- 20 Marks

Question

Eebuks Ltd is a retailer of academic textbooks that sells through its own network of bookshops and online through its website. The revenue from the website includes both cash sales and sales on credit to educational institutions. The company has provided historical analysis from its trade receivables ledger indicating that for sales made on credit, 25% payment is received in the month of sale, 70% after 30 days, and the remainder are irrecoverable debts.

You are a Manager in Makafui & Associates, a firm of Chartered Accountants offering a range of services from audit to non-audit for its clients. On 1 July 2023, your firm was asked by Eebuks Ltd, a company that is not an audit client of your firm, to consider a potential engagement to review and provide an assurance report on Prospective Financial Information. Makafui & Associates has already conducted specific client identification procedures in line with money laundering regulations with satisfactory results.

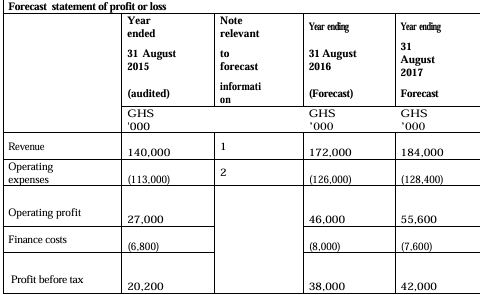

Additionally, Eebuks Ltd has approached your firm to obtain an independent assurance opinion on its cash flow forecast, which is being prepared for its bankers in support of an application for an increase in its existing overdraft facility.

Required:

a) In line with ISAE 3400: The Examination of Prospective Financial Information, discuss FIVE (5) matters to be considered by Makafui & Associates before accepting the engagement to review and report on Eebuks Ltd’s Prospective Financial Information. (10 marks)

b) Assuming Makafui & Associates accepts the engagement, recommend EIGHT (8) procedures to be performed in respect of Eebuks Ltd’s cash flow forecast. (10 marks)

Answer

a) Matters to Consider Before Accepting the Review Engagement:

Before accepting the review engagement to provide an assurance report on Eebuks Ltd’s cash flow forecast, ISAE 3400 The Examination of Prospective Financial Information identifies several matters that need consideration:

- Intended Use of the Information: The firm should determine whether the cash flow forecast and assurance report will be used solely to support the increase in Eebuks Ltd’s overdraft facility. If the report is intended for other purposes, such as securing additional loans, this must be clarified as it affects the risk assessment.

- Distribution of the Information: The firm should consider whether the information will be distributed generally or to a limited audience. General distribution increases the risk associated with the engagement due to a broader audience relying on the information.

- Period Covered and Key Assumptions: Makafui & Associates should evaluate the period covered by the forecast and the assumptions used. Unrealistic assumptions or long-term forecasts may introduce significant risk, making the engagement inappropriate.

- Scope of Work: The firm must clearly define the scope, including the specific elements of the forecast to be reviewed. The level of assurance required by Eebuks Ltd and the form of the report should also be considered to ensure the engagement meets the client’s needs.

- Resources and Skills: The firm should assess whether it has the necessary staff with the required expertise to complete the engagement within the deadline and whether they will have access to all relevant information.

- Client Integrity: ISQC 1 requires an evaluation of the client’s integrity. Makafui & Associates should assess the reasons for appointing a different firm from the auditors and consider potential biases in the forecast.

- Ethical Matters: The firm must ensure no threats to independence or objectivity exist, particularly if the incumbent auditors were not chosen to provide the assurance report. Permission to contact the auditors should be obtained; otherwise, the engagement should be declined.

b) Procedures to Examine Eebuks Ltd’s Cash Flow Forecast:

- Mathematical Accuracy: Cast the cash flow forecast to confirm its mathematical accuracy.

- Consistency with Accounting Policies: Confirm the consistency of the accounting policies used in the preparation of the forecast with those used in the last audited financial statements.

- Opening Cash Position: Agree the opening cash position to the cash book and the bank statement.

- Key Assumptions Review: Discuss the key assumptions with management, such as collection and payment periods, and assess their reasonableness.

- Analytical Review: Perform an analytical review by comparing forecast trends with historical cash flows and sector data, investigating any significant differences.

- Recalculate Cash Flow Patterns: Recalculate the patterns of cash flows based on historical data to ensure accuracy in the forecast preparation.

- Sample Testing of Overheads: Obtain a breakdown of forecast overheads and compare it with historical data. Ensure that non-cash items like depreciation are excluded from the cash flow forecast.

- Review Supporting Documentation: For significant costs, review supporting documents like invoices or agreements to verify the accuracy and completeness of forecast payments.

- Board Minutes Review: Review board minutes to identify discussions or decisions relevant to the cash flow forecast.

- Sensitivity Analysis: Conduct sensitivity analyses by varying key assumptions to assess the impact on the cash position.

- Bank Confirmation: Obtain confirmation from the bank regarding the terms of the additional finance and ensure the forecast accurately reflects these terms.

- Management Representations: Obtain written representations from management confirming the reasonableness of their assumptions and completeness of the information provided.

- Topic: Assurance services, Planning, The audit approach

- Series: JULY 2023

- Uploader: Joseph