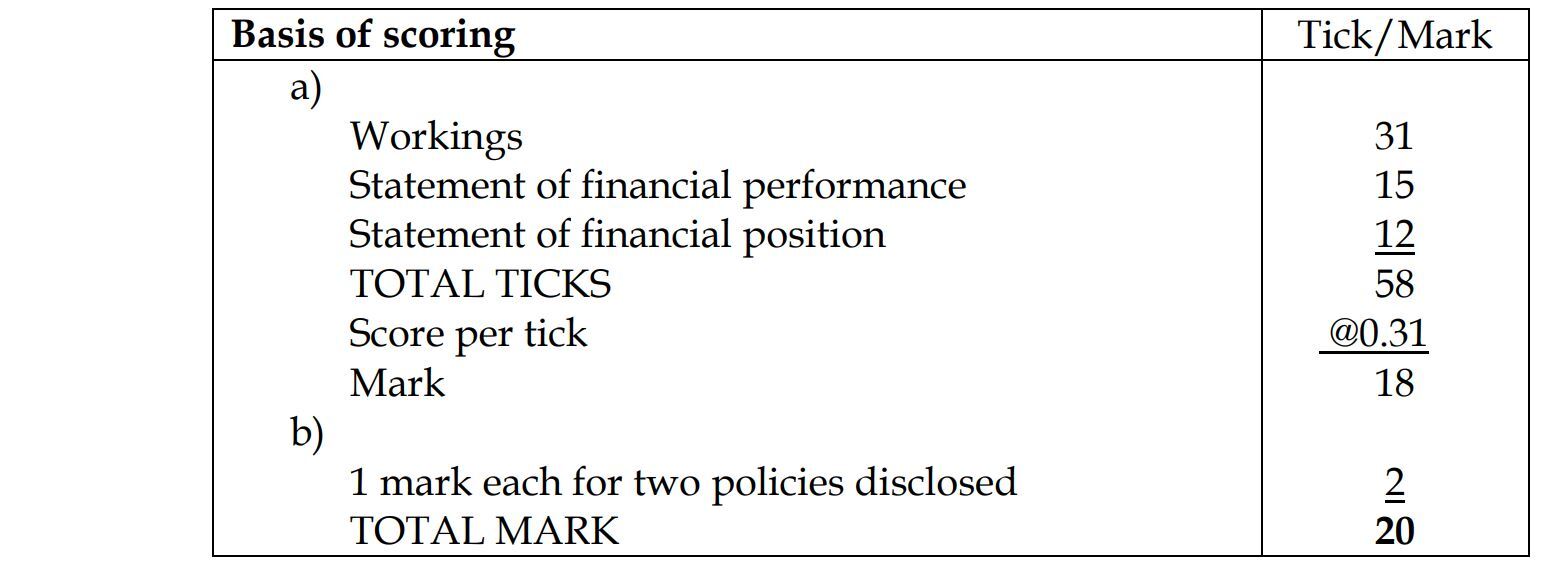

- 20 Marks

Question

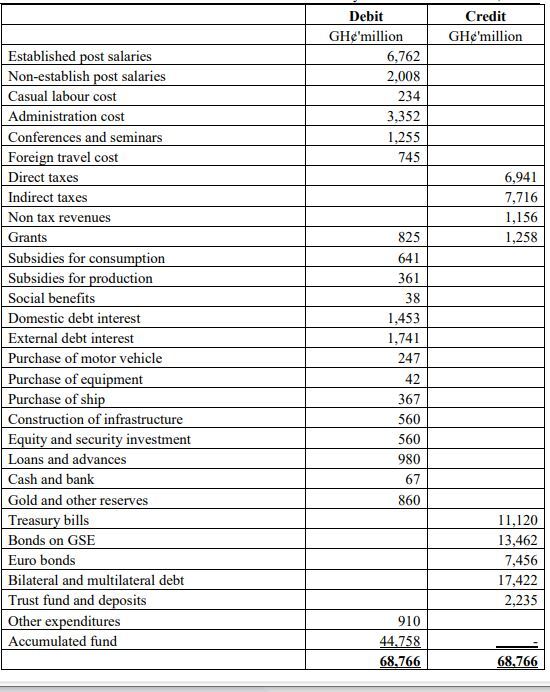

Below is the Trial Balance of the Consolidated Fund for the year ended 31 December 2014.

