- 20 Marks

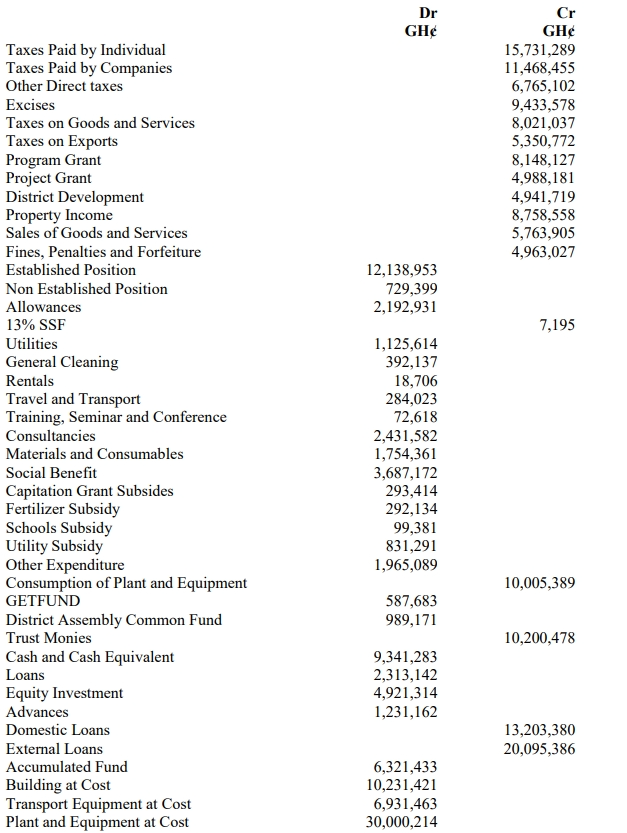

PSAF – May 2019 – L2 – Q4a – Preparation and presentation of financial statements for central government

Prepare the Statement of Financial Performance for the Consolidated Fund for the year ended 31 December 2018.

Question

Additional Information:

i) The Controller and Accountant General uses the modified accrual accounting concept in the preparation of its accounts.

ii) Established Post salaries of GH¢2,937,000 were outstanding as of 31/12/2018.

iii) Interest on domestic and external loans is provided for at 20% and 15%, respectively.

iv) The Central Government depreciates assets on a cost basis using the schedule below:

| Class of Assets | Number of Years |

|---|---|

| Building | 50 years |

| Plant, Machinery, Furniture, and Fittings | 20 years |

| Transport Equipment | 7 years |

| Computer Software and License | 5 years |

v) Provisions:

Specific provision for bad debt is made for loans receivables and investments as and when their non-recoverability is determined, and where a request is made for write-off to parliament. This provision is set at 3% and 5%, respectively.

Required:

a) Prepare the Statement of Financial Performance of the Consolidated Fund for the year ended 31/12/2018.

(10 marks)

b) Prepare the Statement of Financial Position for the Consolidated Fund as at 31/12/2018.

(7 marks)

c) State and explain THREE (3) Accounting Policies that usually accompany Consolidated Fund Financial Statements.

(3 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "PSAF – May 2019 – L2 – Q4a – Preparation and presentation of financial statements for central government"

- 20 Marks

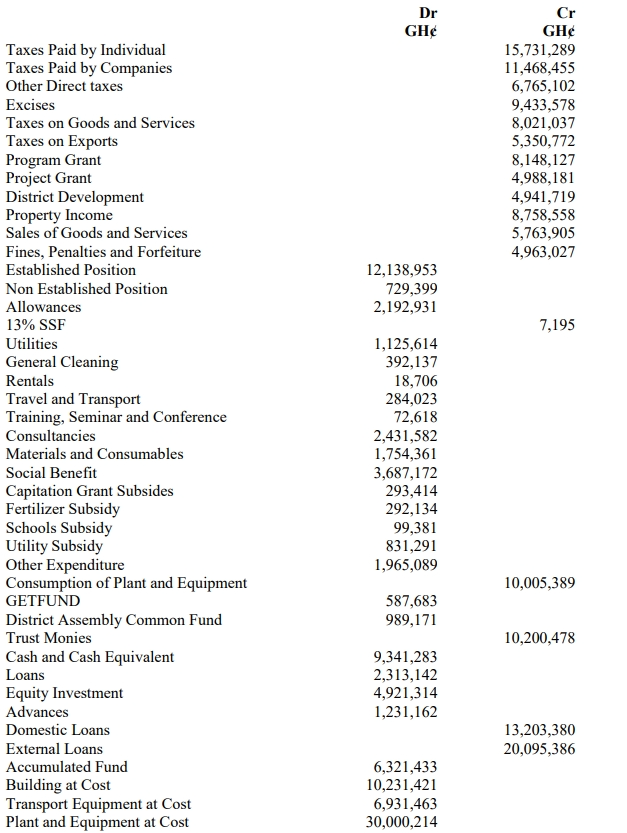

PSAF – May 2019 – L2 – Q4a – Preparation and presentation of financial statements for central government

Prepare the Statement of Financial Performance for the Consolidated Fund for the year ended 31 December 2018.

Question

Additional Information:

i) The Controller and Accountant General uses the modified accrual accounting concept in the preparation of its accounts.

ii) Established Post salaries of GH¢2,937,000 were outstanding as of 31/12/2018.

iii) Interest on domestic and external loans is provided for at 20% and 15%, respectively.

iv) The Central Government depreciates assets on a cost basis using the schedule below:

| Class of Assets | Number of Years |

|---|---|

| Building | 50 years |

| Plant, Machinery, Furniture, and Fittings | 20 years |

| Transport Equipment | 7 years |

| Computer Software and License | 5 years |

v) Provisions:

Specific provision for bad debt is made for loans receivables and investments as and when their non-recoverability is determined, and where a request is made for write-off to parliament. This provision is set at 3% and 5%, respectively.

Required:

a) Prepare the Statement of Financial Performance of the Consolidated Fund for the year ended 31/12/2018.

(10 marks)

b) Prepare the Statement of Financial Position for the Consolidated Fund as at 31/12/2018.

(7 marks)

c) State and explain THREE (3) Accounting Policies that usually accompany Consolidated Fund Financial Statements.

(3 marks)

Find Related Questions by Tags, levels, etc.