- 5 Marks

Question

Flowqueen, a sole proprietor of Freddy Ent, was adjudged the best distributor of Mino Ltd for the year 2020 and received the following gifts:

- 70 Inches Samsung LED valued at GH¢50,000 from Freddy Ltd.

- Toyota saloon car worth GH¢80,000 from the clients of Freddy Ltd.

Her income from the business for the 2020 year of assessment amounted to GH¢120,000.

Required:

Compute the appropriate tax or taxes of Flowqueen for the 2020 year of assessment.

Answer

Computation of Tax for Flowqueen

Step 1: Gift Tax Calculation

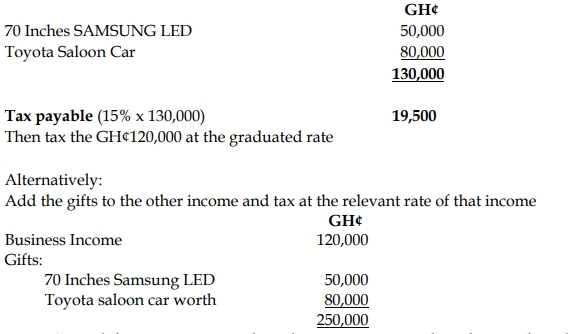

The total value of gifts received by Flowqueen in 2020 is:

Alternatively, if the gifts are treated as part of Flowqueen’s income, her total taxable income becomes GH¢250,000 (GH¢120,000 + GH¢130,000), and the relevant taxes would apply to the entire amount.

- Tags: Business income, Capital gains tax, Gift tax, Sole Proprietor, Tax computation

- Level: Level 2

- Topic: Taxation of Capital Gains

- Series: NOV 2021

- Uploader: Theophilus