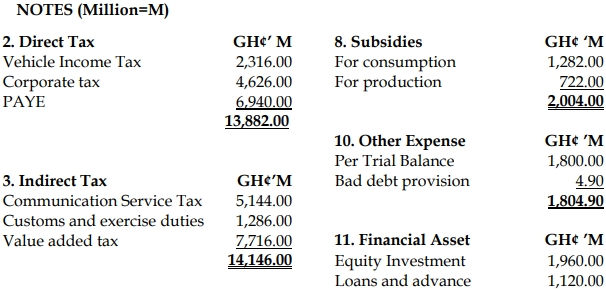

Additional Information:

i) It is the policy of Controller and Accountant General to adopt the accrual basis of preparing the public accounts of the Consolidated Fund for the first time in compliance with the Financial Administration Regulation 2004 and the International Public Sector Accounting Standards (IPSAS). The effective date is 31 December 2014.

ii) The current Chart of Accounts based on the GFS 2001 is used in the classification of revenues and expenditures.

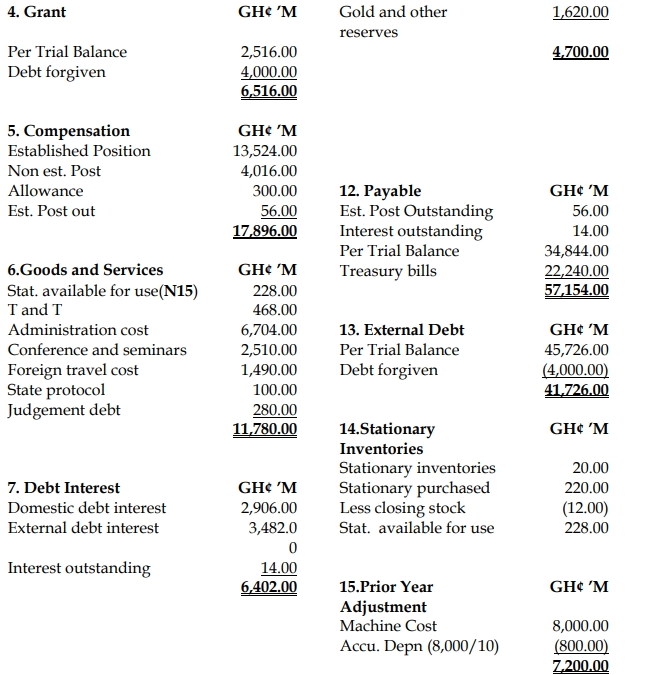

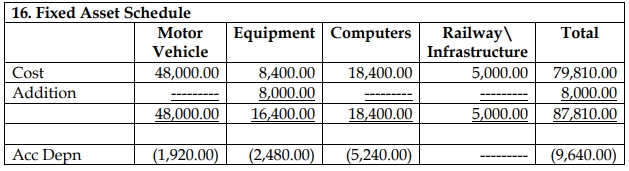

iii) Consumption of fixed capital charged on cost for the year has been computed as GH¢156,000,000.

iv) Direct tax revenues due to government but were not received at 31 December 2014 amounted to GH¢49,000,000.

v) An established post salary in arrears as a result of salary increment in the fourth quarter of 2014 was GH¢56,000,000 and goods and services outstanding at the end of the year amounted to GH¢12,000,000.

vi) The grant shown in the trial balance as expenditure represents a statutory transfer to the District Assembly Common Fund (DACF). Any arrears in the DACF should be treated as payable. The current rate of transfer is 7.5% on the amount received.

vii) Public debt interest of GH¢14,000,000 was due to creditors but was not paid as at 31 December 2014.

Required:

a) Prepare in a form suitable for publication and in accordance with the relevant Financial Laws and IPSAS:

