- 5 Marks

Question

The following information is an extract of projected financial performance of YZ Ltd, a manufacturing company that intends to go into operation with a basis period from January to December. Management is contemplating operating in either Kumasi or Konongo, but the results are expected to be the same irrespective of the location. The following projected results from January to December Year 1 are worth analyzing:

| Kumasi (Regional Capital) | Konongo (District Capital) | |

|---|---|---|

| Revenue | GH¢ 3,000,000 | GH¢ 3,000,000 |

| Cost | GH¢ 1,200,000 | GH¢ 1,200,000 |

| Gross Profit | GH¢ 1,800,000 | GH¢ 1,800,000 |

| Expenses | GH¢ 1,000,000 | GH¢ 1,000,000 |

| Net Profit | GH¢ 800,000 | GH¢ 800,000 |

The following additional information is relevant:

A building to be bought on 1 March Year 1 for GH¢400,000 has been granted full year’s depreciation at the rate of 20%, and the same has been added to the projected cost above.

Required:

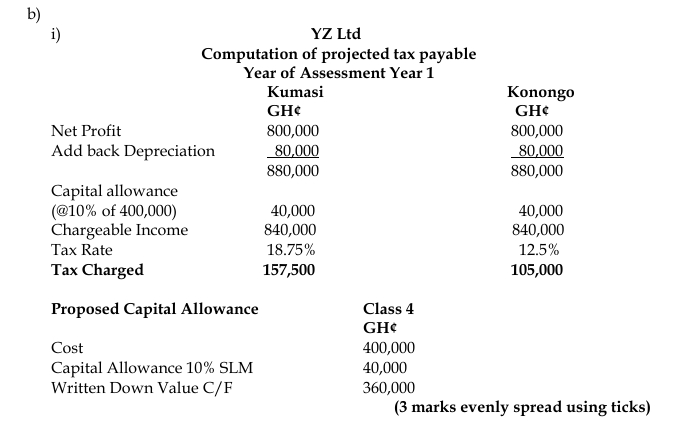

i) Compute the projected tax payable based on the information above and recommend where management is likely to site the entity and why.

ii) What other TWO (2) factors, apart from what has been identified in (i) above, may dictate siting a manufacturing business in a regional capital?

Answer

Recommendation: Management is likely to invest in Konongo (District Capital) since it offers a lower tax rate of 12.5% compared to 18.75% in Kumasi. The tax saving is GH¢ 52,500 by choosing Konongo.

ii) Other factors that may dictate the siting of a manufacturing business in a regional capital apart from tax rates:

- Proximity to skilled labor

- Availability of infrastructure (e.g., roads, electricity)

- Tags: Capital Allowance, District Capital, Regional Capital, Tax computation, Tax Decision

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: NOV 2018

- Uploader: Dotse