- 20 Marks

Question

a) Describe the FIVE (5) main elements of financial statements in accordance with the IASB’s Conceptual Framework. (10 marks)

b) Bimbila Ltd commenced business on 1 June 2020 and reported the following net profits during its first two years in business:

| GHȼ | |

|---|---|

| 1 June 2020 to 31 May 2021 | 135,000 |

| 1 June 2021 to 31 May 2022 | 140,000 |

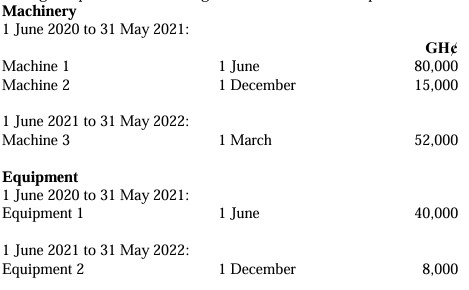

During this period the following non-current assets were purchased on the dates shown:

Bimbila Ltd has a policy to depreciate machinery at 25% per annum on cost (straight line method) and equipment at 20% per annum on cost (straight line method), rates being charged for each month of ownership. Bimbila Ltd is now considering using the reducing balance method, with the following rates applying to the balance at the end of each year:

- Machinery: 20%

- Equipment: 15%

A full year’s depreciation is charged irrespective of the date of purchase.

Required:

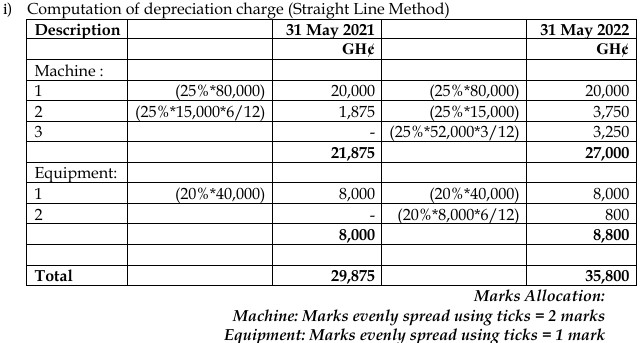

i) Calculate the total depreciation for the years ended 31 May 2021 and 31 May 2022 using the original method (straight line) and rates for:

- Machinery (2 marks)

- Equipment (1 mark)

ii) Calculate the total depreciation for the years ended 31 May 2021 and 31 May 2022 using the alternative method (reducing balance) and rates for:

- Machinery (2 marks)

- Equipment (1 mark)

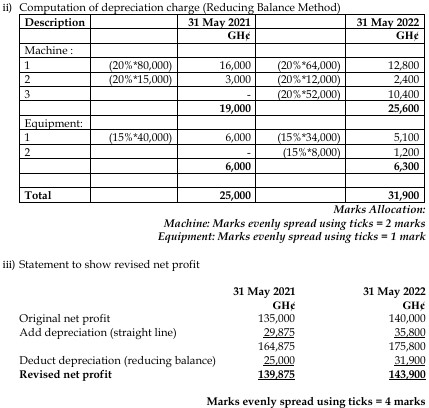

iii) Prepare a statement to show the net profit which would have been reported for each of the years ended 31 May 2021 and 31 May 2022 if the reducing balance method had been used. (4 marks)

Answer

a) Elements of Financial Statements

Asset

A present economic resource controlled by the entity as a result of past events. An economic resource is a right that has the potential to produce economic benefits.

Liability

A present obligation of the entity to transfer an economic resource as a result of past events.

Equity

The residual interest in an entity after the value of all its liabilities has been deducted from the value of all its assets.

Income

Increases in assets or decreases in liabilities that result in increases in equity, other than those relating to contributions from holders of equity claims.

Expenses

Decreases in assets or increases in liabilities that result in decreases in equity, other than those relating to distributions to holders of equity claims.

(5 points @ 2 marks each = 10 marks)

b) Depreciation Calculations

- Uploader: Theophilus