- 6 Marks

Question

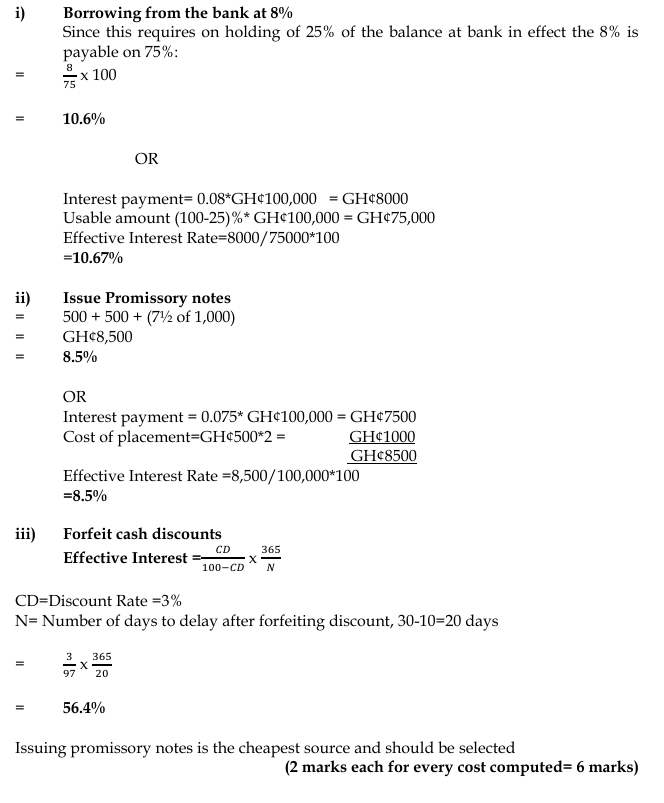

Abbot Ltd needs to increase its working capital by GH¢100,000. It has decided that there are essentially three alternatives of financing available. They are:

i) Borrow from a bank at 8%. This alternative would necessitate maintaining a 25% compensation balance.

ii) Issue promissory notes at 7.5%. The cost of placing the issue would be GH¢500 each six months.

iii) Forego cash discount, granted on the basis of 3/10, net 30.

The firm prefers the flexibility of bank financing, and has provided an additional cost of this flexibility to be 1%.

Required: Assess which alternative financing method should be selected.

Answer

The costs of the three alternatives are:

- Tags: Bank Loan, Cash discount, Cost Analysis, Financing, Promissory notes, Working Capital

- Level: Level 3

- Topic: Sources of finance and cost of capital

- Series: NOV 2017

- Uploader: Dotse