- 20 Marks

Question

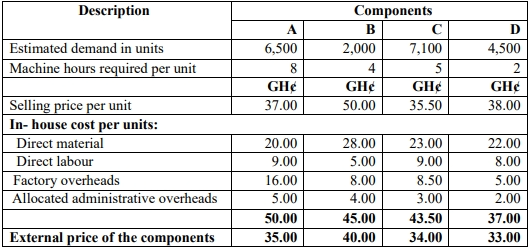

Hwerema Technologies produces various components for telecom companies. The demand for these components is increasing. However, Hwerema Technologies’ production facility is restricted to 50,000 machine hours. Therefore, the company is considering whether to import certain components to make up for the shortfall in production to meet market demand. In this respect, the following information has been gathered:

Factory overheads include fixed overheads estimated at GH¢1.50 per machine hour.

Required:

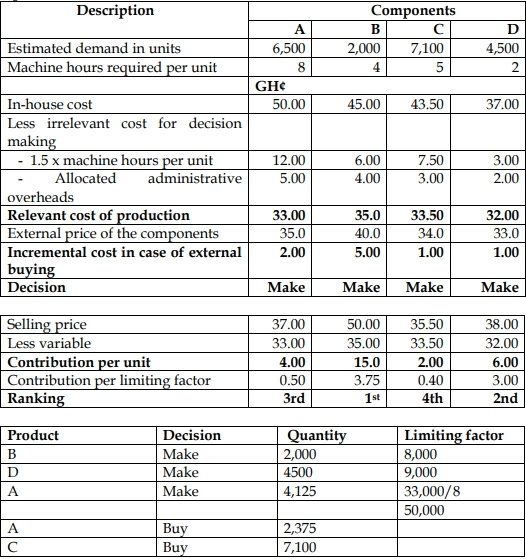

a) Determine the optimal units to be produced in-house and units to be imported. (16 marks)

b) State FOUR (4) qualitative considerations relevant to make-or-buy decisions. (4 marks)

Answer

a) Optimal decision

b)

Non-financial considerations relevant to make or buy decisions

Risk of outsourcing works:

- Suppliers may produce items to a lower standard of quality.

- The supplier may fail to meet delivery date and the buyer may depend on the

supplier to commit onward delivery to its buyer. In case of buying of a component,

production process of the end-product may be held up by a lack of component.

Benefits of outsourcing work:

- Outsourcing work will enable the management to focus all its efforts on those

aspects of operation the entity does best. - The external supplier may have specialist expertise which enables it to provide

outsourced products more efficiently and at a cheaper price.

- Tags: Machine Hours, Make or buy decision, Outsourcing, Production planning, Relevant Costs

- Level: Level 2

- Topic: Decision making techniques, Relevant Cost and Revenue

- Series: MAR 2024

- Uploader: Joseph