- 12 Marks

Question

(i) The issued share capital of Ghana Trust, a publicly listed company on the Ghana Stock Exchange, at 31st March 2013 was GH¢10 million. Its shares are denominated at 25 pesewas each. Ghana Trust’s earnings attributable to its ordinary shareholders for the year ended 31st March 2013 were also GH¢10 million, giving an earnings per share of 25 pesewas.

Year ended 31st March 2014:

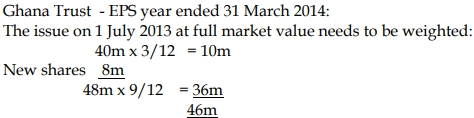

On 1st July 2013, Ghana Trust issued eight million ordinary shares at full market price. On 1st January 2014, a bonus issue of one new ordinary share for every four ordinary shares held was made. Earnings attributable to ordinary shareholders for the year ended 31st March 2014 were GH¢13.8 million.

Year ended 31st March 2015:

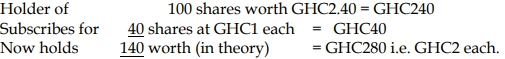

On 1st October 2014, Ghana Trust made a rights issue of shares of two new ordinary shares at a price of GH¢1.00 each for every five ordinary shares held. The offer was fully subscribed. The market price of Ghana Trust’s ordinary shares immediately prior to the offer was GH¢2.40 each. Earnings attributable to shareholders for the year ended 31st March 2015 were GH¢19.5 million.

Required:

Calculate Ghana Trust’s earnings per share for the years ended 31st March 2014 and 2015 including comparative figures. (7 marks)

(ii) On 1st April 2015, Ghana Trust issued GH¢20 million 8% convertible loan stock at par. The terms of the conversion (on 1st April 2018) are that for every GH¢100 of loan stock, 50 ordinary shares will be issued at the option of loan stockholders. Alternatively, the loan stock will be redeemed at par for cash. Also, on 1st April 2015, the directors of Ghana Trust were awarded share options on 12 million ordinary shares exercisable from 1st April 2018 at GH¢1.50 per share. The average market value of Ghana Trust’s ordinary shares for the year ended 31st March 2015 was GH¢2.50 each. The income tax rate is 25%. Earnings attributable to ordinary shareholders for the year ended 31st March 2015 were GH¢25,200,000. The share options have been correctly recorded in the statement of profit or loss.

Required:

Calculate Ghana Trust’s basic and diluted earnings per share for the year ended 31st March 2015. (5 marks)

Answer

a)

(i)

Without the bonus issue this would give an EPS of 30p (13.8m/46m x 100).

The bonus issue of one for four would result in 12 million new shares giving a

total number of ordinary shares of 60 million. The dilutive effect of the bonus

issue would reduce the EPS to 24p (30p x 48m/60m).

The comparative EPS (for 2013) would be restated at 20p (25p x 48m/60m).

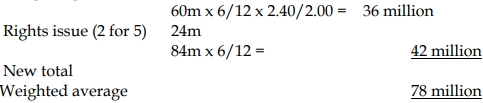

EPS year ended 31 March 2015:

The rights issue of two for five on 1 October 2014 is half way through the

year. The theoretical ex rights value can be calculated as:

Weighting:

EPS is therefore 25P (GHC19.5m/78m x 100).

The comparative (for 2014) would be restated at 20P (24Px 2.00/2.40).

(ii) The basic EPS for the year ended 31 December 2015 is 30p (GHC25.2m/84m x

100).

Dilution

Convertible loan stock:

- On conversion, loan interest of GH¢1.2 million after tax would be saved (GH¢20 million x 8% x (100% – 25%)), and a further 10 million shares would be issued (GH¢20m/GH¢100 x 50).

Directors’ options:

- Options for 12 million shares at GH¢1.50 each would yield proceeds of GH¢18 million. At the average market price of GH¢2.50 per share, this would purchase 7.2 million shares (GH¢18m/GH¢2.50). Therefore, the ‘bonus’ element of the options is 4.8 million shares (12m – 7.2m).

Using the above figures, the diluted EPS for the year ended 31st December 2015 is 26.7p (GH¢25.2m + GH¢1.2m)/(84m + 10m + 4.8m).

- Tags: Convertible Loan Stock, Diluted EPS, Earnings Per Share, Share Options

- Level: Level 2

- Topic: Financial Reporting Standards and Their Applications

- Series: MAY 2016

- Uploader: Joseph