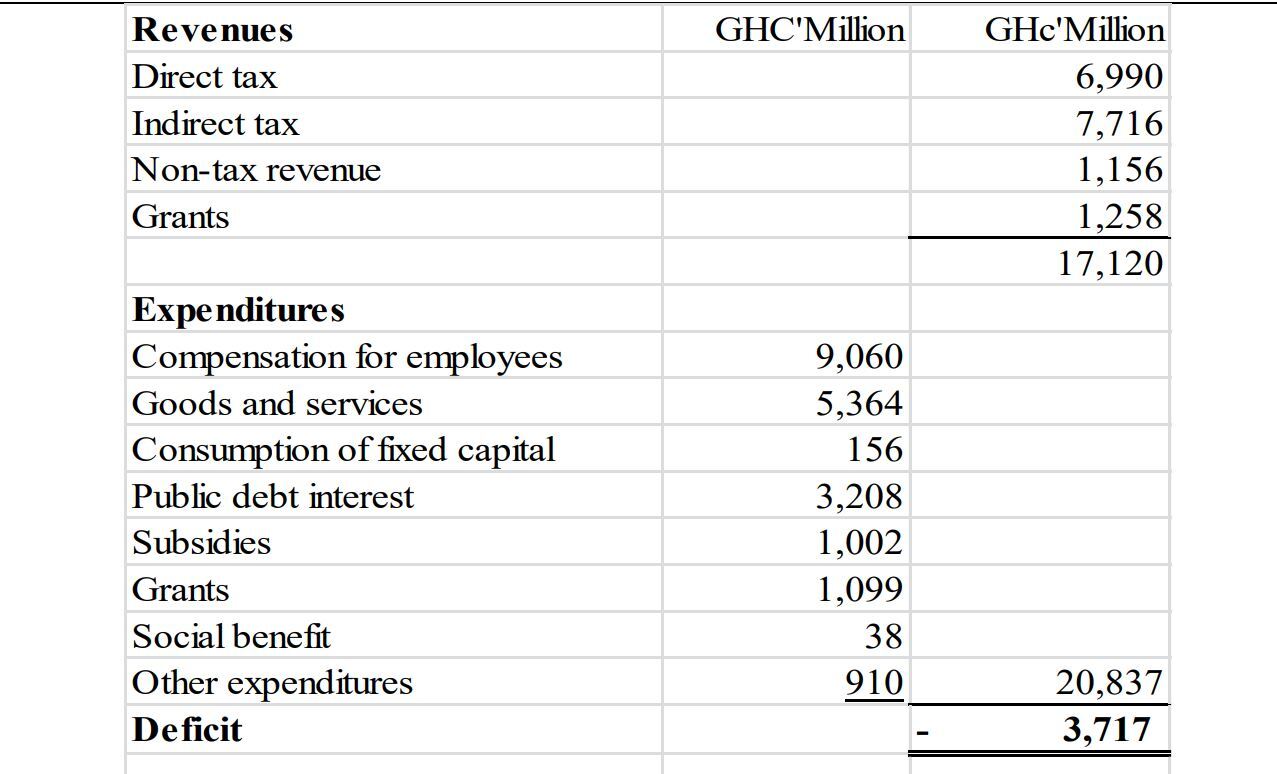

i) Statement of Financial Performance of the Consolidated Fund for the year ended 31 December 2014.

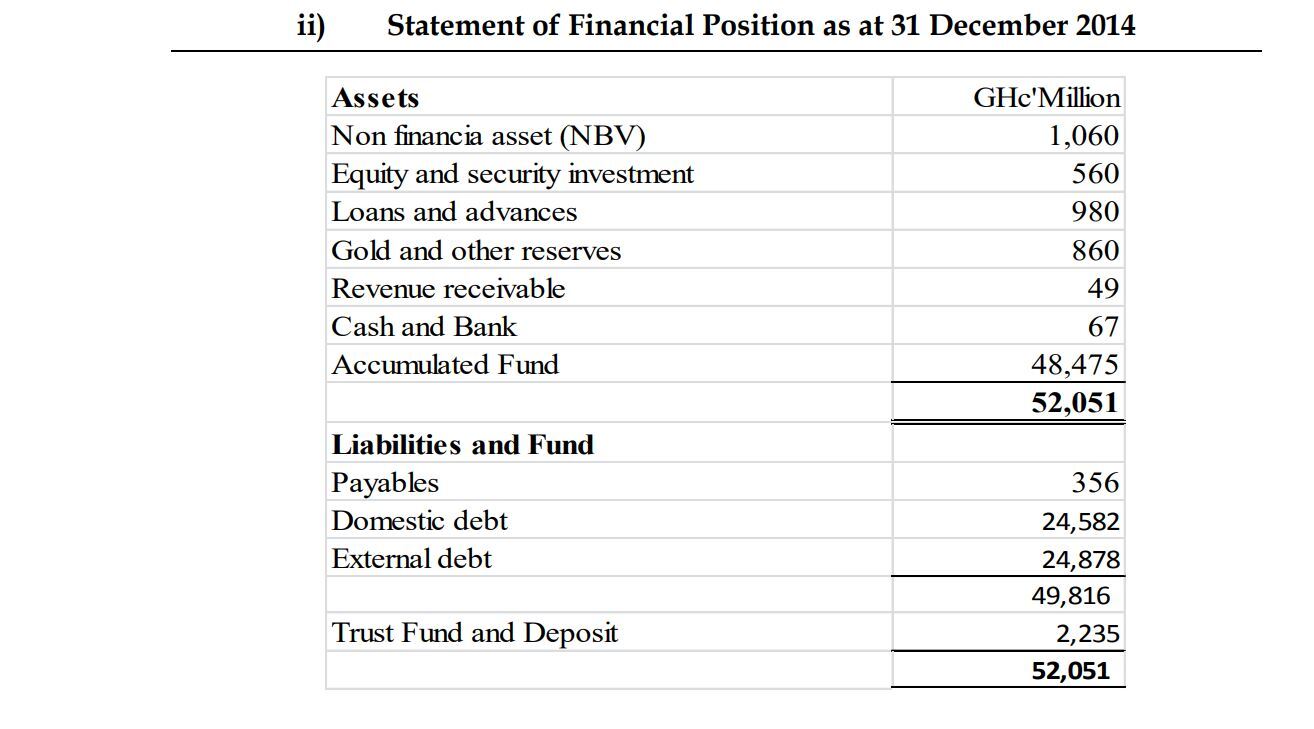

ii) Statement of Financial Position of the Consolidated Fund as at 31 December 2014.

