- 16 Marks

Question

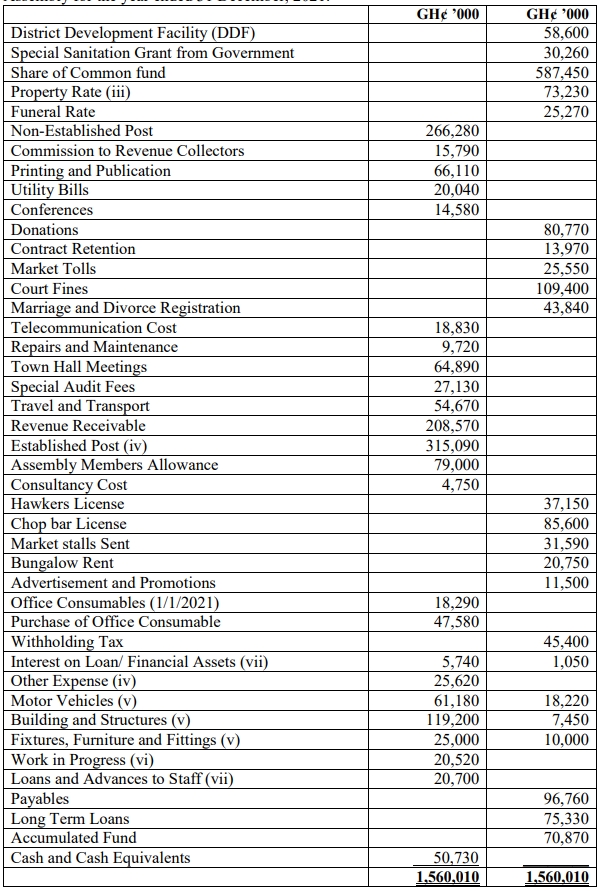

The Trial Balance was extracted from the books of Bokom Municipal Assembly (BMA) as at 31st December 2015.

| Debit | GH¢’000 | Credit | GH¢’000 |

|---|---|---|---|

| Property rate | 450 | Sundry payables | 60 |

| Basic rates | 200 | Short term loans | 120 |

| Special rates | 50 | Deposits | 100 |

| Lorry park fees | 40 | Accumulated Fund | 43 |

| Marriage and divorce registration | 10 | ||

| Building permits | 110 | ||

| Penalties | 80 | ||

| Market toll | 620 | ||

| Share of District Assembly Common Fund | 980 | ||

| District Development Facility | 350 | ||

| Compensation for employees | 1,000 | ||

| Herbalist licenses | 20 | ||

| Hawkers licenses | 15 | ||

| Other licenses | 12 | ||

| Royalties | 50 | ||

| Share of stool land revenue | 150 | ||

| Market Store rent | 70 | ||

| Other rentals | 40 | ||

| Interest on investment | 10 | ||

| Gains from business | 30 | ||

| Established post | 1,080 | ||

| Non-established post | 700 | ||

| Goods and services | 950 | ||

| Interest expense | 20 | ||

| Social benefits | 180 | ||

| Other expenditure | 260 | ||

| Bank and Cash | 40 | ||

| Advances and loans | 80 | ||

| Investment | 100 | ||

| Property, Plant, and equipment | 1,200 | ||

| 4,610 | 4,610 |

Additional Information:

- Revenues are classified as follows: Rate, Land Revenue, Fees and Fines, Licenses, Rent income, investment income, and Grants.

- The expenditure classification should comply with the harmonized Chart of Accounts.

- Consumption of fixed capital for the year is computed as GH¢260,000.

