CASE STUDY: GUSSIE PERRY LTD

Introduction:

Gussie Perry Ltd (GPL) is a long-established divisionalized company with its origins in shipping. The company has been in existence for nearly 120 years and has developed a reputation for reliability and quality service.

The shipping activities in which Gussie Perry Ltd (GPL) is engaged comprise four divisions – cruise, ferry, container, and bulk shipping. The cruise division is engaged entirely in the carriage of passengers, while the ferry division carries passengers and vehicles. The vehicles carried by the ferries range from motor cars to articulated trucks and buses. The container and bulk shipping divisions are engaged in the carriage of freight only.

Organizational Goals:

The company has stated over recent years that it aims to:

- Increase its international business to achieve long-term profitability.

- Provide the necessary capital investment to support its international operations.

- Train and develop the company’s employees.

Environmental and Safety Policy:

Environmental protection is now a key aspect of corporate social responsibility. Pressure on Gussie Perry Ltd (GPL) for better environmental performance is coming from many quarters. The company recently implemented an environmental and safety policy, which is monitored through an audit system, in an effort to ensure that its policies are being executed. It is the aim of the company to have operational standards that match the best industry standards. Training of management, staff, and specialist auditors is seen as a priority within the organization’s environmental and safety policy. This has become a major concern for the company because of customer anxiety about the safety of the ferries.

Financial Results:

In the last financial year, earnings per share were GH¢2.12, producing a dividend cover of 1.15 times. The dividend per share paid by Gussie Perry Ltd (GPL) has remained at the same level for five years. Comparative values for divisional revenue and operating profit are shown in Table 1.

Table 1: Divisional Financial Data

| Division |

Cruise |

Ferry |

Container |

Bulk Shipping |

| Current year’s revenue (GH¢’000) |

5,136 |

4,002 |

7,572 |

750 |

| Previous year’s revenue (GH¢’000) |

4,410 |

3,756 |

6,306 |

672 |

| Current year’s operating profit (GH¢’000) |

780 |

650 |

252 |

(30) |

| Previous year’s operating profit (GH¢’000) |

528 |

480 |

240 |

(18) |

| Assets/Capital Employed (GH¢’000) |

2,800 |

2,500 |

3,200 |

3,800 |

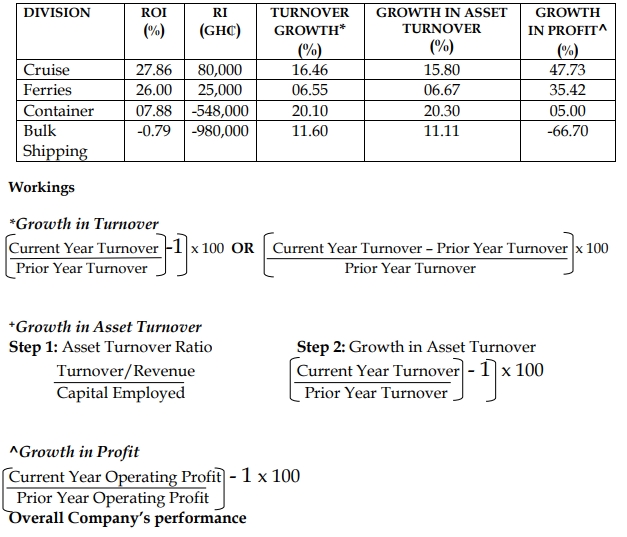

During the year, general inflationary levels in the shipping industry were 14% per annum. The company’s cost of capital is 25%.

Extract from the Chairman’s Statement for the Financial Year:

In his statement, Mr. Aaron Yeboah, the Chairman of Gussie Perry Ltd (GPL), commenting on revenue and profit before the inflation adjustment, said the company achieved encouraging results, particularly in the cruise division. The company had taken delivery of a new cruise liner, at a cost of GH¢1,200,000, and has two more on order. Aaron believed that this was an expanding market and considered the company to be in a good position to take advantage of the opportunity. With regard to the ferry division, Aaron expected continued growth, although there was an expectation of potential new entrants due to increased cargo volumes. This contrasted with his view of the declining performance of the container and bulk shipping divisions as shown in Table 1.

Market Information:

Gussie Perry Ltd (GPL) commissioned market research into its cruise and ferry operations. The results of this research indicated that, in recent years, within the cruise liner industry, there has been a change in customer appeal. Traditionally, the main customer base had comprised traders. In the last five years, the cruise division has experienced an increase in its clientele, especially holidaymakers. This stemmed from the promotion of domestic tourism.

Furthermore, the research showed a 15% increase in marine transport, but Gussie Perry Ltd’s market share actually reduced by 4%. The report indicates that the probability of the cruise market continuing to grow was bright. However, there were uncertainties about the future potential of the container and bulk shipping divisions.

Required:

a) Identify FOUR ways in which GPL’s concern for environmental and safety policy can impact on its performance. (4 marks)

b) The Chairman of the company has recently attended a short course on strategic planning. He was particularly interested in the relevance of mission statements to the strategic management process. Explain in FOUR ways how a mission statement is relevant in strategic management. (8 marks)

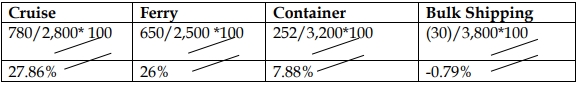

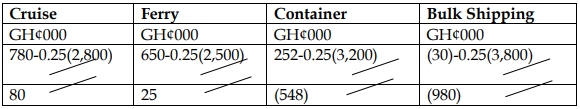

c) i) Calculate the current return on investment (ROI) and residual income (RI) for each division for the current year. (4 marks)

ii) Assess the performance of each division and advise the management of Gussie Perry Ltd (GPL). (8 marks)

d) With reference to Porter’s Five Competitive Forces model, assess the nature of the cruise and ferry shipping market in which Gussie Perry Ltd (GPL) is engaged. (16 marks)