii)

The five main audit testing procedures and examples related to plant and machinery are:

Inspection: Physically inspecting plant and machinery to confirm their existence (testing the existence assertion).

Observation: Observing the maintenance of plant and machinery to confirm their condition and allocation (testing the accuracy, valuation, and allocation assertion).

Inquiry: Inquiring of management regarding useful lives and profitability of the plant (testing the valuation and allocation assertion).

Confirmation: Writing to third parties that hold the company’s plant to confirm its existence (testing the existence assertion).

Recalculation: Recalculating depreciation of plant and machinery to verify that the depreciation charge is correct (testing the accuracy, valuation, and allocation assertion).

(5 marks)