- 10 Marks

Question

Wina Ltd (Wina) is a company incorporated in the United States of America and also resident

in the United States of America. The Company has been looking for opportunities across Africa

to invest its idle funds in support of shareholders’ decision.

In the latter part of 2021, the management of Wina identified Ghana as a country with huge

potentials for foreign investments. Wina intends to acquire 60% shares in Fatia Ltd (Fatia), a

company resident in Ghana with indigenous ownership but with unimpressive financial

records.When the deal is approved, it would provide a financial facility, the equivalent of

GH¢10,000,000 as a loan with interest at the rate of 22.5% comparable to all other interest

rates.

The equity of Fatia amounts to GH¢500,000 comprising Stated Capital of GH¢250,000,

Retained Earnings of GH¢200,000 and Revaluation Reserves of GH¢50,000.

Required:

Using the format of a memo:

Advise the management of Wina as a final level candidate on the tax implications of this

investment and the credit support that Wina can give without any restriction from the Ghana

Revenue Authority.

Answer

To: Management of Wina Ltd

From: Final Level Student

Date: [Insert Date]

Subject: Tax Implications of Investment in Fatia Ltd and Provision of Financial Facility

Introduction:

This memo addresses the tax implications associated with the proposed acquisition of 60% shares in Fatia Ltd, a resident company in Ghana, and the provision of a financial facility of GH¢10,000,000 with an interest rate of 22.5%. The focus will be on the applicable tax laws, particularly thin capitalization rules, and allowable credit support.

1. Thin Capitalization Rules:

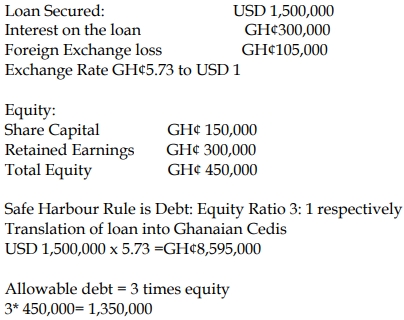

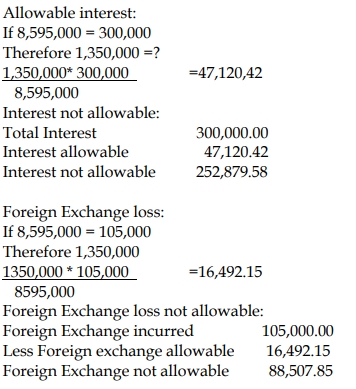

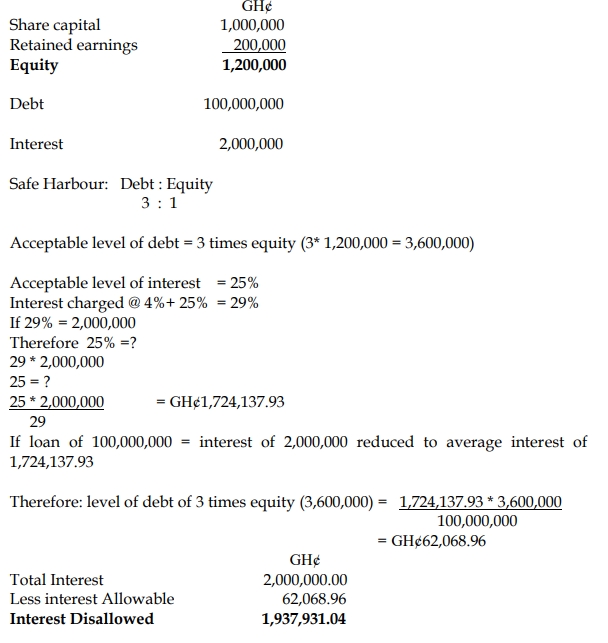

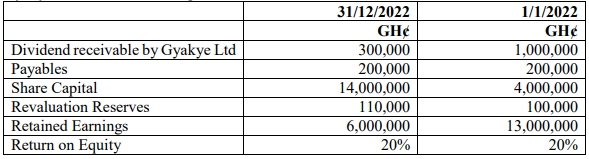

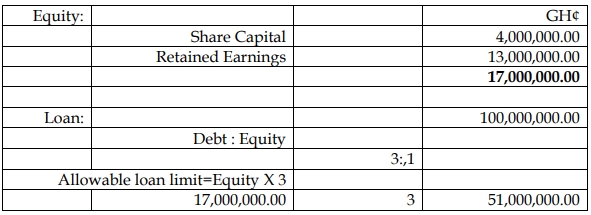

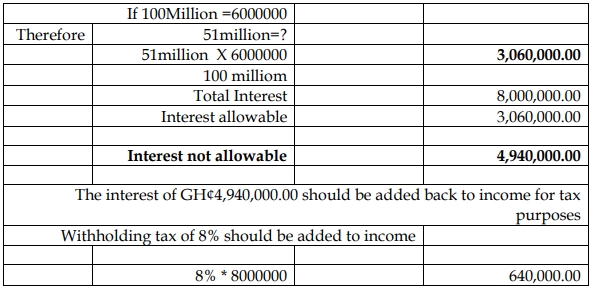

- According to the Ghana Income Tax Act, 2015 (Act 896), if a non-resident entity controls 50% or more of a resident company, thin capitalization rules apply. The safe harbor debt-to-equity ratio is 3:1.

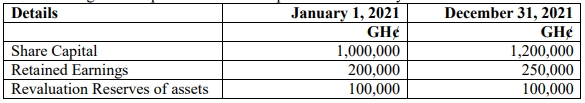

- Fatia Ltd has total equity of GH¢500,000 (comprising GH¢250,000 Stated Capital, GH¢200,000 Retained Earnings, and GH¢50,000 Revaluation Reserves).

- Based on the 3:1 ratio, Fatia Ltd can only support up to GH¢1,500,000 of debt without restriction (GH¢500,000 * 3).

2. Excess Debt Disallowed:

- The financial facility proposed (GH¢10,000,000) exceeds the allowable debt by GH¢8,500,000 (GH¢10,000,000 – GH¢1,500,000).

- Interest on the excess debt will not be allowed as a deduction for tax purposes in Ghana.

3. Withholding Tax on Interest Payments:

- Interest paid on the loan will attract withholding tax at a rate of 8%.

- The withholding tax on interest constitutes a final tax for Wina Ltd, meaning it satisfies the tax liability on the interest income received.

4. Foreign Exchange Implications:

- Any foreign exchange fluctuations related to the loan repayment and interest payments will follow the same tax treatment as the interest itself.

5. Recommendations:

- To minimize tax liabilities and avoid disallowed interest, Wina Ltd should consider increasing Fatia Ltd’s equity base, thereby allowing a higher debt capacity under the 3:1 ratio.

- Alternatively, Wina Ltd could restructure the financial arrangement to remain within the allowable debt limits.

Conclusion:

By adhering to the thin capitalization rules and managing the debt-to-equity ratio, Wina Ltd can minimize the risk of disallowed interest and ensure compliance with Ghana’s tax laws.

Best Regards,

[Your Name]

Final Level Student

- Tags: Debt-equity ratio, Tax Credit, Thin Capitalization, Withholding Tax

- Level: Level 3

- Topic: Tax planning

- Series: AUG 2022

- Uploader: Joseph