- 20 Marks

Question

Walata Ltd manufactures and sells a unique anti-cold formula called the Magic Ball. The product is produced from a combination of two ingredients; R and Q with the following details:

Standard quantity per unit:

- Q: 3kg

- R: 2kg

Standard prices:

- Q: GH¢2.50

- R: GH¢4.00

For the quarter just ended, the following results were recorded:

- Actual production: 2,000 units

| Material | Quantity purchased and used | Price per Kilogramme |

|---|---|---|

| Q | 4,800 kg | GH¢4.25 |

| R | 5,400 kg | GH¢2.20 |

Required:

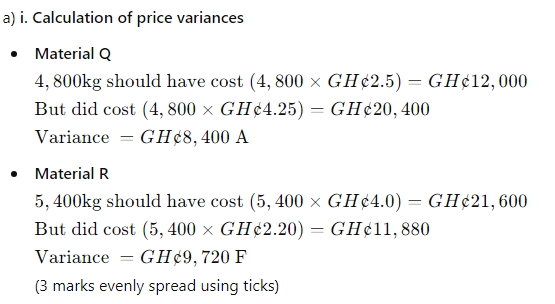

i) Calculate the price variance for each material. (3 marks)

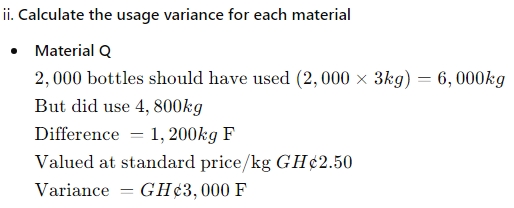

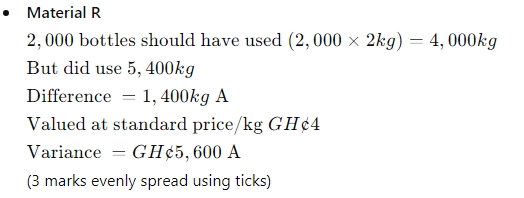

ii) Calculate the usage variance for each material. (3 marks)

b) Apagya Ltd has two product lines AB and CD. Time rate and piece rate labour rewarding systems are used for AB and CD products respectively.

Required:

Explain the terms time rate and piece rate, clearly outlining their differences and giving examples of business settings where each could be applied. (4 marks)

c) AB Ltd operates a 40-hour weekly work regime and rewards labour for all overtime worked at time and one-half.

The wage rate is GH¢80 per hour.

The following details are recorded for the month of October 2019 for an employee (Adamu):

| Week | Hours Worked |

|---|---|

| 1 | 36 |

| 2 | 48 |

| 3 | 45 |

| 4 | 46 |

Required:

i) Compute the total direct labour costs for Adamu for the month of October 2019. (4 marks)

ii) Calculate the total indirect labour costs for Adamu for the month of October 2019. (4 marks)

d) Explain the treatment of overtime premium in accounting for labour costs. (2 marks)

Answer

b) Piece Rate

This is a wage reward system where labour is paid based on the volume of work done. Here, the output recorded is the reference point for measuring the wages payable to the employee but not the time spent. Examples of production settings where this rate system is applicable may include construction, manufacturing, food processing, etc. (2 marks)

Time Rate

This is a reward system that relates wages to the time spent by the employee. Example: hourly, daily, weekly, fortnightly, or monthly, depending on the nature of the employee’s skill. This is usually used in service firms such as accounting firms, hospitality services, law firms, etc. (2 marks)

c) AB Ltd

i) Computation of total direct labour costs for the month of October 2019

| Week | Hours Worked | Calculation | Cost (GH¢) |

|---|---|---|---|

| 1 | 36 | 36 x GH¢80 | 2,880 |

| 2 | 48 | 48 x GH¢80 | 3,840 |

| 3 | 45 | 45 x GH¢80 | 3,600 |

| 4 | 46 | 46 x GH¢80 | 3,680 |

| Total | 14,000 | ||

| (4 marks evenly spread using ticks) |

ii) Computation of total indirect labour costs for the month of October 2019

| Item | Calculation | Cost (GH¢) |

|---|---|---|

| Idle time | 4 x GH¢80 | 320 |

| Overtime premium (Week 2) | 8 x GH¢80 x 50% | 320 |

| Overtime premium (Week 3) | 5 x GH¢80 x 50% | 200 |

| Overtime premium (Week 4) | 6 x GH¢80 x 50% | 240 |

| Total | 1,080 | |

| (4 marks evenly spread using ticks) |

d) Treatment of Overtime Premium in Accounting for Labour Costs

Overtime premium is generally accounted for as indirect labour costs. However, where overtime payments result from customer-specific requirements for the production of a product or job, then such overtime premium may be accounted for as direct labour.

(2 marks)

- Tags: Overtime Premium, Piece Rate, Price Variance, Time Rate, Usage Variance

- Level: Level 1

- Uploader: Joseph