- 7 Marks

Question

c) On 1 January 2021 Partey Leasing PLC (Partey), acquired a large-scale custom-made equipment and leased it to Mane Ltd (Mane) for six years. Mane makes annual payments of GH¢10 million, commencing on 31 December 2021. The equipment has a useful life of seven years. Mane is responsible for insuring and maintaining the equipment, and is required to pay additional GH¢1.5 million at the end of each year provided a defined performance target is met. Mane has guaranteed that the value of the equipment at 31 December 2026 will not be less than GH¢1 million, although Partey anticipates that the open market value at that date will be approximately GH¢2.5 million. The costs incurred by Partey and Mane in arranging the lease amounted to GH¢2.1 million and GH¢1.6 million respectively. The rate of interest implicit in the lease is 9.49% per annum. Mane achieved the defined performance target on 31 December 2021 and made the required payment.

Required: In line with IFRS 16: Leases, explain how Partey would account for the above lease in its financial statements for the year ended 31 December 2021.

(7 marks)

Answer

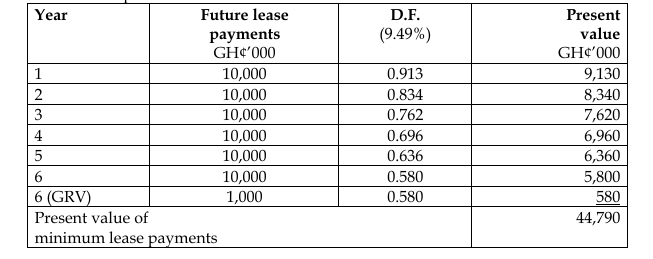

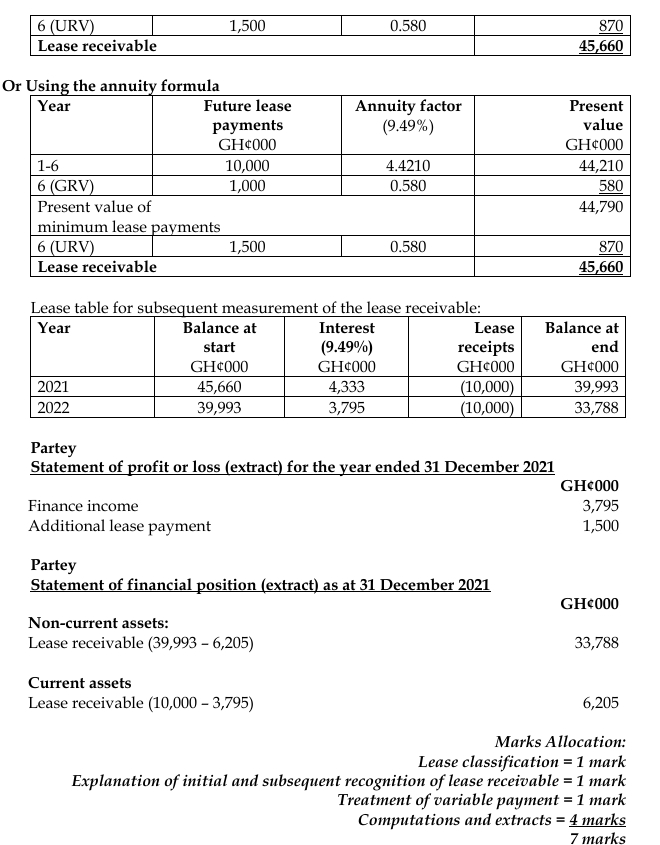

Partey would account for the lease agreement as a finance lease based on the following reasons: The lease term of six years occupies more than 75% of the equipment’s useful economic life of seven years; Mane, the lessee, is responsible for insuring and maintaining the equipment; and The underlying asset is custom-made. At the initial recognition date, Partey would recognise a lease receivable for the finance lease. The receivable would be initially measured at either the sum of the equipment’s fair price and lessor’s initial direct costs or the present value of minimum lease payments and unguaranteed residual value, and subsequently adjusted for interest income, lease payments, any required re-measurements and impairment (if any).

The lease payments would exclude the variable payment as the variability depends on management’s own performance. Partey would only account for such payment as income if the predefined condition is met:

- Tags: Finance lease, IFRS 16, Initial Recognition, Lease Receivable, Leases, Subsequent Measurement

- Level: Level 3

- Topic: IFRS 16: Leases

- Series: JULY 2023

- Uploader: Dotse