i) Comparative Cash Flow Analysis Report

To: Chairperson, Governing Board

From: Senior Financial Accountant

Date: 1/1/2021

Subject: Comparative Analysis of Cash Flow Performance – Saglema Plc vs. Adidome Plc

Introduction:

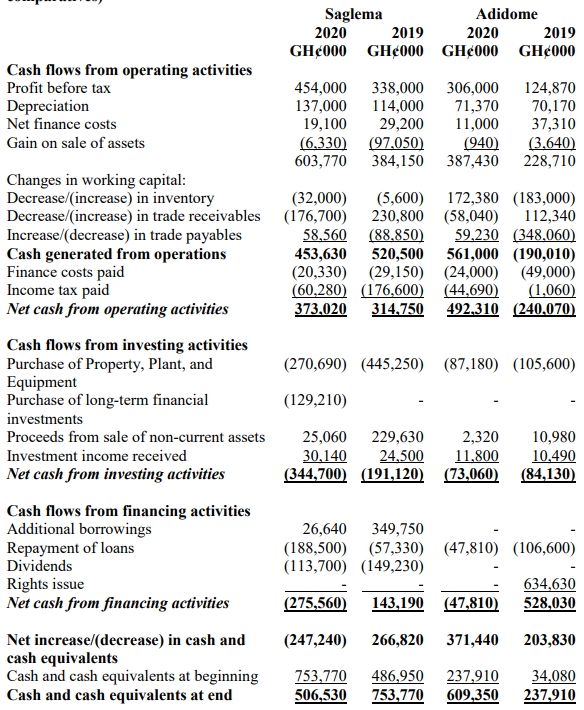

This report provides a comparative analysis of Saglema Plc’s cash flow performance relative to its competitor, Adidome Plc, over the financial years 2019 and 2020. The analysis focuses on key aspects of cash flows from operating, investing, and financing activities, highlighting significant trends, strengths, and challenges.

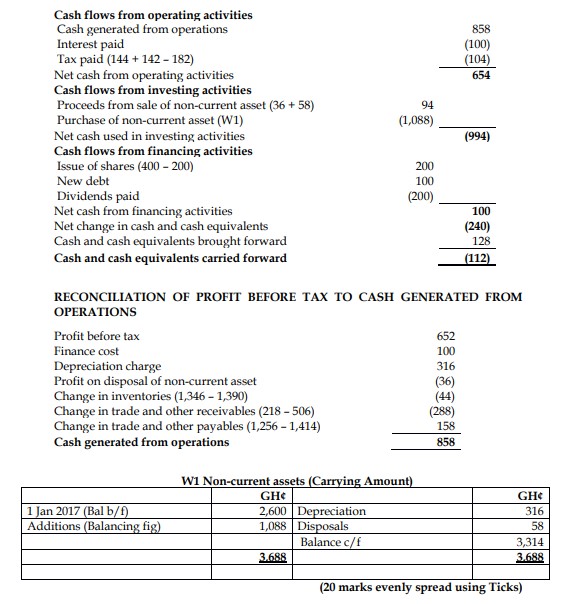

1. Net Cash Flow Movements:

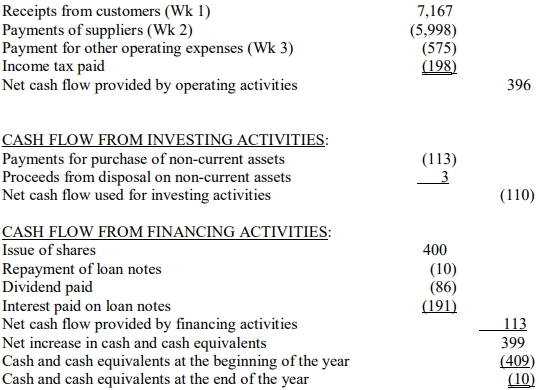

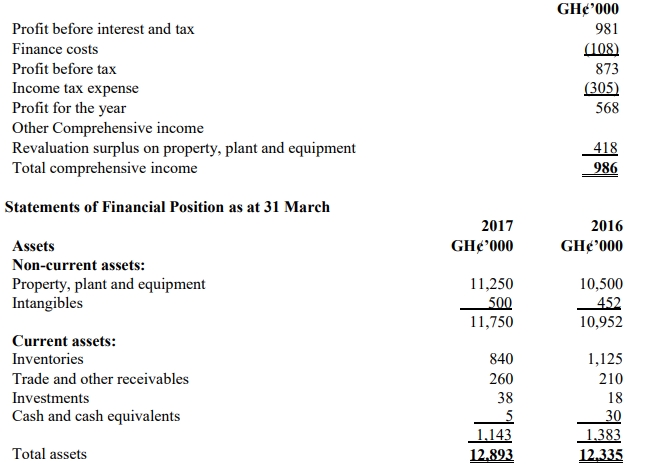

Saglema Plc reported a net decrease in cash and cash equivalents of GH¢247,240 in 2020, while Adidome Plc experienced a net increase of GH¢371,440. The contrasting trends indicate that Adidome has improved its cash generation significantly over the past year, while Saglema faced challenges in maintaining its cash balances.

