a) Partnerships and limited liability companies present several similarities for business owners looking for the right company structure. Both have similar income distribution and tax-reporting formats, and both are simpler to set up and operate than a corporation. Despite their similarities, they have differences.

Required:

Identify and explain THREE fundamental differences between a company and a partnership. (6 marks)

b) Sole proprietorships are the smallest form of business organization, and also the most common in the country. However, while there are certain advantages (it is easier to set up a sole proprietorship than a limited liability company, for instance), there are numerous disadvantages.

Required:

State FOUR disadvantages of the sole proprietorship as a mode of business. (4 marks)

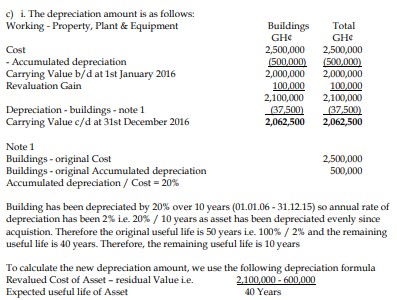

c) Otiko Ltd’s head office building is the only building it owns. Using professional valuers, it revalued this building on 1 January 2016, at GH¢2,100,000. Otiko Ltd has adopted a revaluation policy for buildings from this valuation date and has decided that the original useful life of buildings has not changed as a result of the revaluation. The building was acquired on 1 January 2006. The cost of the building on acquisition was GH¢2,500,000 and the accumulated depreciation to the 31 December 2015 amounted to GH¢500,000. The depreciation up to 1 January 2016 was depreciated evenly since acquisition. The professional valuer believes that the residual value on the building would be GH¢600,000 at the end of its useful life.

Required:

Calculate the depreciation amount of the building for the year ended 31 December 2016 based on the information provided in the above scenario. (6 marks)

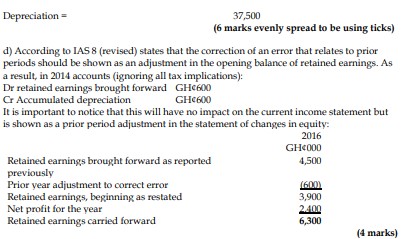

d) WD noted in 2016 that in 2015 it had omitted to record a depreciation expense on an asset amounting to GH¢600. Its accounts before the correction of the error are;

|

2016 (GH¢000) |

2015 (GH¢000) |

| Gross profit |

6,000 |

6,900 |

| Distribution costs |

(600) |

(600) |

| Administration expenses |

(1,800) |

(1,800) |

| Depreciation |

(600) |

Nil |

| Profit from operations |

3,000 |

4,500 |

| Income tax |

(600) |

(900) |

| Net profit |

2,400 |

3,600 |

WD’s retained earnings (income surplus) for the two years before the correction of the error were;

|

2016 (GH¢000) |

2015 (GH¢000) |

| Retained earnings carried forward |

6,900 |

4,500 |

| Retained earnings brought forward |

4,500 |

900 |

Required: Describe how the above error should be corrected in accordance with IAS 8: Accounting policies, changes in accounting estimates and errors. (4 marks)