- 20 Marks

Question

a) Shareholders of a large company substantially delegate the management of their business to agents (managers). Decision-making authority is also delegated to management. In a perfect condition, Management is expected to give priority to the interest of shareholders rather than their personal interest.

Required:

i) In reference to the above, explain THREE (3) areas of conflict between Management and Shareholders. (6 marks)

ii) Explain TWO (2) aspects of cost to shareholders in appointing an agent (Management). (4 marks)

b) Gologo Ghana Ltd is making a choice between issuing a public bond and placing the debt privately for GH¢600 million.

The public offer will be in GH¢100,000 denominations and carry a coupon or interest payment of 25% per annum. The bond will, however, sell for GH¢96,000 each. The issuing and underwriting cost will be 5% of the market value and is tax deductible.

The private placement will attract an interest rate of 26% per annum, and the company will receive the full face value of the loan. In both cases, the debt will be repaid after 20 years. The tax rate for the company is 30%.

Required:

i) Calculate the annual yield (%) the buyers of the public bond will earn. (3 marks)

ii) Compute the cost of both the bond and the private debt. (7 marks)

Answer

a)

i) Areas of Conflict Between Management and Shareholders:

- Risk-Taking:

Management might be interested in taking higher risks, but shareholders might prefer to avoid excessive risks to protect their investment and ensure steady returns. - Short-Term vs. Long-Term Performance:

Management may focus on short-term decisions to generate quick profits, which might not align with shareholders’ interest in long-term growth and value maximization. - Gearing Level Decisions:

Management might introduce or increase debt in the capital structure, raising the level of financial risk, which might not be acceptable to shareholders who prefer a more conservative approach.

(Any 3 points explained @ 2 marks each = 6 marks)

ii) Costs to Shareholders for Appointing Management:

- Hiring and Reward Costs:

This includes salaries, benefits, and bonuses paid to management, which represent a cost to shareholders. - Cost of Appointing Independent Non-Executive Directors:

Shareholders may incur costs in appointing independent non-executive directors to oversee management and ensure accountability, which also adds to the overall cost.

(Any two points @ 2 marks each = 4 marks)

b)

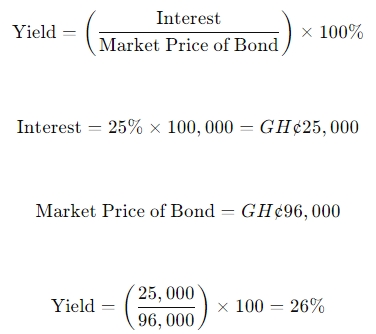

i) Annual Yield Buyers of the Bond Will Earn:

ii) Cost of Both Bond and Private Debt:

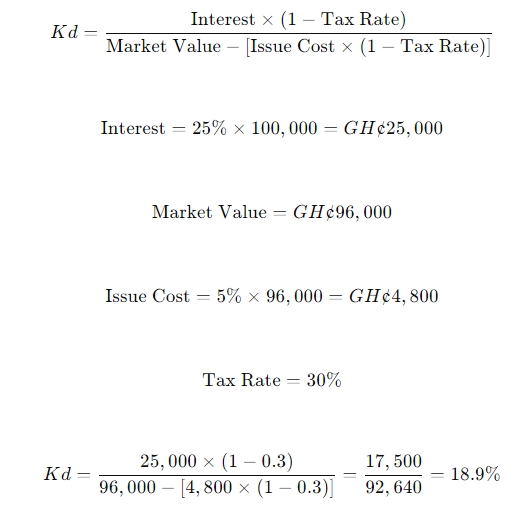

Cost of Public Bond (Kd):

Cost of Private Debt:

Kd = 26% × (1 − Tax Rate) = 26% × (1 − 0.3) = 18.2%

- Tags: Agency theory, Bond issuance, Cost of Debt, Private placement

- Level: Level 2

- Topic: Economic and regulatory environment, Sources of finance: debt

- Series: JULY 2023

- Uploader: Theophilus