- 20 Marks

Question

Amna and Bean are brothers and equal partners in their partnership business, A&B General Wholesale Merchants Limited. The partnership is in its second year of trading and operates from an office premises owned by Amna. The cost of the premises as at 1 January, 2019 was GH¢200,000. Bean provided all the office furniture and equipment used by the partnership, valued at GH¢80,000 as at 1 January, 2019.

Amna and Bean use their own personally acquired motor vehicles for the partnership business and charge the partnership for the business mileage incurred for fuel and maintenance. The cost of the two motor vehicles as at 1 January, 2019 was GH¢120,000. The partnership has employed three staff in addition to the partners.

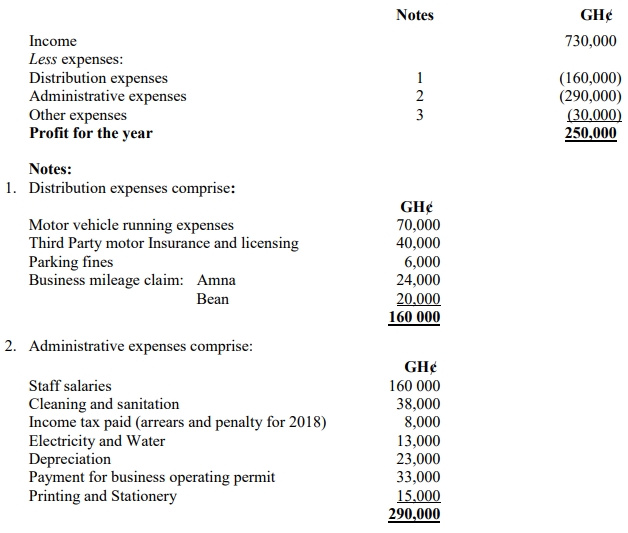

The partnership’s income statement for the year ended 31 December 2020 is detailed below:

3. Other expenses comprise penalties for late filing of tax returns and payment of taxes.

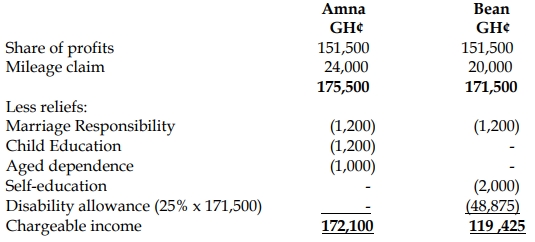

Amna and Bean are both married. Amna has two children, both in accredited senior high schools in Ghana. Bean has one child who is currently attending university in the United Kingdom. Amna takes full care of her aged mother. Bean, who is currently undertaking a training course in Wholesaling Risks, is certified as handicapped in one of his legs through an accident. Bean paid GH¢3,300 for the training course.

Required:

- Explain the principles governing partnership taxation.

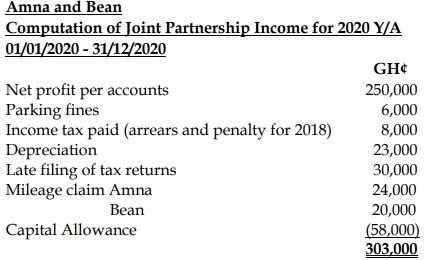

- Calculate the joint partnership taxable income for the year ended 31 December, 2020. You are required to include capital allowance where necessary.

- Calculate the taxable income of Amna and Bean for the year ended 31 December, 2020.

- What are the taxation rules on payment to casual and temporary staff?

Answer

- Principles Governing Partnership Taxation

Partnership income is taxed in the hands of the individual partners in accordance with their profit-sharing ratios. Therefore, the partnership is not a taxable person. A partnership is not liable to pay income tax with respect to its chargeable income and is not entitled to any tax credit with respect to that income, but is liable to pay income tax with respect to withholding payments.

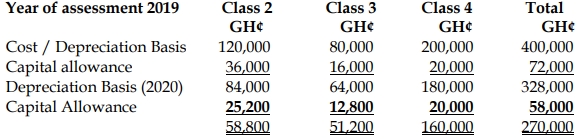

Each partner is required to report his or her share of the partnership’s taxable profit or loss in his or her individual tax return and pay income tax on this. Apart from the profit share, all other incomes received by the partner would have to be taken into account to determine the chargeable income. Each partner will claim his/her reliefs. - Computation of Capital Allowance for Relevant Years

- Computation of Taxable Income of Partners for 2020 Y/A

01/01/2020 – 31/12/2020

- Taxation Rules on Payment to Casual and Temporary Staff

Casual Workers: Payment to a casual worker is treated as income earned, and tax is withheld at a rate of 5%. Tax withheld is treated as final tax. A casual worker is engaged for seasonal or intermittent work not exceeding six months, with remuneration calculated on a daily basis.

Temporary Workers: Payment to a temporary worker is subject to tax at the graduated rates for individuals. A temporary worker is employed for at least one month but not permanently or for seasonal work.

- Topic: Income Tax Liabilities

- Series: MAY 2021

- Uploader: Theophilus