- 3 Marks

Question

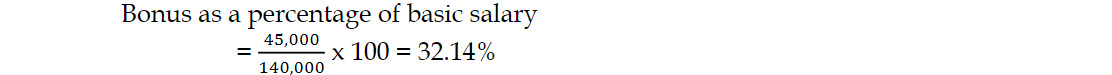

Bisa works with Kaydei Ltd and earns an annual basic salary of GH¢140,000. He was paid a bonus of GH¢45,000 in 2021.

Required:

Determine the tax liability on the bonus.

(3 marks)

Answer

Bisa

Bonus as a percentage of basic salary

Bonus is more than 15% of annual basic salary therefore part of the bonus will be

taxed at 5% and the excess will be taxed at graduated rate.

Tax on Bonus: GH¢ GH¢

15% x GH¢140,000 = 21,000 x 5% = 1,050.00

Total Bonus 45,000

Added to other income 24,000

- Topic: Income Tax Liabilities, Tax Administration

- Series: APR 2022

- Uploader: Cheoli