- 7 Marks

Question

On 1 January 2020, Barikisu Ltd (Barikisu) entered into a contract with a customer to construct a specialised building for a consideration of GH¢2 million plus a bonus of GH¢0.4 million if the building is completed within 18 months. The estimated cost to construct the building is GH¢1.5 million. If the customer terminates the contract, Barikisu can demand payment for the cost incurred to date plus a mark-up of 30%. However, on 1 January 2020, due to factors outside of its control, such as the weather and regulatory approval, Barikisu is not sure whether the bonus will be achieved.

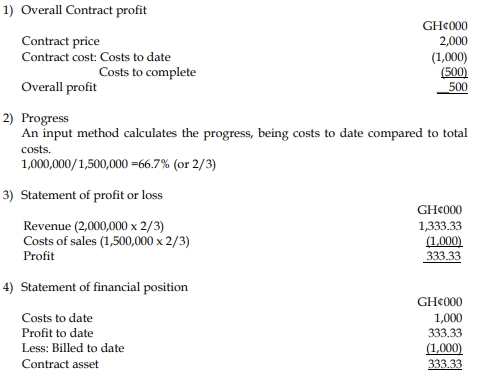

As at 31 December 2020, Barikisu has incurred a cost of GH¢1.0 million. They are still unsure as to whether the bonus target will be met. Therefore, Barikisu decided to measure progress towards completion based on the cost incurred. To date, Barikisu has received GH¢1 million from the customer.

Required:

Recommend to the directors of Barikisu how this transaction should be accounted for in the financial statements for the year ended 31 December 2020 in accordance with relevant International Financial Reporting Standards (IFRS).

Answer

Constructing the building is a single performance obligation in accordance with IFRS 15: Revenue from Contracts with Customers.

The bonus is a variable consideration. It is excluded from the transaction price because it is not highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur. The construction of the building should be accounted for as an obligation settled over time. Barikisu Ltd should recognise revenue based on progress towards satisfaction of the construction of the building.

- Topic: IFRS 15: Revenue from contracts with customers

- Series: NOV 2021

- Uploader: Theophilus