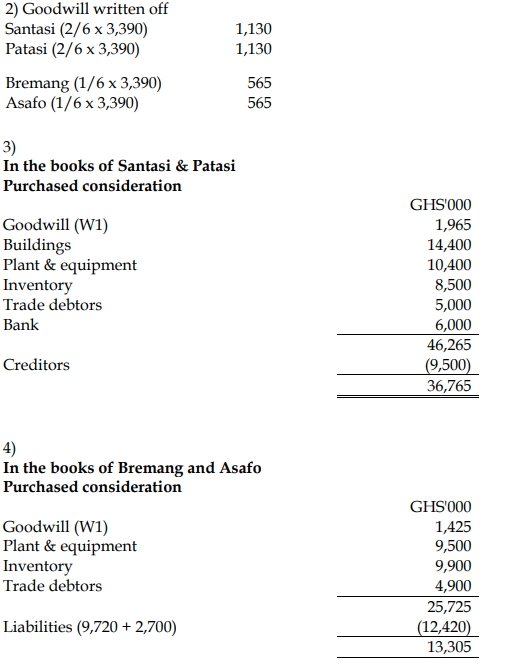

Sodzedo is sole proprietor with a small business. Below is a list of balances of the trial

balance extracted as at 30 June 2019 which failed to agree:

GH¢

Purchases 66,450

Payables 44,520

Sales 213,390

Discount allowed 2,220

Receivables 158,550

Sales Returns 6,300

Expenses 32,130

Non-Current Assets 68,250

Bank Overdraft 9,420

Capital 37,500

VAT Liabilities 18,960

a) Prepare the trial balance for Sodzedo as at 30 June 2019 and derive the balance in suspense account as at 30 June 2019. (5 marks)

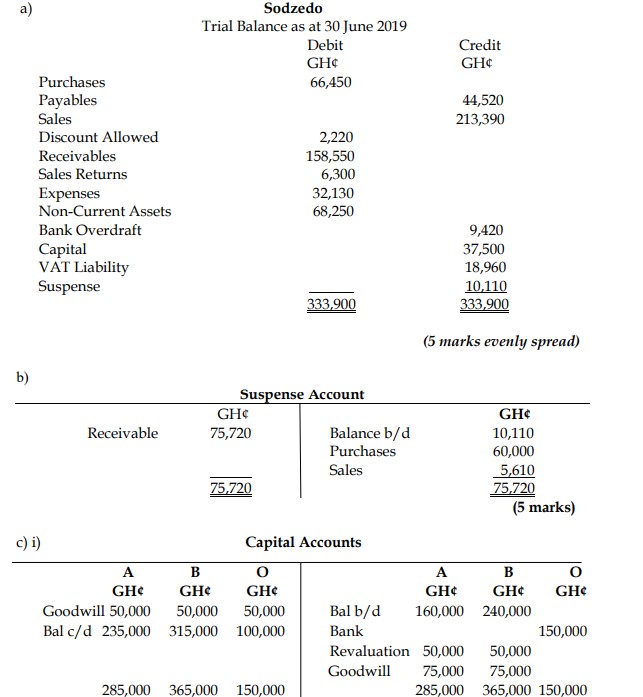

b) A detailed examination of the books was undertaken, and the following matters were uncovered:

i) The total in the purchases day book was GH¢126,450, but the figure used when posting to the purchases account was GH¢66,450.

ii) An invoice from a supplier for goods amounting to GH¢25,500 plus VAT at 10% was not recorded in the books and records of Sodzedo.

iii) During the bank reconciliation process, it came to light that GH¢525.70 was earned in interest during the year and has not been accounted for.

iv) A review of the ledgers revealed that receivables were overcast by GH¢75,720.

v) Cash drawings by Sodzedo of GH¢5,610 were treated as cash sales in error.

Required:

Prepare a suspense account to clear the difference. (5 marks)

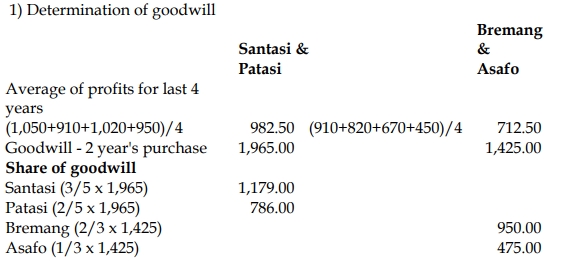

c) Ansah and Boakye have been in partnership for a number of years. The partners did not have a partnership agreement. The following balances have been extracted from the books as at 1 January 2018:

Capital Accounts:

| Partner |

Amount (GH¢) |

| Ansah |

160,000 |

| Boakye |

240,000 |

Current Accounts:

| Partner |

Amount (GH¢) |

| Ansah |

10,400 Dr |

| Boakye |

8,200 Dr |

On 1 July 2018, they decided to admit Owusu to the partnership. On this date:

Owusu introduced capital of GH¢150,000 into the partnership. The amount was paid into the bank account.

Non-current assets were revalued from GH¢280,000 to GH¢420,000. Inventory was revalued from GH¢70,000 to GH¢30,000. Goodwill was valued at GH¢150,000. It was decided that goodwill would not remain in the books of the new partnership.

The three partners agreed that:

- Profits and losses would be shared equally.

- Under the new partnership agreement, 10% interest per annum on capital is allowed. The interest on capital is calculated on the adjusted balances after admission of Owusu.

- Each partner would receive a salary of GH¢27,000 per annum. No interest on drawings would be paid.

The net profit before appropriation for the year ended 31 December 2018 was calculated at GH¢471,800. Profits earned accrued evenly throughout the year.

The partners’ drawings were:

| Partner |

Amount (GH¢) |

| Ansah |

85,000 |

| Boakye |

62,000 |

| Owusu |

38,000 |

Required:

i) Prepare the Capital Accounts for Ansah, Boakye, and Owusu for the year ended 31 December 2018. (8 marks)

ii) Prepare the Appropriation Account for Ansah and Boakye for the half year ended 30 June 2018. (2 marks)