- 20 Marks

Question

a) Employees may be paid either using piece rate or hourly rate.

Required:

In reference to the statement above, state THREE (3) tasks/jobs that:

i) Piece rate may be used. (3 marks)

ii) Hourly rate may be used. (3 marks)

b) Krenkren enterprise uses the hourly rate to pay her employees. The current rate is GH¢6 per hour. However, employees are paid 1.5 times for each overtime hour worked. Each employee is to work a minimum of 40 hours a week without a guaranteed payment. Any extra hour will attract overtime rate.

Extract from the time sheet for a week has been provided below:

| Name | Staff Number | Hours worked |

|---|---|---|

| Kwame Sarfo | H 1356 | 56 |

| John Addae | H 3456 | 38 |

| Thomas Appia | F 2254 | 48 |

| Rose Danso | F 8645 | 50 |

Required:

Calculate the basic pay for each of the staff. (9 marks)

c) The following standard costs apply to the manufacture of a product by Pontir Ltd:

- Standard weight to produce one unit: 12 kgs

- Standard price per kg: GH¢9

- Standard hours to produce one unit: 10

- Standard rate per hour: GH¢4

Actual production and costs for one accounting period were:

| Cost Element | Actual Usage | Actual Cost (GH¢) |

|---|---|---|

| Material | 3,770 kgs | 35,815 |

| Labour | 2,755 hours | 11,571 |

The actual output was 290 units.

Required:

Calculate relevant material and labor cost variances and present these in a format suitable for presentation to the management of Pontir Ltd. (5 marks)

Answer

a)

i) Tasks that may use Piece rate as a mode of payment:

- Molding of blocks

- Production of pieces of furniture

- Sewing of dresses

- Baking of bread

(Any 3 points @ 1 mark each = 3 marks)

ii) Tasks that may use Hourly rate as a mode of payment:

- Dressing of hair at the salon

- Clerical work at the office

- Servicing of cars

- Maintenance of machines

- Repair of equipment

(Any 3 points @ 1 mark each = 3 marks)

b)

Computation of basic pay:

| Name | Staff Number | Hours Worked | Rate (GH¢) | Overtime Hours | Overtime Rate | Basic Pay (GH¢) |

|---|---|---|---|---|---|---|

| Kwame Sarfo | H 1356 | 56 | 6 | 16 | 1.5 × 6 | 384 |

| John Addae | H 3456 | 38 | 6 | 0 | 0 | 228 |

| Thomas Appia | F 2254 | 48 | 6 | 8 | 1.5 × 6 | 312 |

| Rose Danso | F 8645 | 50 | 6 | 10 | 1.5 × 6 | 330 |

Total: (9 marks)

c)

Summary of variances for one accounting period

(F = Favourable; A = Adverse)

Materials:

| Variance Type | Amount (GH¢) | Favourable/Adverse |

|---|---|---|

| Price | 1,885 | A |

| Usage | 2,610 | A |

| Cost | 4,495 | A |

Labour:

| Variance Type | Amount (GH¢) | Favourable/Adverse |

|---|---|---|

| Rate | 551 | A |

| Efficiency | 580 | F |

| Cost | 29 | F |

Workings:

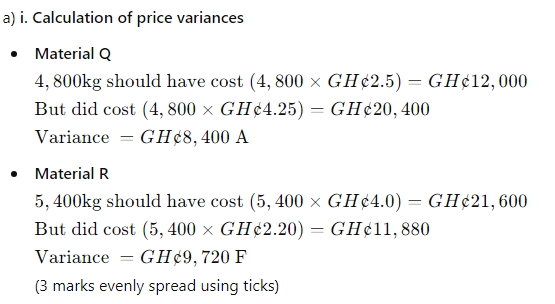

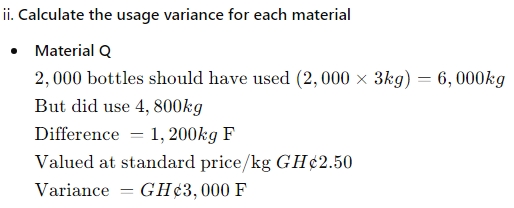

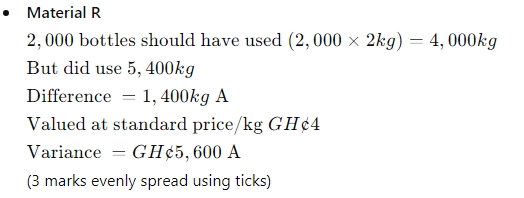

Materials:

- Actual cost: GH¢35,815

- Price variance: GH¢1,885 A

- Actual quantity purchased/used: 3,770 × GH¢9 = GH¢33,930

- Usage variance: GH¢2,610 A

- Standard quantity for actual production at standard price: 290 × 12 × GH¢9 = GH¢31,320

- Cost variance: GH¢4,495 A

Labour:

- Actual cost: GH¢11,571

- Rate variance: GH¢551 A

- Actual quantity purchased/used: 2,755 × GH¢4 = GH¢11,020

- Efficiency variance: GH¢580 F

- Standard quantity for actual production at standard price: 290 × 10 × GH¢4 = GH¢11,600

- Cost variance: GH¢29 F

Total: (5 marks)

- Tags: Hourly Rate, Labor Cost, Piece Rate, Standard Costing, Variance Analysis

- Level: Level 1

- Uploader: Joseph