- 20 Marks

Question

a) Lease or Buy decision could be a tough call to make, especially considering that different industries benefit more than others from leasing or buying outright depending on the specific needs of that sector.

Freda Automobile (Freda), an emerging automobile company has taken a decision to provide a new Toyota Land Cruiser for its Chief Executive Officer (CEO). The company is considering whether to buy or lease. The Toyota Land Cruiser has a useful life of six years and will cost GH¢1,000,000 to buy and will be funded with a bank loan. The Finance Director provided the borrowing interest rate for the loan at 22% per annum. The annual repairs and maintenance cost when the V8 is bought is GH¢18,000. The corporate tax rate is currently 25% paid in the same year the profit is made. The capital allowance on the V8 is 25% per annum on reducing balance basis.

Alternatively, the Toyota Land Cruiser could be leased at a rental cost of GH¢250,000 per annum for six years payable at the beginning of each year.

Required:

i) Explain TWO (2) reasons why Freda will prefer leasing option to outright buy. (4 marks)

ii) Calculate the Net Present Value (NPV) for the buy option. (5 marks)

iii) Calculate the Net Present Value (NPV) for the lease option. (4 marks)

iv) Based on your computations in ii) and iii) above, advise management which option should be considered. (2 marks)

b) The Ghana Stock Exchange (GSE) market has recently been intensifying its public education for Ghanaian companies to list on the stock market to raise the needed capital for expansion and growth. You have been approached by owners of Asafo Ghana Ltd who have expressed interest in getting listed on the stock market but have limited knowledge on what they stand to benefit by listing their company on the market.

Required:

Explain FOUR (4) advantages Asafo Ghana Ltd could derive from listing on GSE. (5 marks)

Answer

a)

i) Reasons why leasing is preferred to buying:

- Lower Initial Cash Outlay: Leasing prevents high initial cash outlay upfront compared to buying, which can be beneficial for cash flow management, especially for a growing company like Freda Automobile.

- Risk of Obsolescence: Leasing helps reduce the risks of holding obsolete equipment since it is owned by the lessor, especially in fast-changing industries where assets may quickly become outdated.

- Maintenance Costs: Depending on the lease terms, leasing can transfer the cost of maintenance to the lessor, further reducing the financial burden on the lessee.

- Credit Score Consideration: Leasing may provide a better option to access and use assets or equipment if the company’s credit score is not strong enough to secure a favorable loan for purchasing the asset.

ii) Buying Option – Net Present Value (NPV) Calculation:

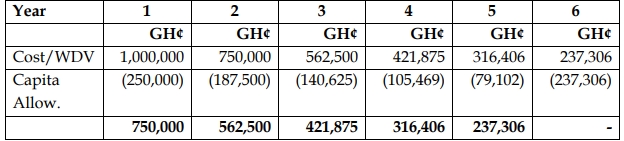

Computation of Capital Allowance @ 25%

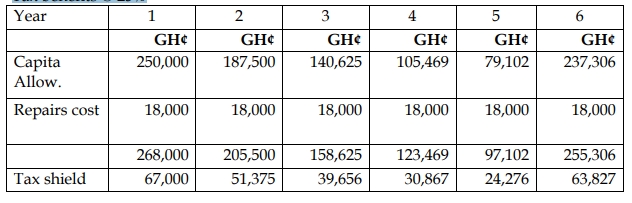

Tax benefits @ 25%

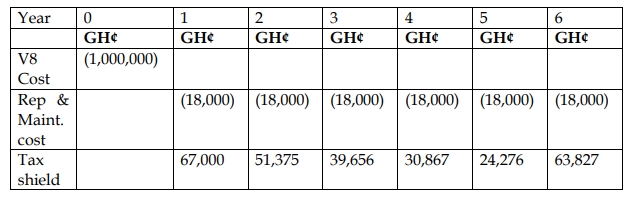

EVALUATION

Cost of borrowing 22%

Cost of borrowing net of tax benefit = 75% x22% = 16.5%

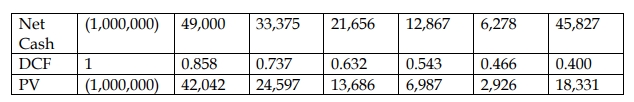

NPV =(1,000,000)+42,042+24,597+13,686+6,987+2,926+18331

= (891,431)

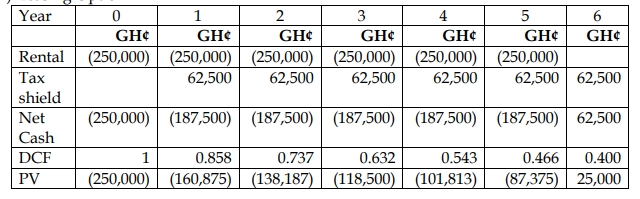

iii) Leasing Option

NPV= (250,000)+(160,875)+(138,188)+(118,500)+(101,813)+(87,375)+25000

= (831,750)

Alternative

Annuity factor for 5 years = 3.2365

Year 1-5 (187,500) x 3.236 = (606,750)

Year 6 62,500 x 0.400 = 25,000

Year 0 x 1 = (250,000)

(831,750)

iv) Based on the analysis above the LEASE OPTION should be taken to provide the

V8 for the CEO.

b) Advantages of listing on the Ghana Stock Exchange (GSE):

- Access to Long-Term Capital: Listing on the GSE allows Asafo Ghana Ltd to raise long-term capital through the issuance of shares, which can be used for expansion and growth.

- Enhanced Corporate Image: Being listed on the stock exchange can enhance the company’s brand, status, and prestige, increasing its visibility and reputation.

- Increased Liquidity: Listing provides shareholders with liquidity, as they can easily buy or sell shares in the open market.

- Tax Incentives: Listed companies often benefit from tax incentives provided by the government, reducing the overall tax burden.

- Transferability of shares provides access to liquidity to the shares

- Realization of investment proceeds and public trading enhances valuation of

shares - Provision of incentives to employees and investing public

- Tags: Lease vs Buy Decision, NPV Calculation, Stock Market Listing

- Level: Level 2

- Topic: Capital structure

- Series: AUG 2022

- Uploader: Joseph