- 20 Marks

Question

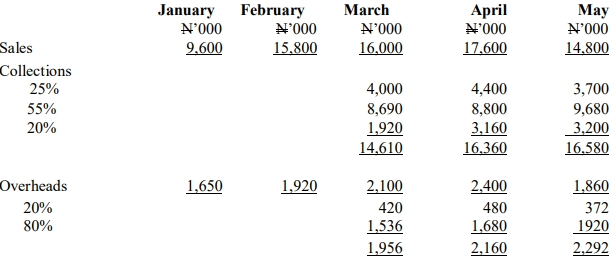

WHYME LIMITED is engaged in the manufacturing and sales of fast-moving consumer products. The following data are projections for a period of six months:

| Month | Sales (N’000) | Purchases (N’000) | Salaries (N’000) | Staff Salary Deductions (N’000) | Overheads (N’000) |

|---|---|---|---|---|---|

| Jan | 9,600 | 5,400 | 1,650 | 78 | 1,650 |

| Feb | 15,800 | 12,000 | 1,760 | 82 | 1,920 |

| March | 16,000 | 10,000 | 1,760 | 90 | 2,100 |

| April | 17,600 | 11,000 | 1,789 | 89 | 2,400 |

| May | 14,800 | 11,200 | 1,842 | 92 | 1,860 |

| June | 14,200 | 9,800 | 1,800 | 85 | 1,720 |

Other additional information:

- Sales are 25% on cash basis, 55% is collected in the month following sales, and the balance in the third month.

- All purchases are on 30 days credit while 20% of overheads are paid in the same month, with the balance in the following month.

- Net salaries will be paid in the same month, while statutory deductions are remitted on the 10th day of the following month.

- A N10 million loan will be released in March to finance the purchase of a new asset costing N12 million in the same month. The loan will be repaid equally over four months starting from April. (Ignore interest).

- An old asset will be disposed of in April for N1.5 million.

- Cash balance as at the end of February will be N6.5 million, with N2.5 million put into a short-term investment in March at a 2% monthly interest rate, credited at the beginning of the following month.

Required:

Prepare a cash budget for the period of March to May. (Ignore taxation).

(20 Marks)

Answer

WHYME LIMITED

CASH BUDGET FOR THREE MONTHS ENDING MAY YEAR XXX

| March (N’000) | April (N’000) | May (N’000) | |

|---|---|---|---|

| INFLOWS | |||

| Sales Collections | 14,610 | 16,360 | 16,580 |

| Loan | 10,000 | – | – |

| Fixed Asset Disposal | – | 1,500 | – |

| Investment Income | – | 50 | 50 |

| Total Inflows (A) | 24,610 | 17,910 | 16,630 |

| OUTFLOWS | |||

| Purchases | 12,000 | 10,000 | 11,000 |

| Salaries | 1,670 | 1,700 | 1,750 |

| Salaries Deductions | 82 | 90 | 89 |

| Overheads | 1,956 | 2,160 | 2,292 |

| Fixed Assets | 12,000 | – | – |

| Loan Repayment | – | 2,500 | 2,500 |

| Investment | 2,500 | – | – |

| Total Outflows (B) | 30,208 | 16,450 | 17,631 |

| Balance B/F | 6,500 | 902 | 2,362 |

| Net Cash Flow (A – B) | (5,598) | 1,460 | 1,001 |

| Balance C/F | 902 | 2,362 | 1,36 |

Workings

- Tags: Asset Disposal, Cash Budget, Financial planning, Loan, Payments, Receivables

- Level: Level 1

- Uploader: Joseph