- 10 Marks

Question

a) Plainview Farms Limited is considering acquiring Cottage Industries Limited. The extracts of the financial statements of the two companies are as follows:

Statement of Financial Position

| Plainview Farms Ltd (GH¢’m) | Cottage Industries Ltd (GH¢’m) | |

|---|---|---|

| Net Assets | 6,300 | 1,892 |

| Equity Capital | 2,000 | 1,000 |

| Income Surplus | 4,300 | 892 |

Income Statement

| Plainview Farms Ltd (GH¢’m) | Cottage Industries Ltd (GH¢’m) | |

|---|---|---|

| Profit after tax | 800 | 300 |

| Dividend | (600) | (100) |

| Retained earnings | 200 | 200 |

The two companies retain the same proportion of profits each year, and this is expected to continue in the future. Plainview Farms Limited’s return on investment is 16%, while Cottage Industries Limited’s is 21%. One year after the post-acquisition period, Plainview Farms will retain 60% of its earnings and expects to earn a return of 20% on new investment.

The dividends of both companies have been paid. The required rate of return for ordinary shareholders of Plainview Farms Limited is 12%, and for Cottage Industries Limited it is 18%. After the acquisition, the required rate of return will become 16%.

Required:

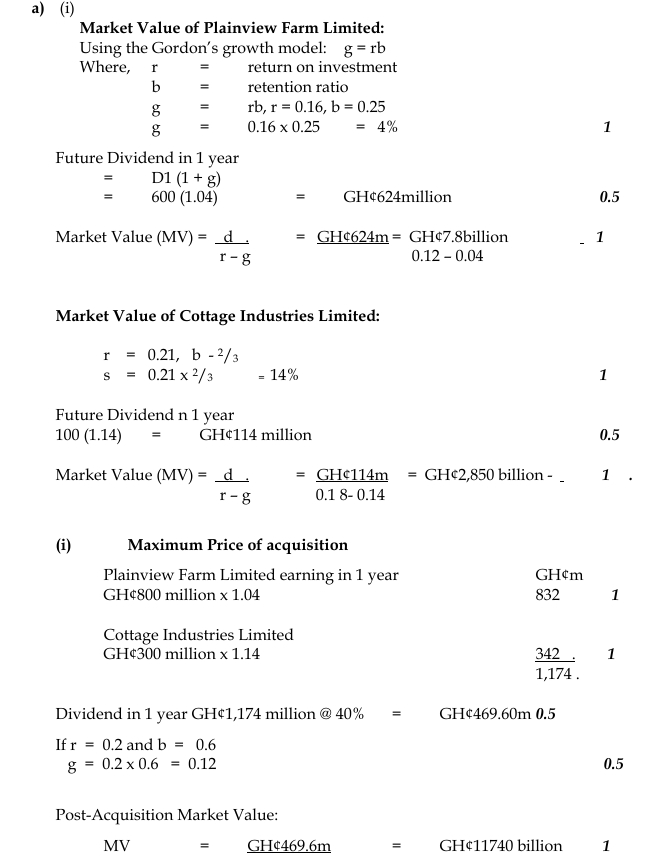

i) Calculate the pre-acquisition market values of both companies. (5 marks)

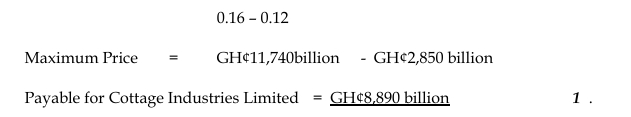

ii) Calculate the maximum price Plainview Farms Limited will pay for Cottage Industries Limited. (5 marks)

Answer

- Tags: Acquisitions, Market Value, Mergers, Shareholder Returns, Valuation

- Level: Level 3

- Uploader: Dotse