- 20 Marks

Question

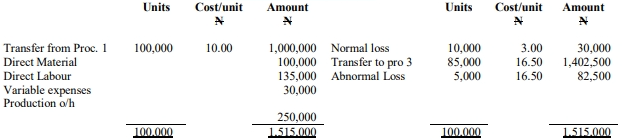

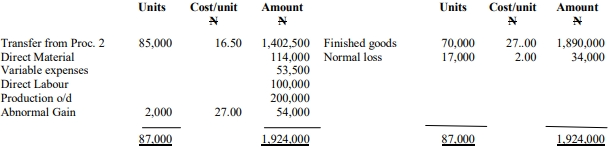

MAPUTO NIGERIA LIMITED manufactures its product through three processes. The following data relates to Process 2 and Process 3 for the month of October:

- 100,000 units at N10 each were transferred from Process 1 to Process 2.

| Cost Components | Process 2 (N) | Process 3 (N) |

|---|---|---|

| Direct Materials | 100,000 | 114,000 |

| Direct Labour | 135,000 | 100,000 |

| Variable Expenses | 30,000 | 53,500 |

| Production Overhead | 250,000 | 200,000 |

- Normal output: 90% for Process 2 and 80% for Process 3

- Actual output: 85,000 units for Process 2 and 70,000 units for Process 3

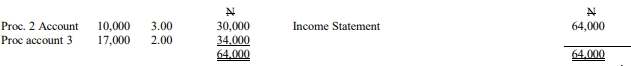

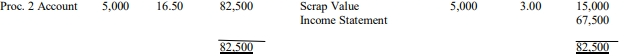

- Scrap value of loss: N3 per unit for Process 2 and N2 per unit for Process 3

Required:

a. Prepare Process 2 and Process 3 accounts (16 Marks)

b. Prepare the Normal Loss account (2 Marks)

c. Prepare the Abnormal Gain account (2 Marks)

Answer

MAPUTO NIGERIA LIMTED

PROCESS 2 ACCOUNTS

a

i)

PROCESS 3 ACCOUNTS

ii)

b) NORMAL LOSS ACCOUNT

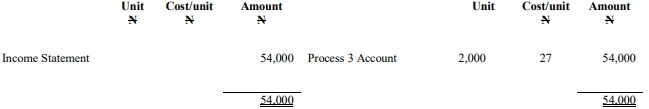

c) ABNORMAL LOSS ACCOUNT

ABNORMAL GAIN ACCOUNT

- Tags: Abnormal Gain, Manufacturing Costs, Normal Loss, Process Costing, scrap value

- Level: Level 1

- Topic: Process Costing

- Series: MAY 2015

- Uploader: Joseph