- 10 Marks

Question

Tsekpo produces strong and affordable doors for the Ghanaian market. The company has been operating for the past five years from its manufacturing base at Tafo.

During the year under consideration, Tsekpo invested in a new information technology system in order to improve its management accounting information. Unfortunately, there have been problems with the software since its acquisition. The standard cost card, which provides details of the standard production cost to make one door, has been lost and the company is unable to prepare its budget for the year ahead.

The Management Accountant has retrieved some information relating to actual costs and variances for the year. The budgeted production for the year was 21,000 doors. Other relevant information is shown below:

Actual Costs:

Cost Element Actual Quantity Amount (GH¢)

Direct material costs (16,200 sq. m) 16,200 sq. m 81,000

Direct labour costs (8,640 hours) 8,640 hours 108,864

Variable production overhead costs N/A 54,000

Fixed production overhead costs N/A 85,200

Variances:

Direct material price variance: GH¢4,050 (Favorable)

Direct material usage variance: GH¢5,670 (Favorable)

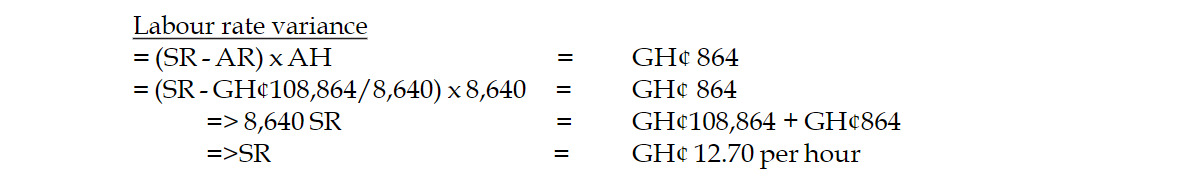

Direct labour rate variance: GH¢864 (Favorable)

Direct labour efficiency variance: GH¢27,432 (Favorable)

Variable production overhead expenditure variance: GH¢432 (Adverse)

Variable production overhead efficiency variance: GH¢13,392 (Favorable)

Fixed production overhead expenditure variance: GH¢3,775 (Adverse)

Additional Information:

Actual production was 600 doors above the budgeted level.

Tsekpo operates a standard variable costing system.

Required:

Using the information provided, prepare the standard cost card for the production of one door.

Answer

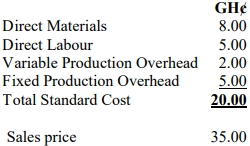

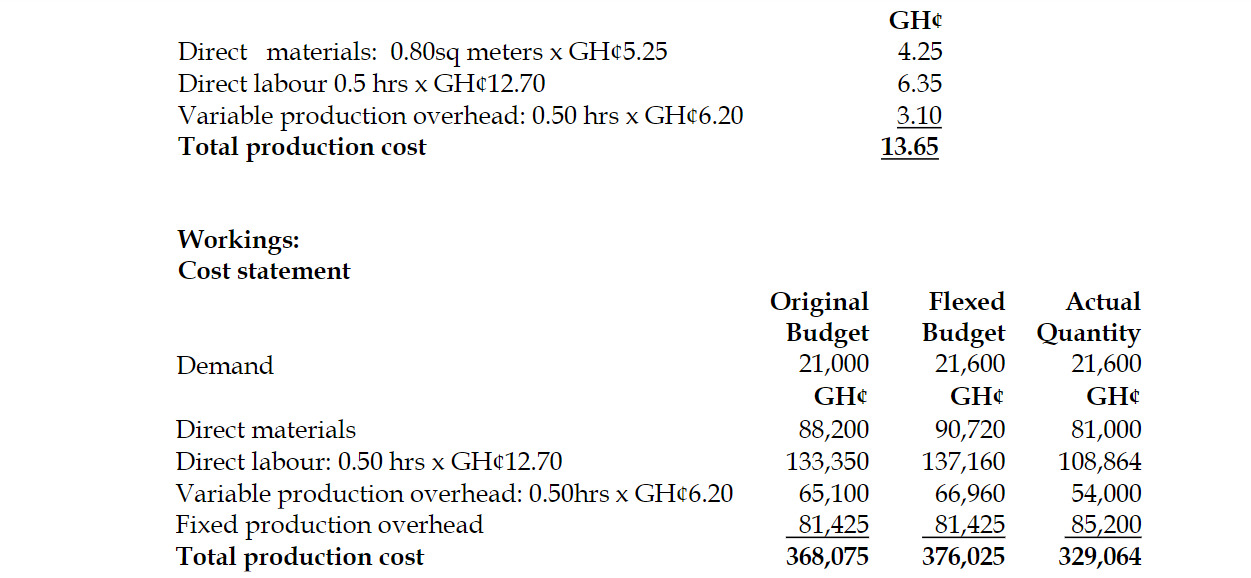

Standard Cost Card for One Door:

Per Unit

Materials price variance

= (SP – AP) x AQ = GH¢4,050

= (SP – GH¢81,000/16,200) x 16,200 = GH¢4,050

=> 16,200 SP = GH¢81,000+GH¢4,050

=>SP = GH¢ 5.25 per square metre

Materials usage variance

= (SQ – AQ) x SP = GH¢5,670

= (SQ – 16,200) x GH¢5.25 = GH¢5,670

=> 5.25 SQ = GH¢85,050 + GH¢5,670

=> SQ = 17,280 square metres

SQ = Total standard materials quantity for actual production

=> need to get standard quantity to produce one unit

= 17,280 square metres / 21,600 units = 0.80 square metres per unit

Labour efficiency variance

= (SH – AH) x SR = GH¢ 27,432

= (SH – 8,640) x GH¢12.70 = GH¢ 27,432

=> 12.70 SH = GH¢109,728 + GH¢27,432

=> SH = 10,800 hours

SH = Total standard hours required for actual production

=> need to get standard quantity to produce one unit

= 10,800 / 21,600 units = 0.5 hours per unit

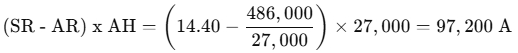

Variable overhead expenditure variance

= (SR – AR) x AH = -GH¢432

= (SR – GH¢54,000/8,640) x 8,640 = -GH¢432

=>8,640 SR = GH¢54,000 – GH¢432

=>SR = GH¢ 6.20 per hour

Variable overhead efficiency variance

= (SH – AH) x SR = GH¢13,392

= (SH – 8,640) x GH¢6.20 = GH¢13,392

=> 6.20 SH = GH¢53,568 + GH¢13,392

=> SH = 10,800

Variable overhead is applied to products based on labour hours

=> standard quantity to produce one unit = 0.50 hours

Fixed production overhead expenditure variance

= (BFO – AFO) = (GH¢3,775)

= (BFO – GH¢85,200) = (GH¢3,775)

=> BFO = GH¢85,200 + (GH¢3,775)

=> BFO = GH¢81,425

(10 marks)

- Topic: Standard Costing, Variance Analysis

- Series: MAR 2023

- Uploader: Cheoli