(Show all workings clearly)

b) Disclose any TWO significant accounting policies as part of the notes to your accounts, as much as the information provided will permit.

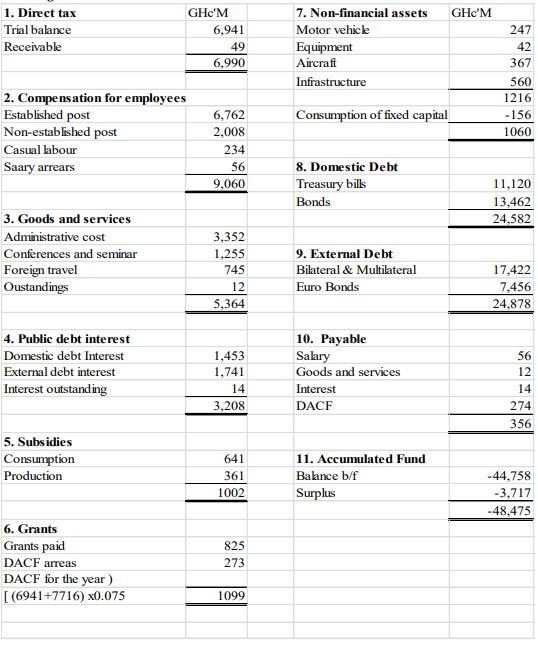

Answer

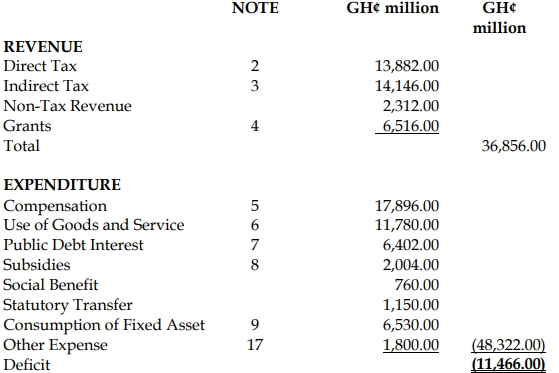

i) Statement of Financial Performance of the Consolidated Fund

for the year ended 31 December, 2014

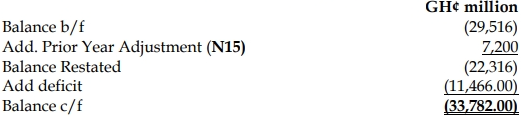

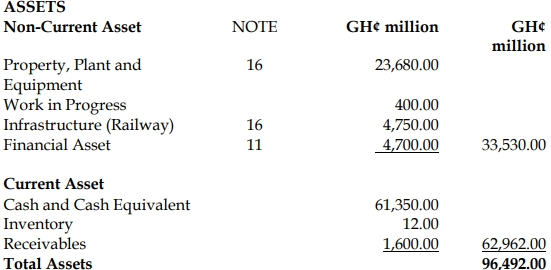

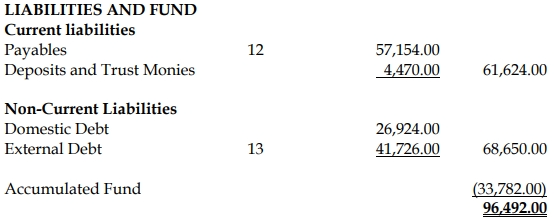

ii) Statement of Financial Position as at 31 December 2014

ii) Statement of Financial Position as at 31 December 2014

(b)

Notes on Accounting Policy include:

i) Basis of Accounting

The accounts are prepared on accrual basis for the first time.

ii) Consumption of Fixed Capital/depreciation policy

Depreciation is charged on non-financial assets acquired during the year.

Infrastructure is depreciated at 5% per annum on cost and other PPEs are

depreciated at 10% per annum on cost.

iii) Accounts are prepared in compliance with the IPSAS and the Financial

Laws of the country.

EXAMINER’S COMMENTS

This was generally fairly well answered by most candidates. Some candidates

however performed very poorly in answering the question, showing that they were

ill-prepared for the examination.

- Uploader: Cheoli