- Saglema’s Decrease: The decline in Saglema’s cash reserves can be attributed to significant outflows for financing activities (loan repayments and dividends) and high capital expenditure on property and long-term investments.

- Adidome’s Increase: Adidome’s improvement in cash balances is primarily driven by strong operational cash flows and lower investment outflows.

2. Cash Flows from Operating Activities:

Both companies generated positive cash flows from operating activities in 2020, indicating healthy operational performance. However, Adidome’s GH¢492,310 outperformed Saglema’s GH¢373,020.

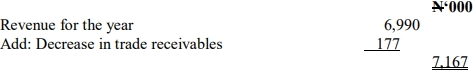

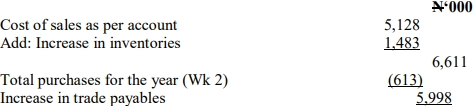

- Saglema’s Performance: Despite higher profits before tax and strong cash generation, Saglema saw reduced operational cash inflows compared to 2019 due to increased working capital needs, especially in receivables and payables management.

- Adidome’s Improvement: Adidome’s operational cash flow surged dramatically from a negative GH¢240,070 in 2019 to a positive GH¢492,310 in 2020. This was due to improved working capital management, particularly in inventory turnover and better receivables collection.

3. Cash Flows from Investing Activities:

Both companies had significant outflows for investing activities, though Saglema’s cash outflow was much higher.

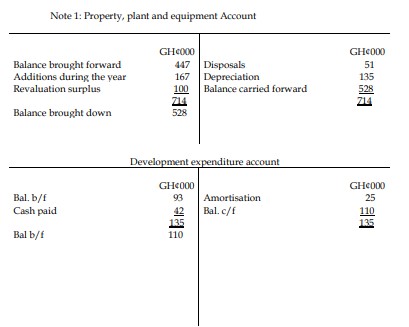

- Saglema’s Outflows: Saglema invested GH¢270,690 in property and equipment and GH¢129,210 in long-term financial investments, indicating a strategy focused on asset acquisition and portfolio diversification. However, this led to a large cash outflow.

- Adidome’s Outflows: Adidome’s investing activities were more modest, with outflows of GH¢87,180, mainly for property acquisitions.

4. Cash Flows from Financing Activities:

In financing activities, Saglema showed significant outflows due to loan repayments and dividend payments, while Adidome had a relatively smaller outflow.

- Saglema’s Strategy: The repayment of loans and dividend payments led to a net outflow of GH¢275,560. These activities, coupled with limited new borrowings, led to pressure on its cash reserves.

- Adidome’s Position: Adidome’s financing activities were minimal, leading to a net outflow of GH¢47,810. The strong cash inflows in 2019 from a rights issue have strengthened its financial position, reducing the need for further financing.

Conclusion:

While Saglema Plc continues to generate robust cash from its core operations, its high capital expenditures and financing obligations have placed pressure on cash balances. Adidome Plc, by contrast, has improved its operational performance and managed its cash flows effectively, leading to a substantial increase in cash reserves.

ii) Uses and Limitations of Cash Flow Analysis

Uses:

- Assessment of Liquidity:

- Cash flow analysis provides a clear picture of the company’s ability to generate cash to meet its short-term obligations, helping assess liquidity and financial health.

- Performance Comparison:

- Cash flow analysis enables comparison between companies, as seen in this case between Saglema and Adidome, offering insight into operational efficiency and financial management strategies.

Limitations:

- Non-Cash Items Exclusion:

- Cash flow statements do not account for non-cash items such as depreciation and amortization, which can affect the assessment of long-term profitability.

- Limited Insight into Profitability:

- While cash flows provide information on liquidity, they do not fully reflect profitability, as some profitable companies may have poor cash flow due to delays in receivables collection or high capital investments.

- Lack of Comparability:

- Different industries or companies may have different cash flow requirements, which can make direct comparisons misleading if not properly contextualized.