- 20 Marks

Question

a) Ansong is a sole proprietor whose accounting year is 1 November to 31 October. Ansong rents factory space at the cost of GHȼ10,000 per quarter, payable in advance. Payments for rent were made on 1 January, 1 April, 1 July, and 1 October during the year 2020.

Required:

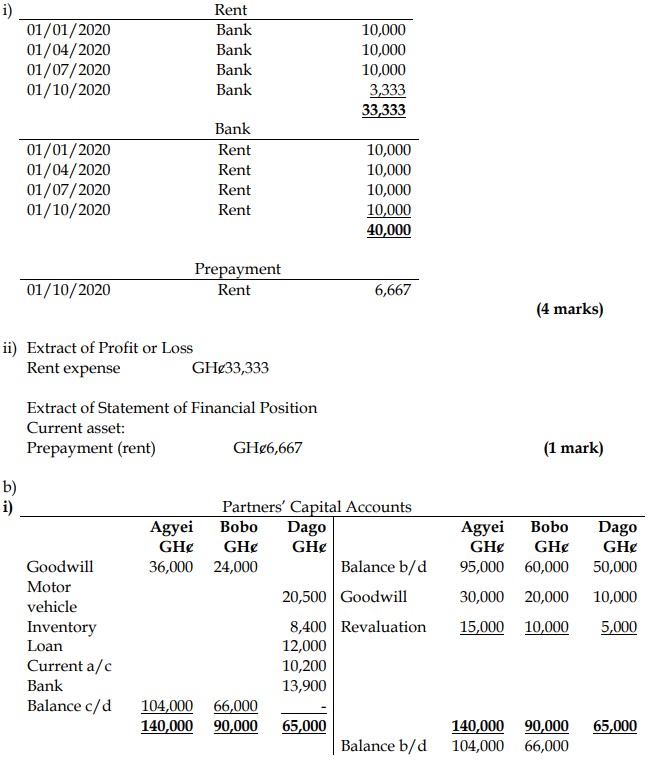

i) Show the ledger entries to record the above transactions for the year ended 31 October 2020.

(4 marks)

ii) Prepare an extract for the Statement of Profit or Loss and Statement of Financial Position.

(1 mark)

b) Agyei, Bobo, and Dago have been in partnership for some years, sharing profits and losses in the ratio 3:2:1, respectively. The partnership statement of financial position as at 30 June 2020 was as follows:

| Assets | GHȼ | GHȼ |

|---|---|---|

| Non-current assets | ||

| Premises | 80,000 | |

| Office equipment | 58,400 | |

| Motor vehicles | 45,000 | |

| Total Non-current assets | 183,400 | |

| Current assets | ||

| Inventory | 28,600 | |

| Trade receivables | 25,800 | |

| Bank | 5,650 | |

| Total Current assets | 60,050 | |

| Total assets | 243,450 | |

| Capital and Liabilities | ||

| Capital accounts | ||

| Agyei | 95,000 | |

| Bobo | 60,000 | |

| Dago | 50,000 | |

| Total Capital | 205,000 | |

| Current accounts | ||

| Agyei | 15,200 | |

| Bobo | 7,040 | |

| Dago (debit balance) | (10,200) | |

| Total Current accounts | 12,040 | |

| Current liabilities | ||

| Trade payables | 26,410 | |

| Total Capital and Liabilities | 243,450 |

The partners have agreed that the following should take effect on 1 July 2020 upon the retirement of Dago:

- Goodwill is to be valued at GHȼ60,000 and will not remain in the books of account.

- Premises are to be revalued to GHȼ116,325.

- Dago is to take inventory costing GHȼ8,400 and a Motor Vehicle with a net book value of GHȼ20,500 as part settlement of his capital.

- A specific allowance for receivables is to be made for GHȼ5,300 owed by an individual customer. In addition, a general allowance for receivables is to be made at 5% of the remaining trade receivables.

- Agyei and Bobo will continue in partnership, sharing profits and losses in the ratio 3:2.

- Dago will transfer GHȼ12,000 to a loan account to be repaid in full in 2025. No loan interest will be charged on this amount.

- The remaining balance from combining both Dago’s capital account and current account will be paid from the business bank account.

Required:

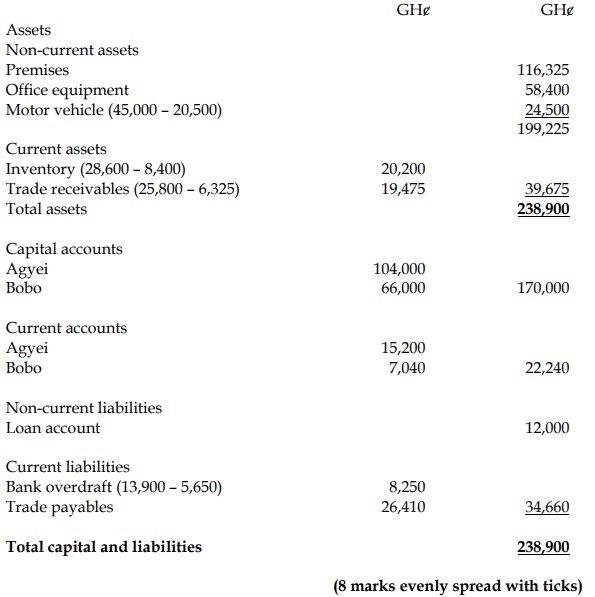

i) Prepare the partners’ capital accounts on 1 July 2020 to show the retirement of Dago.

(7 marks)

ii) Prepare the partnership statement of financial position as at 1 July 2020.

(8 marks)

Answer

a)

Workings:

1. Revaluation surplus calculation:

GHȼ (116,325 – 80,000) – GHS (5,300 + (25,800 – 5,300) x 5%) = GHȼ30,000

Agyei 30,000 x 3/6 = 15,000

Bobo 30,000 x 2/6 = 10,000

Dago 30,000 x 1/6 = 5,000

2. Goodwill in old ratio:

Agyei 60,000 x 3/6 = 30,000

Bobo 60,000 x 2/6 = 20,000

Dago 60,000 x 1/6 = 10,000

3. Goodwill in new ratio:

Agyei 60,000 x 3/5 = 36,000

Bobo 60,000 x 2/5 = 24,000

ii) Partnership Statement of Financial Position as at 1 July 2020

- Topic: Accruals and prepayments, Preparation of Partnership accounts

- Series: NOV 2021

- Uploader: Theophilus