- 15 Marks

Question

Mr. Kogberegbe, a small manufacturer, has approached you as a Cost Accountant with the following data:

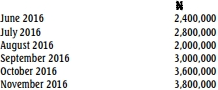

Sales Forecast

Additional information:

• Purchases are 45% of selling price and are paid for two months after

delivery. Delivery is in the month of sales.

• Collections from sales are 25% in the month of sales less 2% cash discount,

55%in the month after salesand the balance in the third month after sales.

• Production overheads are paid in the same month in which they are

incurred and this amounts to N1,240,000 per month. Included in

this amountaredepreciationof N70,000 andprepaidrent of N500,000.

• Other expenses are paid for in arrears and these amount to N620,000 per

month.

• New plant of N540,000 will be bought in the month of January and

installed at acostof N75,000 the following month.

• Bank opening balance as at August 2016 shows an overdraft of

N2,150,000 and interest is charged at 3% of drawn down balance. I g n o r e

other bank charges

Required:

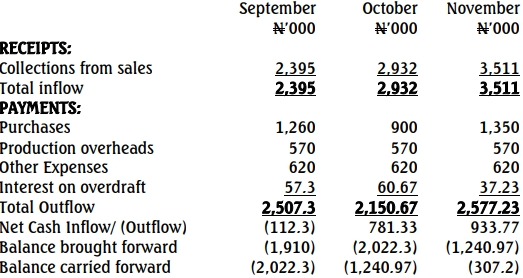

Prepare a cash budget for Mr. Kogberegbe’s business for the three months i.e,

September to November, 2016. Calculate the values to the nearest naira and show

all your workings.

Answer

MR KOGBEREGBE

CASH BUDGET FOR THE THREE MONTHS SEPTEMBER TO NOVEMBER 2016

- Tags: Cost Accounting, Cost Analysis, Small Business

- Level: Level 1

- Topic: Accounting for Cost Elements

- Series: MAY 2016

- Uploader: Joseph