- 20 Marks

Question

a) Markwei Pharmaceuticals Ltd plans to import active ingredients to produce vitamin syrup. The company’s managers are considering three financing options for the cedi equivalent of an invoice value of GH¢2.5 million. The options are detailed below:

Option 1: Use supplier’s credit. The credit term is 1.5/10 net 45.

Option 2: Issue a commercial paper to raise the money from the Ghanaian money market. The commercial paper will pay interest at the rate of 18% per annum. Issue costs totaling GH¢15,000 will be incurred.

Option 3: Obtain a 3-month bank loan. The interest rate on the loan is 22% per annum. Loan arrangement and processing fees are expected to be GH¢5,000.

Required:

i) Compute the effective annual cost of each financing option and recommend the most cost-effective option. (10 marks)

ii) Explain TWO (2) advantages of financing the invoice through the issue of a commercial paper instead of a bank loan. (5 marks)

b) Abongo Shoes Ltd (Abongo) imports leather from Italy. Abongo’s demand for euros to settle its import bills exposes its cash flow to foreign exchange risk. Abongo’s Management is looking for internal strategies they can deploy to hedge the company’s currency risk exposure as external hedging strategies might be too expensive for the company.

Required:

Explain TWO (2) internal strategies for managing foreign currency risk exposures that Abongo’s Management can use. (5 marks)

Answer

i) Computation of Effective Annual Cost

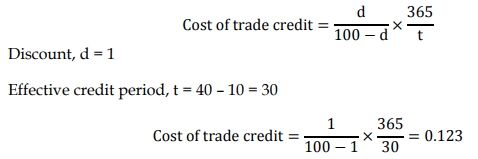

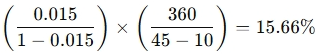

Option 1: Supplier’s Credit

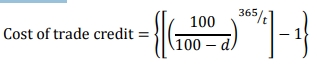

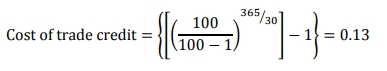

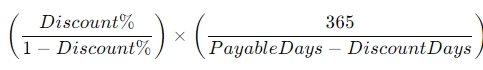

Effective Cost=

Effective Cost=![]()

Alternative using 360 days

Effective Cost=

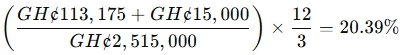

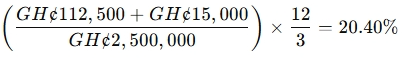

Option 2: Commercial Paper

- Interest on GH¢2,515,000 for 3 months at 18% per annum:

Interest=![]()

- Total cost (including issue costs):

Effective Cost=

Alternative assuming issue cost is paid from existing funds:

Effective Cost

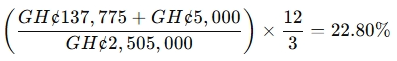

Option 3: Bank Loan

- Interest on GH¢2,505,000 for 3 months at 22% per annum:

Interest=![]()

- Total cost (including loan arrangement and processing fees):

Effective Cost=

Recommendation:

Based on the effective annual costs, the supplier’s credit option (15.88%) is the most cost-effective choice compared to the commercial paper (20.39%) and bank loan (22.80%).

(10 marks)

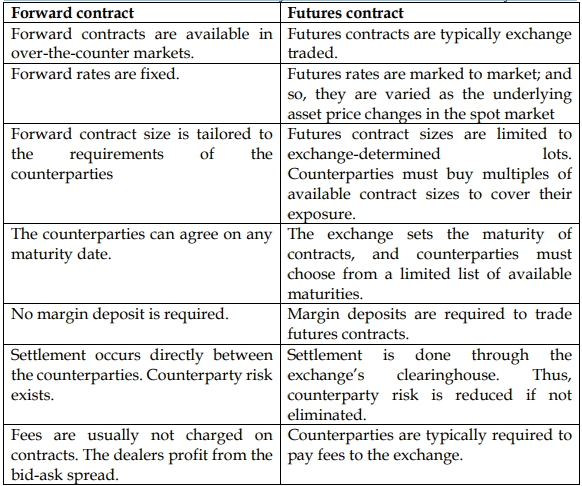

ii) Advantages of Financing Through Commercial Paper

- Lower Interest Rate: As commercial papers are financial securities issued by large and reputable entities, the interest rates quoted are typically lower than those on comparable bank loans, providing potential savings.

- Larger Fundraising Capacity: Commercial papers can be issued in multiple amounts to several investors in a single issue, making it easier to raise larger sums of money compared to a bank loan.

(5 marks)

b)

Internal Strategies for Managing Foreign Currency Risk

- Invoice Currency: Abongo Shoes Ltd can negotiate with suppliers to have invoices denominated in its local currency (cedi), thereby transferring the currency risk to the supplier.

- Matching: The company could match its foreign currency receivables with its payables. For example, if Abongo has some euro-denominated receivables, these can be set off against the euro payables to reduce net exposure.

- Tags: Bank Loan, Commercial Paper, Cost of Finance, Currency risk, Hedging Strategies, Trade Credit

- Level: Level 2

- Uploader: Joseph