- 20 Marks

Question

The current financial year of General Kapito Ltd, a sports apparel company based in Ghana, will be ending in two months’ time. The directors of the company will be meeting next week to approve capital projects that will be implemented in the coming financial year. A major concern for the coming year is the availability of finance to meet investment requirements.

The cost of raising new capital in Ghana’s capital market has risen so high that it is not cost-effective to raise small blocks of capital. Consequently, the directors of the company have decided to finance new projects in the coming year with retained earnings and not raise new external capital from the capital market to bridge any financing gap. The maximum amount of retained earnings that will be available for financing new capital projects in the coming year is GH¢62 million.

There are six independent projects that will be presented before the board of directors for approval in their upcoming meeting. Five of the projects have been appraised already (see a summary of the projects in the table below).

| Project | Investment requirement | Net present value (NPV) | Internal rate of return (IRR) |

|---|---|---|---|

| PROJECT-01 | 25 | 50 | 36.2% |

| PROJECT-02 | 15 | 45 | 37.1% |

| PROJECT-03 | 9 | 35 | 39.5% |

| PROJECT-04 | 12 | 20 | 34.8% |

| PROJECT-05 | 34 | To be computed | To be computed |

| PROJECT-06 | 5 | 2 | 33.5% |

Project-05 refers to a 5-year contract with a local football club for the manufacture and supply of a special football boot for playing under rainy conditions. It is estimated that this project will require an investment of GH¢34 million in plant and equipment at the start of the first year. The estimated cost of required plant and equipment might change as there are speculations about probable change in technology in the coming year. That notwithstanding, this project is expected to return an after-tax net operating cash flow of GH¢13.5 million every year over the coming five years. The estimated after-tax salvage value of the plant and equipment is GH¢10 million at the end of the fifth year.

The company’s required rate of return is 25%.

Required:

a) Compute the NPV and IRR of Project-05. (10 marks)

b) Assess the sensitivity of the outcome of Project-05 to variations in the cost of plant and equipment. Interpret your result. (5 marks)

c) Assuming the projects are divisible, recommend the portfolio of projects that should be funded in the coming year. (5 marks)

Answer

a) NPV and IRR of Project-05

NPV of Project-05:

| Period | NCF (GH¢m) | DF @ 25% | PV @ 25% | DF @ 35% | PV @ 35% |

|---|---|---|---|---|---|

| EOY 0 | -34 | 1.0000 | (34.00) | 1.0000 | (34.00) |

| EOY 1-5 | 13.5 | 2.6893 | 36.31 | 2.2200 | 29.97 |

| EOY 5 | 10 | 0.3277 | 3.28 | 0.2230 | 2.23 |

| Total | NPV | 5.58 | (1.80) |

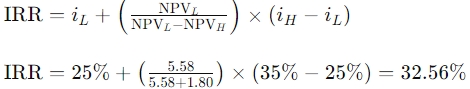

IRR of Project-05:

Project-05 should be considered for further appraisal as its NPV is positive and IRR is greater than the required rate of return.

(Marks allocation: NPV computation = 6 marks; IRR computation = 4 marks)

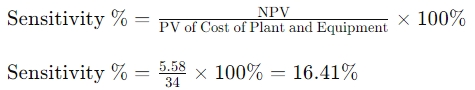

b) Sensitivity of Project-05 to Cost of Plant and Equipment:

Interpretation:

The cost of the plant and equipment will have to increase by 16.41% for the NPV of the project to become zero. This implies that the project will no longer be viable if the cost of equipment and plant increases by more than 16.41%.

(Marks allocation: Sensitivity calculation = 4 marks; Interpretation = 1 mark)

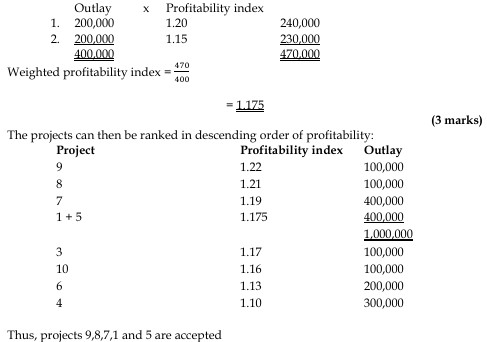

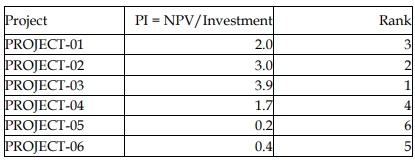

c) Recommended Portfolio of Projects:

Profitability Index (PI) of Projects

Allocating available funds to projects based on PI ranking:

| Rank | Project | Investment Required | Allocation | NPV |

|---|---|---|---|---|

| 1 | PROJECT-03 | 9 | 9 | 35 |

| 2 | PROJECT-02 | 15 | 15 | 45 |

| 3 | PROJECT-01 | 25 | 25 | 50 |

| 4 | PROJECT-04 | 12 | 12 | 20 |

| 5 | PROJECT-06 | 5 | 1 | 0.4 |

| 6 | PROJECT-05 | 34 | 0 | 0 |

Recommended Portfolio:

The company should fund Projects 3, 2, 1, and 4 in full and fund 1/5 of Project 6 for a combined NPV of GH¢150.4 million.

(Marks allocation: Profitability index and ranking = 3 marks; Recommended portfolio = 2 marks)

- Tags: IRR, NPV, Project Selection, Sensitivity Analysis

- Level: Level 2

- Topic: Capital rationing, Discounted cash flow

- Series: NOV 2019

- Uploader: Theophilus