Required:

a) Prepare:

i) A Statement of Financial Performance for the year ended 31st December 2015.

ii) A Statement of Financial Position as at 31st December 2015. (Please show all workings clearly). (16 marks)

Answer

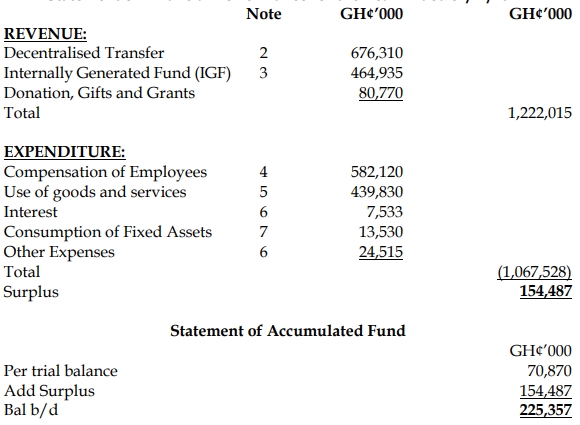

i) Statement of Financial Performance for the year ended 31st December 2015:

| Revenues | GH¢’000 |

|---|---|

| Rates (Property, Basic, Special) | 700 |

| Land Revenue (Royalties, Stool Land) | 200 |

| Fees and Fines (Lorry park fees, Marriage registration, Building permits, Penalties, Market toll) | 860 |

| Licenses (Herbalist, Hawkers, Other licenses) | 47 |

| Rent Income (Market Store, Other rentals) | 110 |

| Investment Income (Interest, Gains from business) | 40 |

| Grants (DACF, DDF, Compensation) | 2,330 |

| Total Revenue | 4,287 |

| Expenditures | GH¢’000 |

|---|---|

| Compensation (Established and Non-Established Posts) | 1,780 |

| Goods and Services | 950 |

| Consumption of Fixed Capital | 260 |

| Interest Expense | 20 |

| Social Benefits | 180 |

| Other Expenditure | 260 |

| Total Expenditure | 3,450 |

Surplus: GH¢837,000

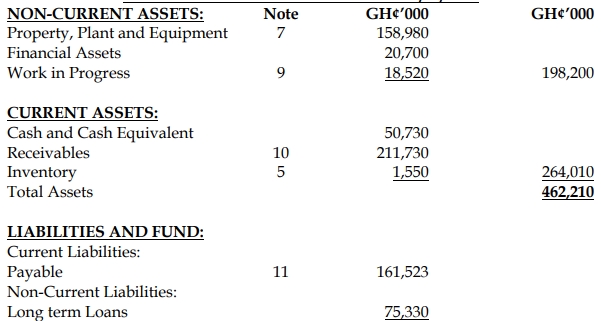

ii) Statement of Financial Position as at 31st December 2015:

| Assets | GH¢’000 |

|---|---|

| Property, Plant, and Equipment (1,200 – 260) | 940 |

| Investment | 100 |

| Advances and Loans | 80 |

| Bank and Cash | 40 |

| Total Assets | 1,160 |

| Liabilities and Fund | GH¢’000 |

|---|---|

| Sundry Payables | 60 |

| Short Term Loans | 120 |

| Deposits | 100 |

| Accumulated Fund (837 + 43) | 880 |

| Total Liabilities and Fund | 1,160 |

Workings:

- Rates:

- Basic Rate: GH¢200,000

- Property Rate: GH¢450,000

- Special Rate: GH¢50,000

- Land Revenue:

- Royalties: GH¢50,000

- Share of Stool Land Revenue: GH¢150,000

- Fees and Fines:

- Lorry Park Fees: GH¢40,000

- Marriage and Divorce Registration: GH¢10,000

- Building Permits: GH¢110,000

- Penalties: GH¢80,000

- Market Toll: GH¢620,000

- Licenses:

- Herbalist Licenses: GH¢20,000

- Hawkers Licenses: GH¢15,000

- Other Licenses: GH¢12,000

- Rent Income:

- Market Store Rent: GH¢70,000

- Other Rentals: GH¢40,000

- Investment Income:

- Interest on Investment: GH¢10,000

- Gains from Business: GH¢30,000

- Grants:

- Share of District Assembly Common Fund: GH¢980,000

- District Development Facility: GH¢350,000

- Compensation for Employees: GH¢1,000,000

- Uploader: Joseph